Welcome to the US Crypto News Morning Briefing—your essential summary of the day’s key crypto developments.

Pour yourself a coffee, as one of Wall Street’s veteran analysts believes the rally is far from over, potentially impacting crypto alongside equities.

Crypto News of the Day: WisdomTree’s Siegel Suggests TradFi Market Potential — Will Crypto Follow?

According to Jeremy Siegel, chief economist at WisdomTree, the US stock market’s rally is not over. In a recent interview, he expressed confidence that equities still have room to rise, dismissing concerns over a summer slow down.

“I believe this bull market is certainly still intact,” Siegel mentioned in a discussion with TradFi media.

Siegel highlighted that revisions in corporate earnings are positive, and market breadth is strengthening.

Although he doesn’t anticipate a meteoric rise, he is confident about a 5–10% potential increase in the next six months, primarily driven by monetary policy.

Siegel consistently advocates for lower short-term interest rates, arguing that the Federal Reserve’s benchmark rate should be at least 100 basis points (bps) below the 10-year Treasury yield.

He posits that the Fed funds rate should ideally be in the “low threes,” which he believes would align with the economy’s direction.

This path would provide “great comfort to investors,” especially since small-cap stocks within the Russell index have responded strongly to easing expectations.

He noted that last week’s significant gains in both growth and value equities demonstrate broad-based support for this rally, dispelling any notions of uncertainty.

Despite concerns over low summer trading volumes, Siegel downplayed these issues, pointing out that reduced trading activity in late August is typical as traders take vacations.

He believes that sustaining gains during traditionally weak times, like late August and early September, historically signals positive outcomes for the rest of the year.

However, Siegel acknowledged potential risks, particularly from the Federal Reserve itself. He cautioned that if Fed Chair Jerome Powell does not meet rate-cut expectations, it could derail the rally.

This week’s upcoming Personal Consumption Expenditures (PCE) report is another focal point, potentially indicating that inflation pressures are easing.

