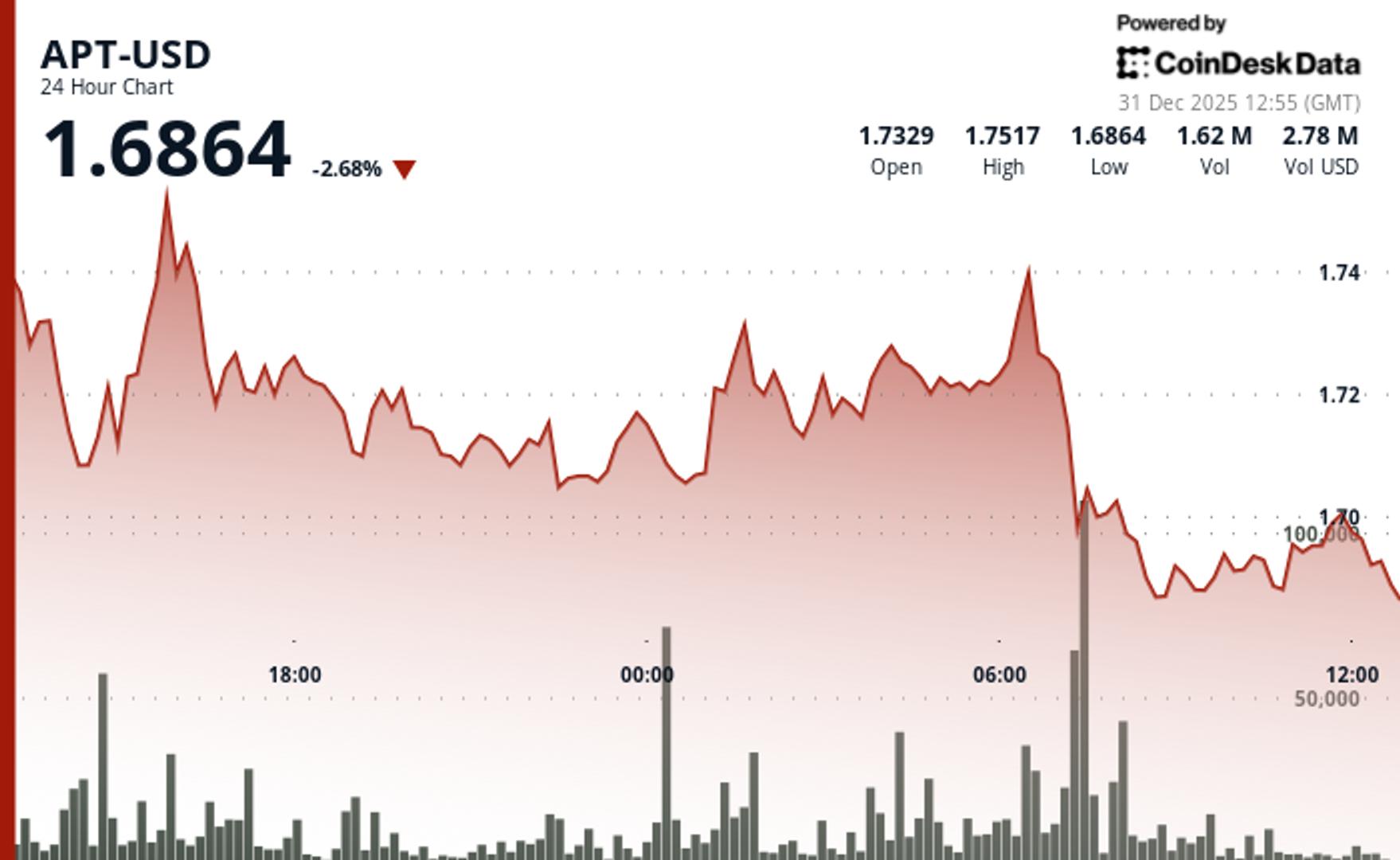

dropped 2.4% to $1.69 on lower-than-average volume, significantly lagging behind the wider crypto market.

The overall market index, the CoinDesk 20 index (CD20), was 0.5% higher at the time of publication.

This relative underperformance compared to major cryptocurrencies indicates cautious investor sentiment towards APT, as noted by CoinDesk Research’s technical analysis model.

The analysis revealed that the token fell from $1.73 to $1.69 within 24 hours, establishing a volatile range-bound pattern with a total fluctuation of $0.09.

The most significant trading activity occurred earlier today, with an impressive volume of 12.2 million tokens, 214% above the 24-hour moving average, indicating strong resistance around $1.75, as per the model.

Price movement displayed consolidation in a narrow channel after the initial drop, according to the model, with momentum slowing as volume normalizes following the high-volume rejection.

APT’s downturn is marked by subdued trading, with the 24-hour volume being 31% above its 7-day average but not reaching significant threshold levels.

Technical Analysis:

- Primary support identified at the $1.68-$1.69 psychological level, with major resistance established at $1.75 due to high-volume rejection.

- Peak volume of 12.17 million (214% above SMA) confirms resistance failure, while recent recovery shows increasing volume over the $1.695 breakout threshold.

- Range-bound consolidation observed in a $0.09 channel following initial decline, with 60-minute charts indicating a bullish recovery pattern.

- Immediate upside target at the $1.70-$1.705 resistance cluster, with broader range highs near $1.75 serving as the next major test.

- Technical indicators reveal predominantly bearish signals across all timeframes.

Disclaimer: Portions of this article were created with the help of AI tools and reviewed by our editorial team to ensure accuracy and compliance with our standards. For further details, please refer to CoinDesk’s comprehensive AI Policy.