Weekly Bitcoin Price Analysis

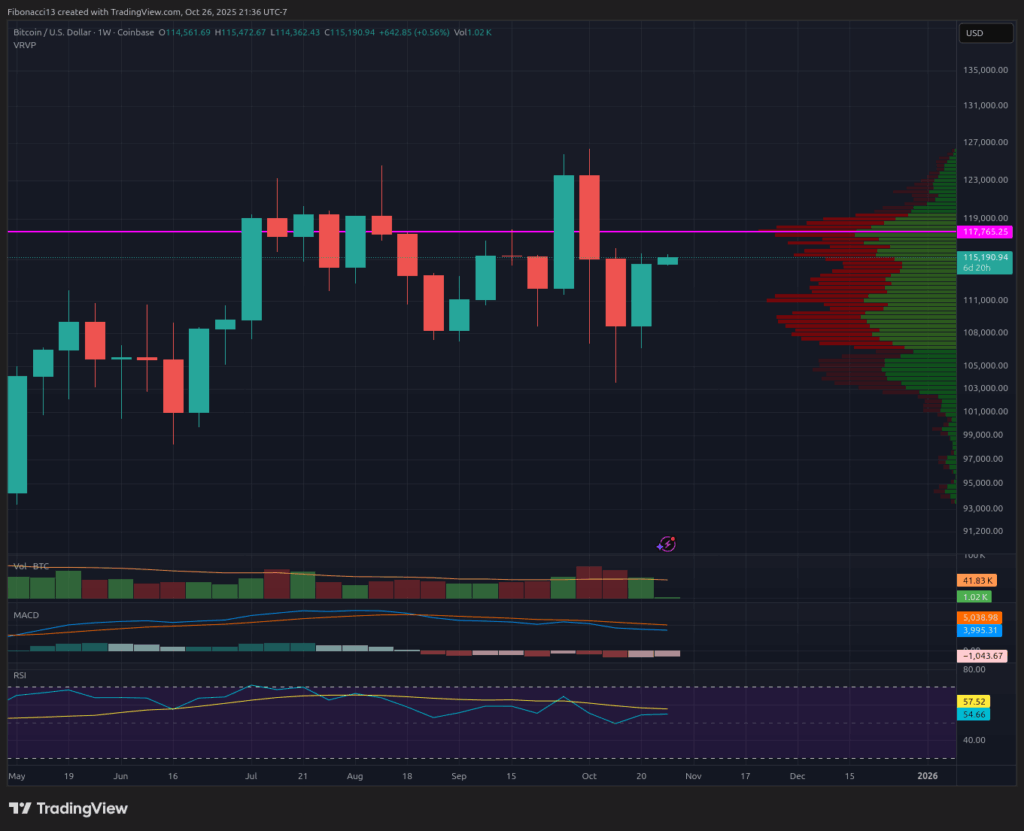

Last week, the price movement of Bitcoin remained relatively calm, leaving traders uncertain about a potential significant drop as the weekend approached. The price stayed above recent lows, gradually increasing to close the week at $114,530. Bulls can take some solace in reclaiming the resistance level at $112,200 and are moving closer to breaking through the next resistance point at $115,500. However, bears still maintain their grip, with formidable resistance levels looming that have yet to be contested by the bulls. The upcoming week could bring notable volatility, particularly with the FOMC meeting on Wednesday and several major companies releasing their third-quarter earnings.

