Here’s the rewritten content while keeping the HTML tags intact:

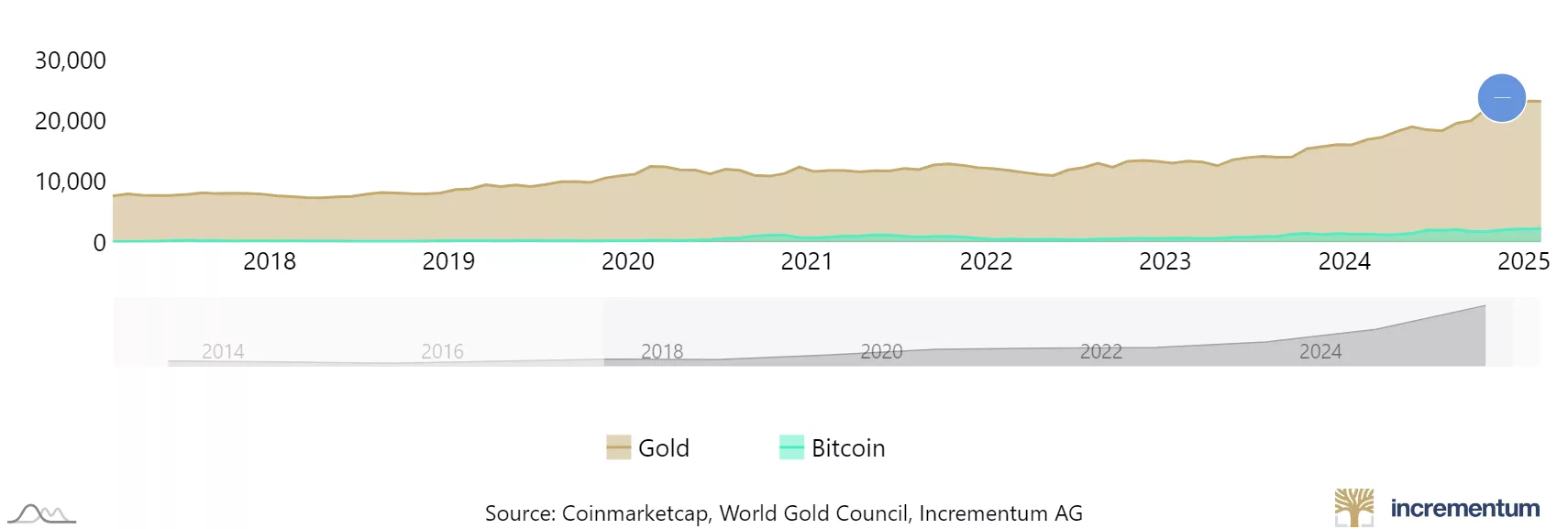

Gold’s market capitalization has soared past $30 trillion for the first time in history, establishing it as the largest asset by market cap so far. Will Bitcoin be able to catch up?

Summary

- For the first time ever, gold’s market cap has exceeded $30 trillion, as spot prices reached $4,369, solidifying its position as the world’s foremost asset.

- In contrast, Bitcoin’s market cap has fallen to $2.15 trillion after a decline of over $200 billion this week, further increasing the gap between the two assets.

Data from Companies Market Cap shows that gold has increased by 1.49% in the last 24 hours. Currently, it is trading at $4,369 following this rise. This month, gold crossed the $30 trillion market cap milestone for the first time, with spot prices at $4,280 at that time.

At press time, gold remains the leading asset by market cap, far surpassing the other four assets in the top five. NVIDIA holds the second spot with a market cap of $4.4 trillion, followed by Microsoft at $3.8 trillion and Apple at $3.6 trillion.

In comparison, its metallic peer, silver, remains outside the top five, with a market capitalization of $2.9 trillion.

Bitcoin (BTC) ranks eighth, having suffered a significant market cap loss after a wave of sell-offs in the crypto market, including an estimated $19 billion liquidation on October 10. As of October 17, Bitcoin’s market cap stands at $2.15 trillion, having shed approximately $200 billion to $230 billion just this week.

There was a period when Bitcoin was achieving consecutive record highs, surging above major companies and even precious metals like silver. Back in April 2025, the leading cryptocurrency climbed up the ranks to become the fifth-largest asset globally, with a market cap reaching $1.86 trillion.

At that time, Bitcoin was on the verge of surpassing the $100,000 threshold. Although it has eventually exceeded $100k and achieved a new all-time high of $126,080 this month, Bitcoin’s growth trajectory has lagged behind other assets that have posted market value increases surpassing $3 trillion.

Can Bitcoin really overtake gold’s market cap?

The divide between Bitcoin and gold as preferred safe-haven assets continues to grow. While Bitcoin struggles against falling crypto values, gold has been flourishing as more investors turn to it during economic uncertainty caused by Trump’s trade tensions with China.

As of now, Bitcoin has slipped by 4.5% in the past 24 hours, currently trading at $105,834, teetering on the brink of $100,000.

Meanwhile, gold’s price has reached a new high of $4,300, boasting nearly a 60% increase over the past year. Bitcoin has seen a 57.3% rise, but has been in a decline this past week, struggling to return to its prior highs of $120,000.

At the conclusion of 2024, Cathie Wood, founder and CEO of ARK Investment Management, forecasted that Bitcoin might eventually eclipse gold’s market cap. At that time, Bitcoin had recently achieved a $2 trillion market cap, while gold was at $15 trillion. She characterized Bitcoin as being in its early stages, emphasizing that it reached $2 trillion in only 15 years.

Gold, with its longer history, managed to attain $15 trillion in market cap. However, gold’s market value has doubled within the last year after hitting new all-time highs, while Bitcoin has struggled to move significantly beyond the $2 trillion mark.

Recently, Deutsche Bank projected that central banks may start acquiring BTC by 2030, a move that could enhance its market value.