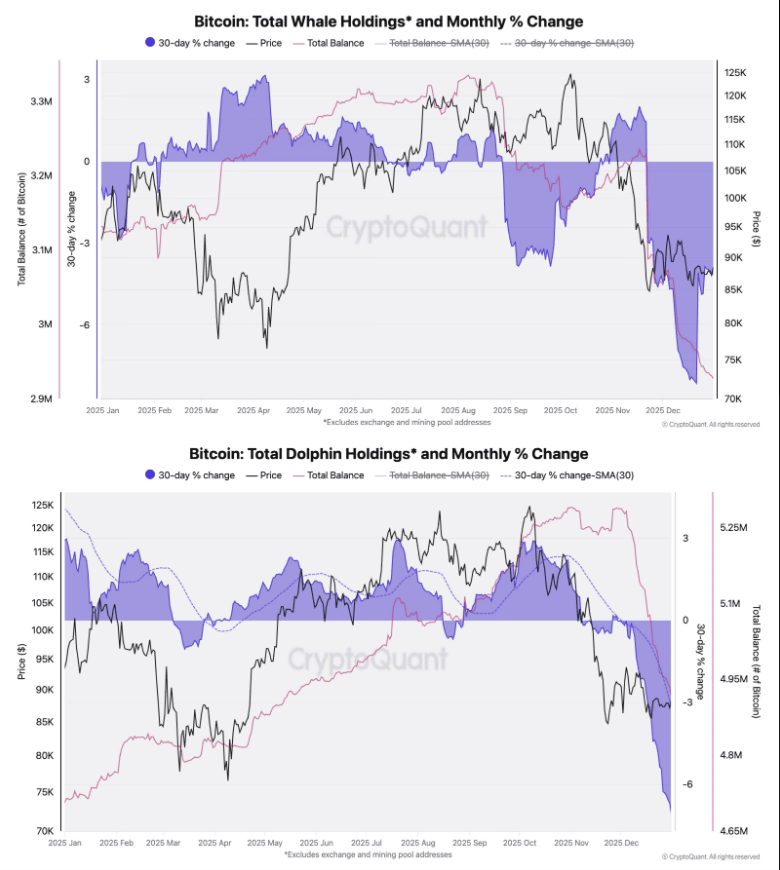

Based on on-chain data from CryptoQuant, the assertion that large holders are significantly reaccumulating Bitcoin is overstated. Information circulated on social media may be skewed by exchange activities rather than new purchases. This misrepresentation is essential because substantial transfers associated with exchanges can give the impression that a single entity is acquiring a large amount, when in reality, it’s often just internal adjustments.

Related Reading

Whale Wallet Totals Can Be Misleading

Exchanges frequently consolidate funds from numerous small accounts into a smaller number of large wallets for operational or compliance purposes. When this occurs, on-chain trackers might categorize these consolidated wallets as “whales,” inflating the perceived number of significant holders.

Julio Moreno, head of research at CryptoQuant, notes that once these exchange-related movements are excluded, the balance held by genuine large holders continues to decline. The number of addresses holding between 100 to 1,000 BTC has decreased, aligning with outflows from spot ETFs.

No, whales are not buying enormous amounts of Bitcoin.

Much of the available Bitcoin whale data has been “impacted” by exchanges merging numerous holdings into fewer addresses with larger balances, which is why it seems like whales are accumulating a substantial number of coins recently.

We… pic.twitter.com/dk9XqqckIX

— Julio Moreno (@jjcmoreno) January 2, 2026

Long-Term Holders Turning Buyer

Reports indicate that another group has shifted its strategy. Matthew Sigel, head of digital assets research at VanEck, states that long-term holders have been net buyers over the past 30 days, following their largest selling phase since 2019.

This shift could alleviate some selling pressure. While it doesn’t guarantee a price increase, it does indicate that at least one significant cohort has stopped contributing to the sell-side. Markets respond to both buyers and sellers, and this actions by long-term holders lessens the notion that a single group is pushing prices downward.

Price Action Shows Mixed Signals

Bitcoin has been fluctuating around the $90,000 mark during slow holiday trading. As of reporting, the price was approximately $89,750 on Saturday, with a 24-hour volume nearing $52 billion.

The token sits about 2.8% below a recent peak of $90,250 and has a market capitalization of around $1.75 trillion, based on a circulating supply of nearly 20 million BTC. Although trading has experienced sharp fluctuations, the low volume indicates insufficient support for a definitive breakout or breakdown.

Market Moves Hinge On ETF Flows

Since US spot Bitcoin ETFs became operational in early 2024, the ownership landscape has shifted. ETFs now account for a significant portion of both on- and off-chain demand, influencing where Bitcoin is stored and altering the appearance of flow on on-chain charts. Reports suggest that ETF outflows have contributed to decreased balances in the 100–1,000 BTC category, while simultaneously, some long-term holders are quietly accumulating.

Related Reading

What This Means For Investors

Overall, the evidence points towards consolidation rather than a new bull run or significant crash. Claims of a substantial whale reaccumulation wave were overstated, failing to consider exchange consolidations.

However, the narrative is not one-dimensional. Long-term holders are exhibiting buying interest, even as large non-exchange addresses continue to reduce their holdings. The future price trend will likely depend on whether ETF inflows return significantly and whether trading volume increases enough to confirm any market movement.

Featured image from Unsplash, chart from TradingView