Bitcoin is closing in on the final day of the quarter, caught in a tight technical and macro landscape, with traders focusing intently on several key levels that may determine October’s trajectory. Ostium Research’s outlook for the week ahead suggests we’re experiencing a diminishing “window of weakness” before a potential Q4 upswing, contingent on the market navigating an event-laden calendar while maintaining critical support levels. As Nik Patel notes, “weekly momentum still favors higher prices, and I believe we are beginning to emerge from the window of weakness I highlighted starting Friday, September 20th.”

Crucial Bitcoin Levels Indicate a Promising October

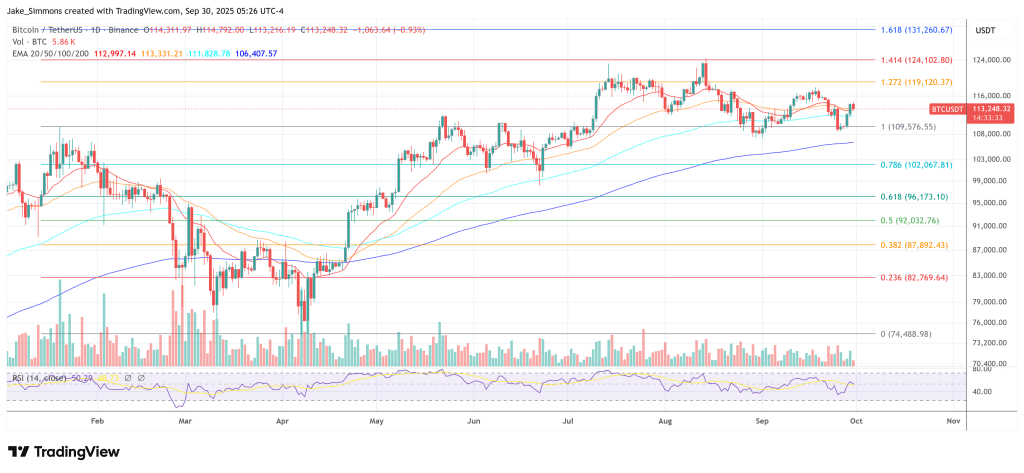

The current spot price remains influenced by last week’s rejection near the August open at $112,000, followed by a swift decline into the low-$108,000s and a rebound into Sunday’s close. On the weekly chart, momentum still trends upwards, yet Patel cautions that the quarter-end, the upcoming October shift, and a packed schedule of data releases could amplify volatility.

His fundamental perspective is clear: “Any dip we see this week should be viewed as a long-term buying opportunity for the rest of Q4,” he asserts, adding that worries about reaching a cycle peak in October are unfounded due to the “tailwinds heading into mid-December.” The mid-cycle risk threshold is around $99,000, with a long-term invalidation point tied to the 360-day moving average near $97,900. “As long as we stay above $99k on a weekly close, I don’t see anything here as mid-term bearish,” Patel confirms.

Related Reading

On the daily chart, the market has established a higher low above approximately $107,000 post-rejection at $112,000, maintaining a constructive short-term framework. Patel’s criteria for upside movement is sharp: “If we push higher off this recent low throughout the week and close above the August open and trendline resistance around $115.7k, it’s highly unlikely we revisit $107k–$108k this October.” Conversely, he emphasizes a critical downside level during a volatility spike: “I believe the lowest we’ll see this week is the 200-day moving average at $104.6k in a major downturn.”

The tactical framework he presents offers both bulls and bears actionable insights, even within the same trading session. On the long side, he suggests capitalizing on a stop-hunt beneath last week’s low or near the September open, “with invalidation if we close below the 360-day moving average, which is currently at $97.9k, a level we haven’t closed beneath since March 2023.”

Should the market rally first, he proposes a flexible approach: a sharper climb into the quarter’s end that “surpasses the $114k high by October 1st,” followed by a potential retreat driven by bearish divergence targeting “at least $110k, if not $108.5k over the weekend,” where he’s ready to initiate long positions again.

Related Reading

The macro landscape adds complexity to an otherwise straightforward technical outlook. Patel anticipates that the dollar will experience a temporary surge before reversing, a scenario that would favor risk assets later in Q4: last week’s post-FOMC dollar rally is likely to be “short-lived,” with DXY “99 as my projected peak,” followed by a more significant decline to 93 in Q4 if momentum drops below the September open. For equities, he expects a somewhat choppier October than crypto but still sees dips as opportunities leading into year-end.

Positioning and derivatives context fortify the directional outlook. Patel underscores the importance of snapshots from Velo and CoinGlass, three-month annualized basis data, and Bitcoin versus altcoin open interest, while layering expected one-week and one-month liquidation clusters to highlight where forced buying or selling could accelerate momentum in either direction. The overarching theme remains that this week’s volatility might be a precursor, rather than a conclusion, to Q4. “The window for cleaning up those lows is likely within the next 5–7 days,” he mentions. “If we breach last week’s low and then reclaim on lower timeframes, that could signify an early October low is forming.”

In conclusion, Bitcoin’s immediate challenge is less about trend deterioration than orchestrating a shakeout. Above ~$112,000, buyers may swiftly target the ~$115,700 pivot; beyond that, the narrative of all-time highs could re-emerge. If the lows are swept first and the market maintains the $104,600–$107,000 range, it could be establishing its October floor. A weekly close below $99,000 would significantly impact the Q4 bullish scenario Patel lays out for readers. “Do not get caught in bearish traps,” he advises. “Consequently, any dip from now until the weekend is where I predict the formation of an October low.”

At the time of publishing, BTC was priced at $113,248.

Featured image created with DALL.E, chart from TradingView.com