An analyst has discussed potential timing for Bitcoin to hit its bottom, referencing historical price patterns across cycles.

Bitcoin Typically Takes 364 Days From Major Peaks to Troughs

In a recent thread on X, analyst Ali Martinez explored what past trends indicate about when Bitcoin might reach a bottom in the current cycle. “Bitcoin $BTC major cycles have exhibited a remarkably consistent rhythm, both in timing and magnitude,” Martinez observed.

Below is a chart provided by the analyst that emphasizes some of the commonalities shared by the recent BTC cycles.

The chart illustrates that Bitcoin’s price has taken approximately 1,064 days to ascend from the bottom of the previous bear market to the peak during the last three cycles, assuming the recent high above $126,000 marks the peak for the current cycle.

The transition from the peak to the subsequent bottom was also comparable in the 2017 and 2021 cycles on the cryptocurrency’s quarterly chart, averaging around 364 days. “If this pattern persists, Bitcoin $BTC is currently within that 364-day correction window, suggesting a potential bottom around October 2026,” Martinez elaborated.

The analyst also indicated a potential bottom target for Bitcoin, again based on the historical cycle patterns. The 2018 bear market experienced an 84.22% drawdown from the bull market peak, while the 2022 bear encountered a decline of 77.57%.

For the current cycle, Martinez has projected a drawdown of 70%, establishing a price target around the $37,500 mark. It remains to be seen whether this cycle will follow a similar path as previous ones or diverge this time.

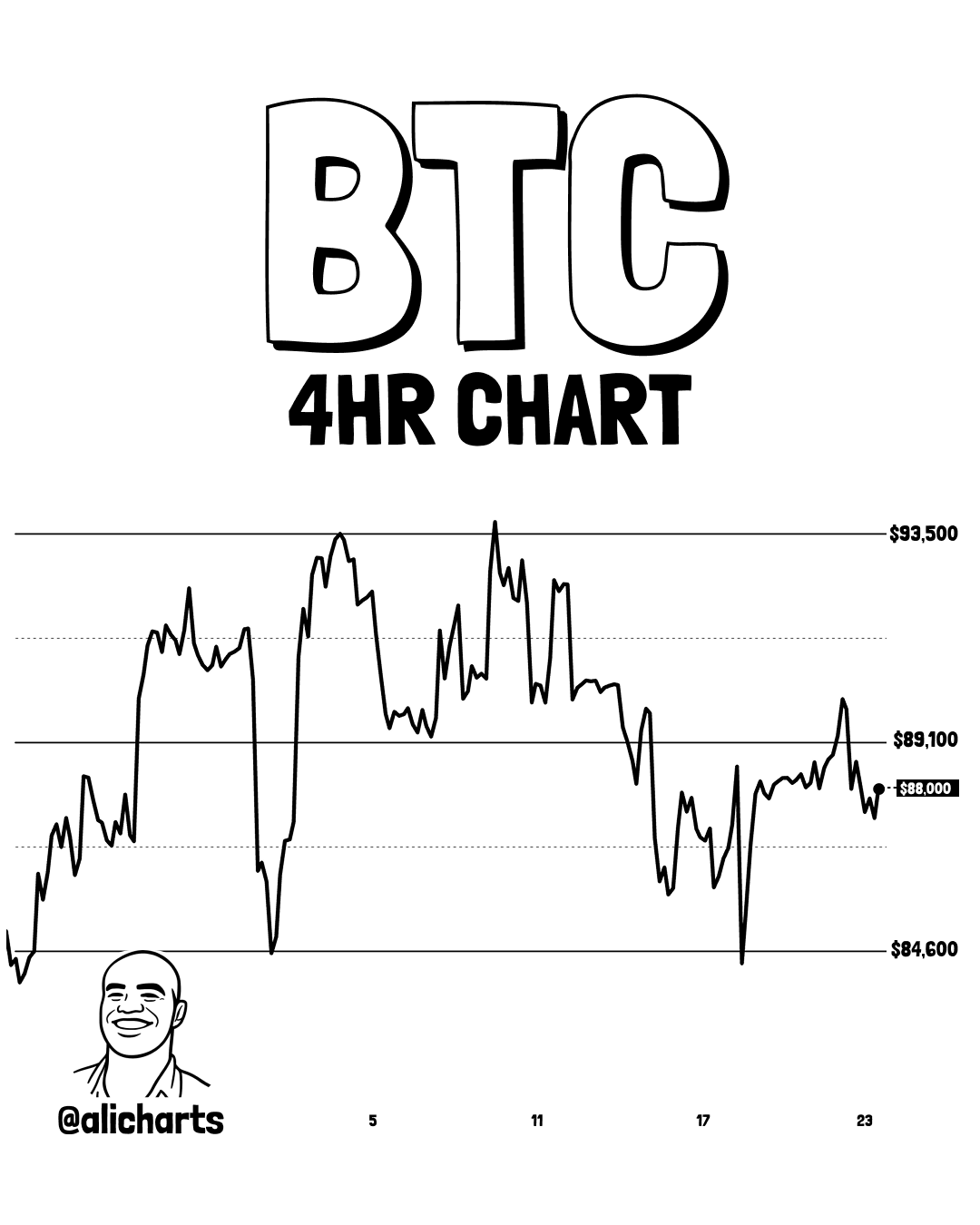

The Bitcoin cycle chart illustrates the long-term trend using its quarterly price, but what about the short-term outlook? In another X post, the analyst shared the 4-hour BTC chart, showing a developing technical analysis (TA) pattern on a shorter scale.

The chart above indicates that Bitcoin has possibly been adhering to a Parallel Channel over the past few weeks. A Parallel Channel occurs when an asset consolidates between two parallel trendlines, with the lower line serving as support and the upper line as resistance.

The cryptocurrency retested the lower boundary of this Parallel Channel last week, resulting in a rebound as support held firm. Since then, the asset has returned to the central area of the pattern, suggesting an absence of a clear directional bias at present.

BTC Price

At the time of writing, Bitcoin is trading around $87,300, reflecting a 0.7% increase over the past week.