Bitcoin has successfully reclaimed crucial levels beyond the $118,000 mark, renewing bullish momentum after a period of uncertainty. This breakout has rejuvenated market sentiment, with traders growing increasingly optimistic that BTC might be on the cusp of a significant movement. Historically, October has proven to be one of the most favorable months for Bitcoin performance, and several analysts are already predicting a substantial surge that could push the asset toward new heights.

Related Reading

What sets this rally apart is the stability reflected in market data. Leading analyst Axel Adler has shared insights indicating that Bitcoin is now in a state of equilibrium, where buying and selling pressures are balanced. Such conditions signal a healthy market structure, establishing a solid foundation for possible upward movement. If this momentum persists, the combination of favorable seasonal trends and a stable equilibrium could catalyze a robust continuation of the cycle.

However, analysts warn that the upcoming days will be pivotal. Reclaiming the $118,000 point is a significant initial step, but Bitcoin must establish support above this level to validate the breakout and maintain its upward trajectory. With volatility making a return, October may once again emerge as a critical month for Bitcoin.

Bitcoin Dynamics Align With A Key Indicator

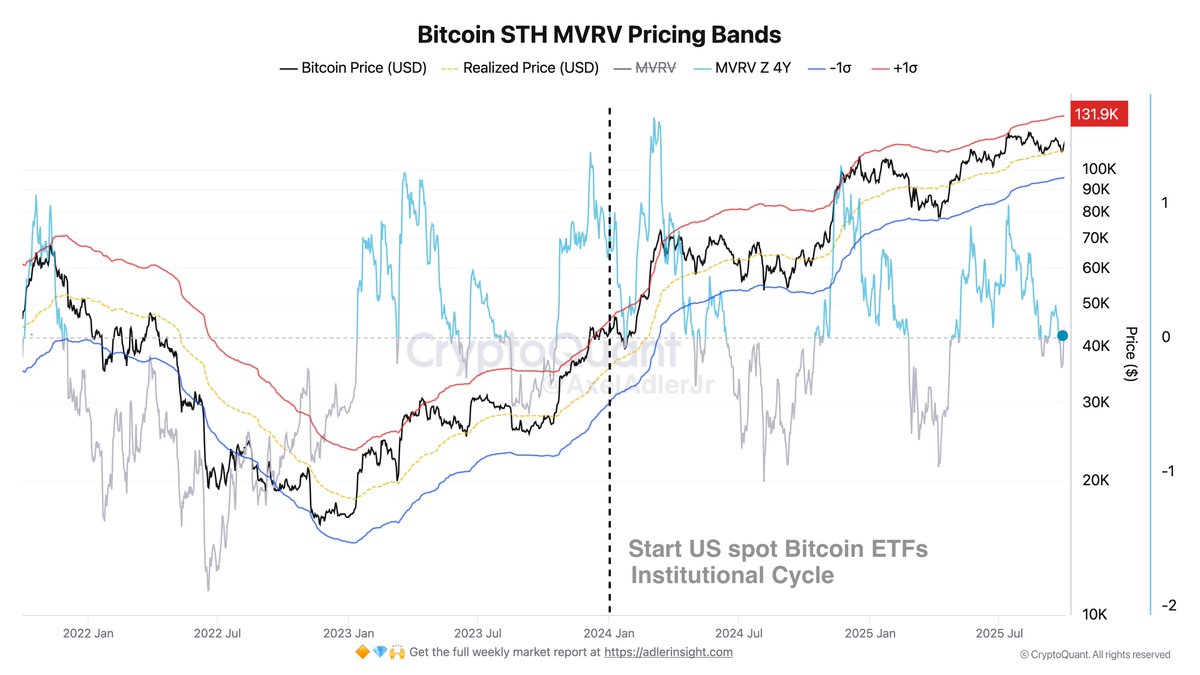

In a CryptoQuant report, Adler clarifies that Bitcoin’s current price behavior aligns closely with the STH-MVRV pricing corridor, a metric designed to indicate the average profitability of recent buyers. This corridor serves as a framework for assessing when short-term holders are making profits and more likely to sell versus when they are at a loss and prone to capitulate. Currently, Bitcoin is comfortably sitting within this range, suggesting a healthy equilibrium in market dynamics.

The upper boundary of the corridor, identified as +1σ, currently rests around $130,000. Adler points out that this level marks a zone where short-term holders typically start locking in profits more vigorously. Historically, price movements approaching this boundary have inspired selling waves, establishing a natural cap until stronger demand materializes. Nevertheless, this upper limit provides the market with a clear target, and if the current dynamics endure, a movement toward $130K seems increasingly plausible.

Equally significant is the base of the corridor, reflecting the average realized price of short-term holders. Since early 2024, Bitcoin has consistently remained above this level (indicated by the yellow line on the chart). This steadfast strength signals enduring bullish sentiment, as short-term dips below the baseline have been quickly corrected, indicating robust demand.

Essentially, Bitcoin is in a state of equilibrium—neither overheated nor oversold—within the established volatility corridor. This balance, coupled with the historical seasonality of October rallies and strong institutional inflows, positions the market favorably for potential upside. If buying pressure persists and volatility decreases, the likelihood of an advance towards the $130K area becomes a tangible prospect in the coming weeks.

Related Reading

Bitcoin Faces Resistance After A Rally

Bitcoin is currently trading around $118,800 on the 12-hour chart, extending its breakout from earlier this week. The price has surged past the critical $117,500 resistance, a level that inhibited rallies throughout September, and is now probing the $119,000–$120,000 range. This region represents the final barrier before a potential retest of summer highs near $125,000.

The moving averages indicate improving momentum. BTC has reclaimed the 50-period (blue) and 100-period (green) moving averages with strong follow-through, turning them into short-term support zones around $114,000–$115,000. Meanwhile, the 200-period (red) moving average continues to ascend from below, bolstering the longer-term bullish trend. The decisive break above several averages in just a few sessions underscores the strength of buyer conviction.

Related Reading

Nonetheless, the chart also indicates that Bitcoin is approaching overextended territory in the short term. Following four consecutive bullish candles, a consolidation phase around $118,000–$119,000 would not be surprising. If it fails to maintain support above $117,500, a pullback to around $115,000 may occur, while sustained buying could pave the way to $120,000 and beyond.

Featured image from ChatGPT, chart from TradingView.com