Current Support and Resistance Levels

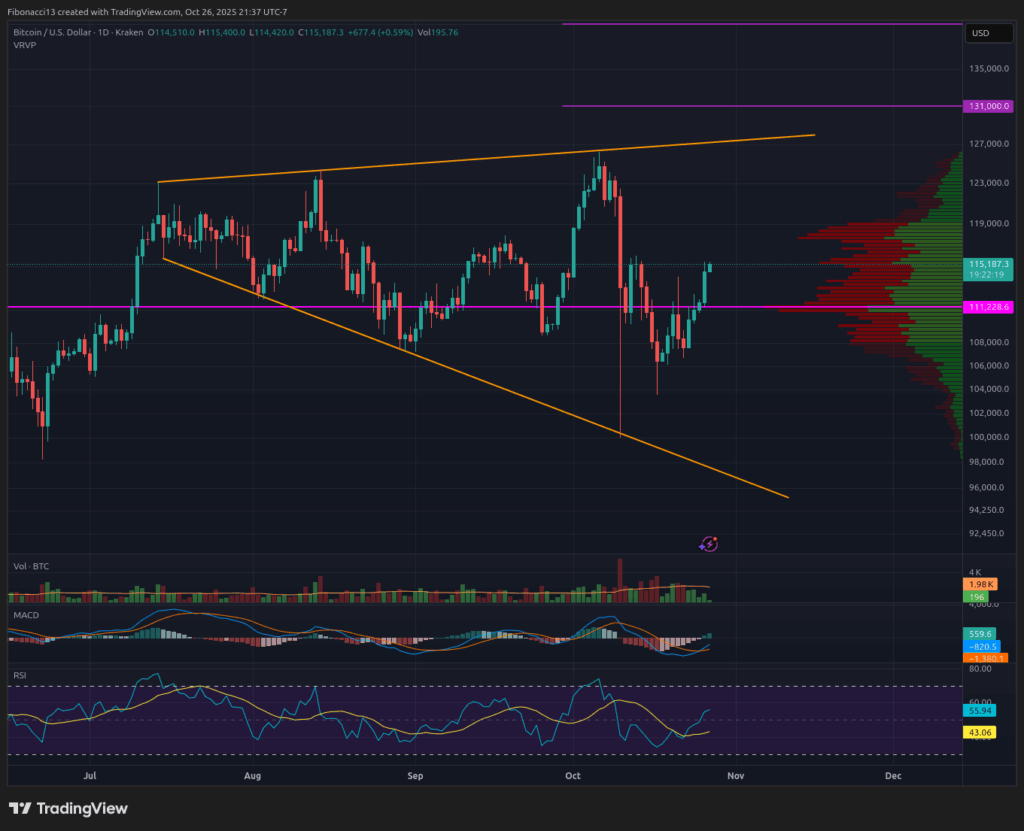

Resistance levels from last week remain unchanged as bulls have made limited headway. Significant resistance sits at $117,600 and $122,000, which means bears are not under substantial pressure yet. If the price surpasses $122,000 this week, we will then monitor the upper boundary of the broadening wedge pattern at $128,000.

Maintaining price above last week’s low indicates a positive trend for bulls, who also sustained the price above the crucial short-term support level of $106,900. It’s essential for this level to hold moving forward; a close below $106,900 could lead to a drop back to the support zone between $105,000 and $102,000, which has already experienced two tests. A third test of this zone would likely lead to a breach rather than a rebound. Below this, $96,000 represents long-term bull market support, a critical level if the price were to decline and test it.

