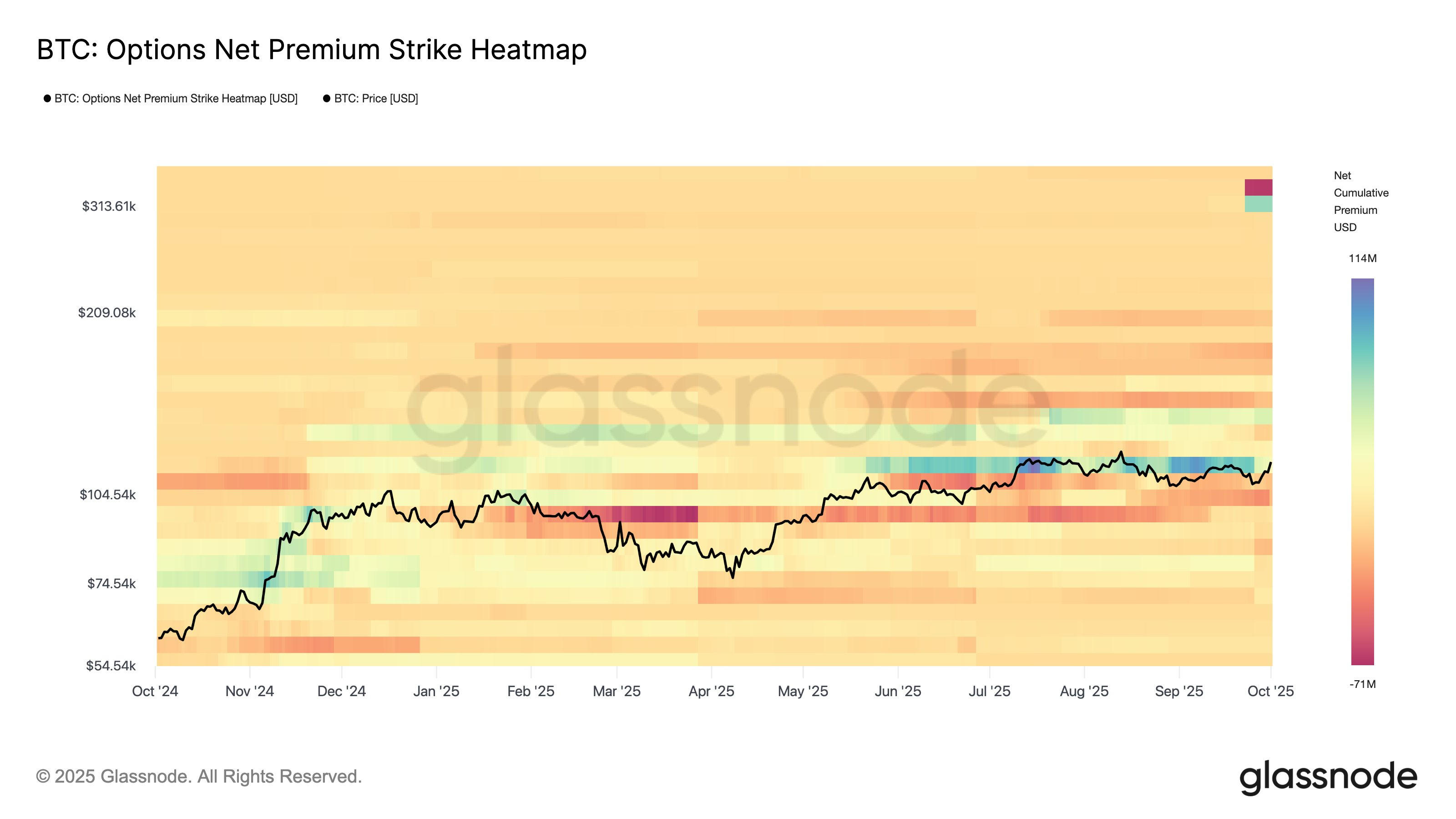

A majority of Bitcoin options are concentrated within the $100,000 to $120,000 range, with some traders speculating on $300,000 moonshots.

Summary

- Bitcoin options are primarily leaning between $100,000 and $120,000, indicating some cautious optimism

- Some traders are betting on improbable $300,000 moonshots, which, although unlikely, are economically feasible

- Analysts attribute BTC’s bullish trend to positive ETF inflows

The Bitcoin options market indicates that wagers are clustered around its current price of $120,000, with some speculative interest in high upside potential. Data from Glassnode on Thursday, Oct. 2, shows Bitcoin options predominantly aligning around the $100,000 to $120,000 range, close to the current price.

Additionally, there’s a noticeable concentration of calls at $130,000, suggesting a positive market trend. Interest is also growing for out-of-the-money options priced near $300,000. While these bets may not yield profitable outcomes, they remain inexpensive and reflect a heightened interest in upside risk.

In summary, the options market indicates that most traders believe Bitcoin (BTC) will continue trading within the $100,000 to $120,000 range. The mild interest at $130,000 and the moonshot bets indicate a sense of cautious optimism.

Bitcoin options highlight positive ETF flows

The optimism appears linked to continued institutional capital inflows, driven by treasury firms and ETFs. Notably, macroeconomic uncertainty, particularly from the U.S. government shutdown, has redirected capital from stocks, thereby benefiting both gold and Bitcoin.

B2BINPAY analysts suggest that institutional investments are the primary driver behind Bitcoin’s rise above $120,000. Specifically, Bitcoin ETF inflows reached $1.3 billion on Oct. 2, reflecting a positive trend over recent weeks.

“Looking ahead, we expect Bitcoin to test between $130,000 and $140,000 in the base scenario, supported by recovering ETF flows and eased Fed expectations. However, there remains a risk of a sharp correction back to $105,000–$110,000 if macro tightening resurfaces,” say B2BINPAY analysts.

If ETF inflows maintain their momentum in the fourth quarter, it could signify the onset of a new bullish cycle, according to B2BINPAY analysts speaking to crypto.news.