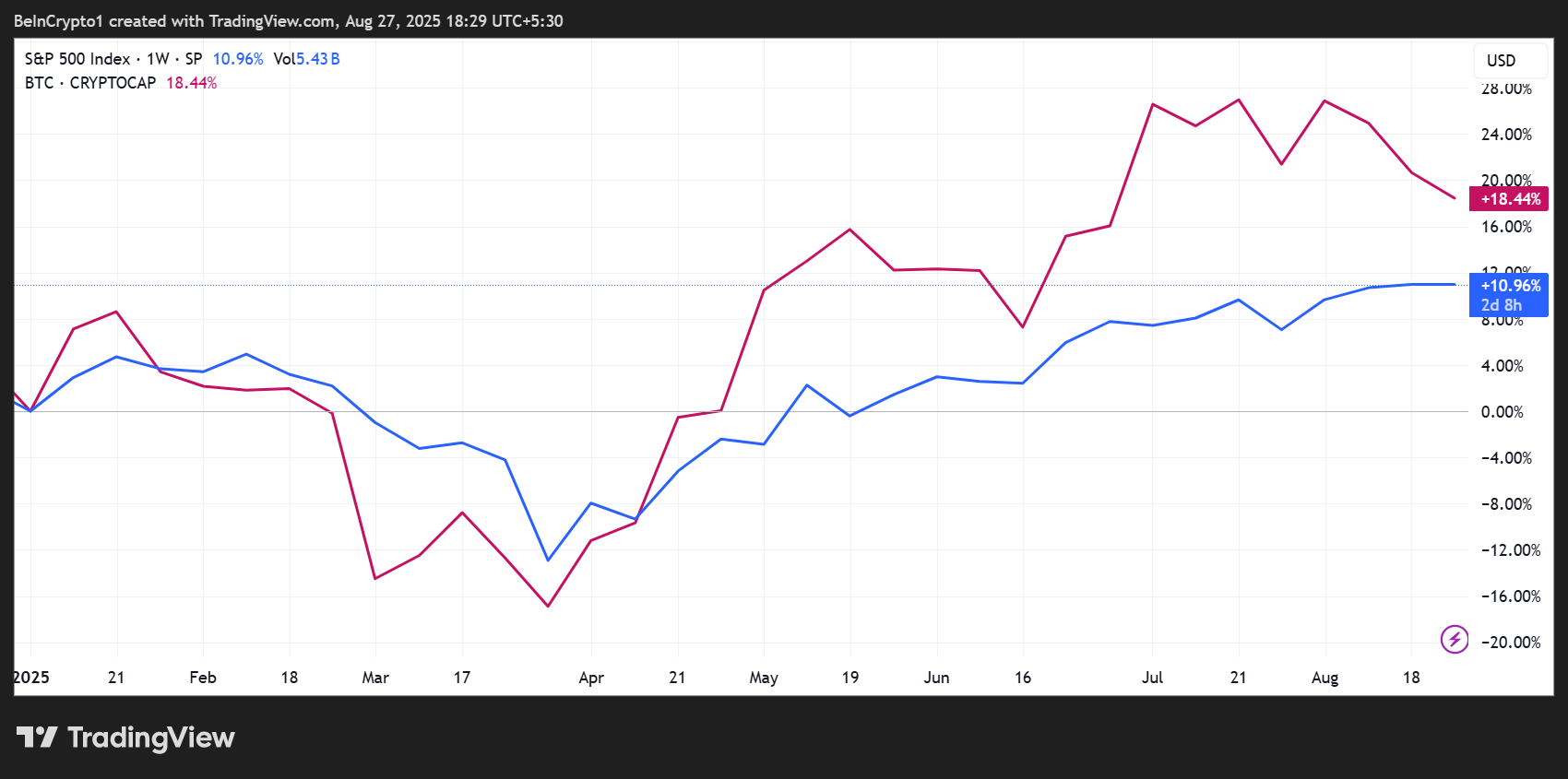

Siegel’s insights are pertinent to crypto markets. Bitcoin and Ethereum, along with other digital assets, have often mirrored Wall Street’s risk appetite, where looser monetary policy typically results in increased capital inflow into equities and crypto.

If Siegel’s predictions hold true, a decrease in interest rates and an extended bull market could also foster a crypto uptrend.

“…a potential Fed interest rate cut opens up retail capital, fueling higher demand for ETH,” Kevin Rusher, founder of RWA borrowing and lending ecosystem RAAC, shared with BeInCrypto.

As institutions increasingly regard Bitcoin as a risk-on asset, the strength of Wall Street remains closely tied to the realm of digital finance.

Chart of the Day

Byte-Sized Alpha

Here’s a roundup of more US crypto news to watch today:

- In response to the White Whale’s $3 million allegations, MEXC addresses the need for KYC in Malaysia.

- XRP Futures ETF sets the record as the fastest CME contract to reach $1 billion in open interest.

- The $5,000 Ethereum price narrative is resurfacing as major players pivot away from Bitcoin.

- Bitcoin price counters a 10-day sell streak—Are buyers regaining control?

- Three scenarios for CRO in 2026 post-Trump media deal.

- HYPE hits a new all-time high of $50 as Hyperliquid aims for breakout towards $73.

- XRP remains in sideways action, but hopeful bullish signs are beginning to appear.

- JPMorgan’s $500 million wager propels a 130% surge for NMR.

Crypto Equities Pre-Market Overview

| Company | At the Close of August 26 | Pre-Market Overview |

| Strategy (MSTR) | $351.36 | $351.12 (-0.068%) |

| Coinbase Global (COIN) | $308.48 | $308.21 (-0.088%) |

| Galaxy Digital Holdings (GLXY) | $24.72 | $24.77 (+0.20%) |

| MARA Holdings (MARA) | $15.84 | $15.81 (-0.19%) |

| Riot Platforms (RIOT) | $13.69 | $13.65 (-0.29%) |

| Core Scientific (CORZ) | $14.04 | $14.08 (+0.28%) |

The post Wall Street Is Still Bullish, But Ethereum Awaits Key Signal | US Crypto News appeared first on BeInCrypto.