This Week’s Outlook

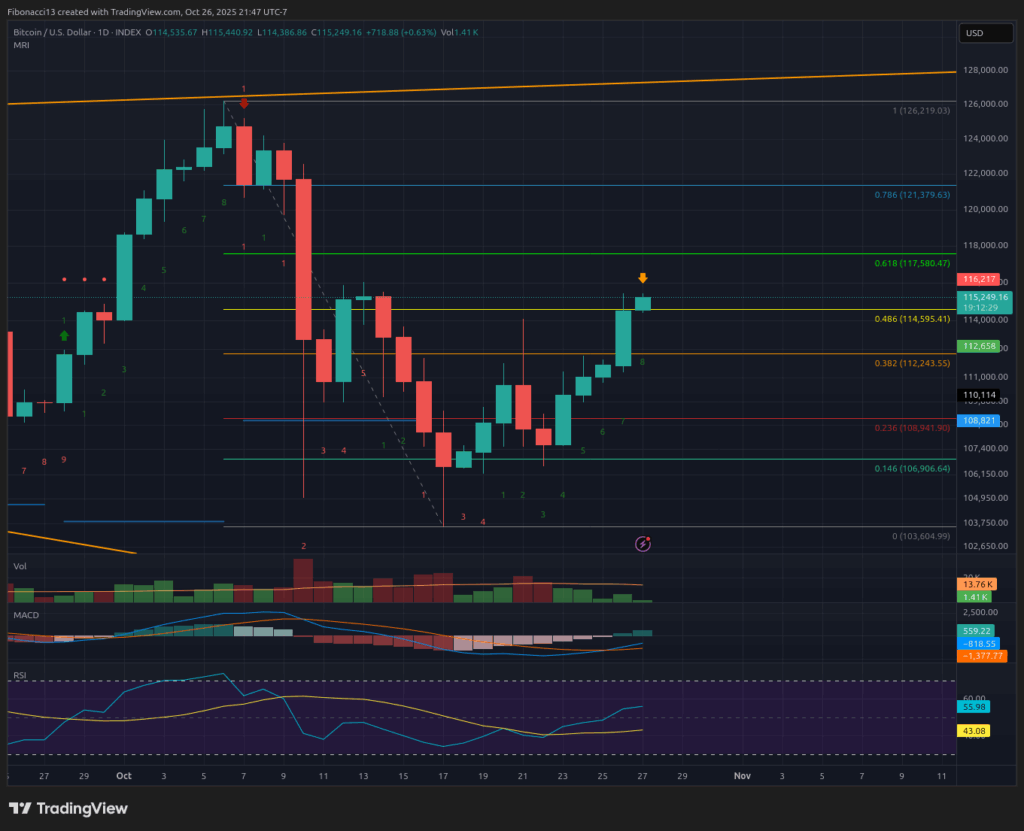

Expect considerable volatility this week, particularly on Wednesday, as the Federal Reserve is set to make an interest rate decision followed by Powell’s speech, and major earnings reports from Microsoft, Meta, and Google are due after market close. Bulls aim to maintain $109,000 as a solid floor this week to retain upward momentum. The Momentum Reversal Indicator currently shows an 8-count entering Monday, signaling a possible decline in momentum. By Tuesday, we should reach a 9-count, indicating at least a pause in upward momentum and potentially a 1 to 4 day price correction. If bulls can propel the price to the 0.618 Fibonacci Retracement level at $117,600 by Monday night or Tuesday morning, we might anticipate a rejection there, allowing us to reassess after the FOMC meeting and earnings reports.

Market Sentiment: Bearish – Despite some gains for bulls last week, bears continue to maintain a strong presence. Bulls must push the price beyond $122,000 to regain control.

The Coming Weeks

If bulls can navigate through this week, there remain potential challenges ahead. The US-China tariff dispute may or may not reach a resolution by next week; a negative outcome could lead to a general market decline. Additionally, a ruling from US courts on the legality of Trump’s tariffs is anticipated by November 5th. Should these tariffs be reinstated, we can expect markets to decline in anticipation of their impact.

Terminology Explained:

Bulls/Bullish: Investors who believe prices will rise.

Bears/Bearish: Investors who expect prices to fall.

Support or Support Level: A price level where an asset is expected to hold, at least initially. More touches at this level can weaken it, increasing the likelihood of a failure to maintain the price.

Resistance or Resistance Level: The opposite of support; a level expected to repel the price at least initially. More touches at resistance weaken it and raise the chances it will not hold back the price.

Fibonacci Retracements and Extensions: Ratios tied to the golden ratio, a universal ratio related to growth and decay cycles in nature, based on constants Phi (1.618) and phi (0.618).

Broadening Wedge: A chart pattern featuring an upper trend line as resistance and a lower trend line as support, with diverging lines validating the pattern and resulting in greater volatility, usually seen as higher highs and lower lows.

Momentum Reversal Indicator (MRI): A specialized indicator created by Tone Vays that tracks buying and selling momentum and potential exhaustion, signaling when momentum is expected to fade or accelerate.