As Bitcoin evolves into a pivotal asset class within public markets, a new category of corporate entity is on the rise: the Bitcoin treasury company. These organizations acquire Bitcoin as a fundamental aspect of their capital strategy, utilizing it to unlock significant upside, strengthen financial resilience, and enhance institutional credibility.

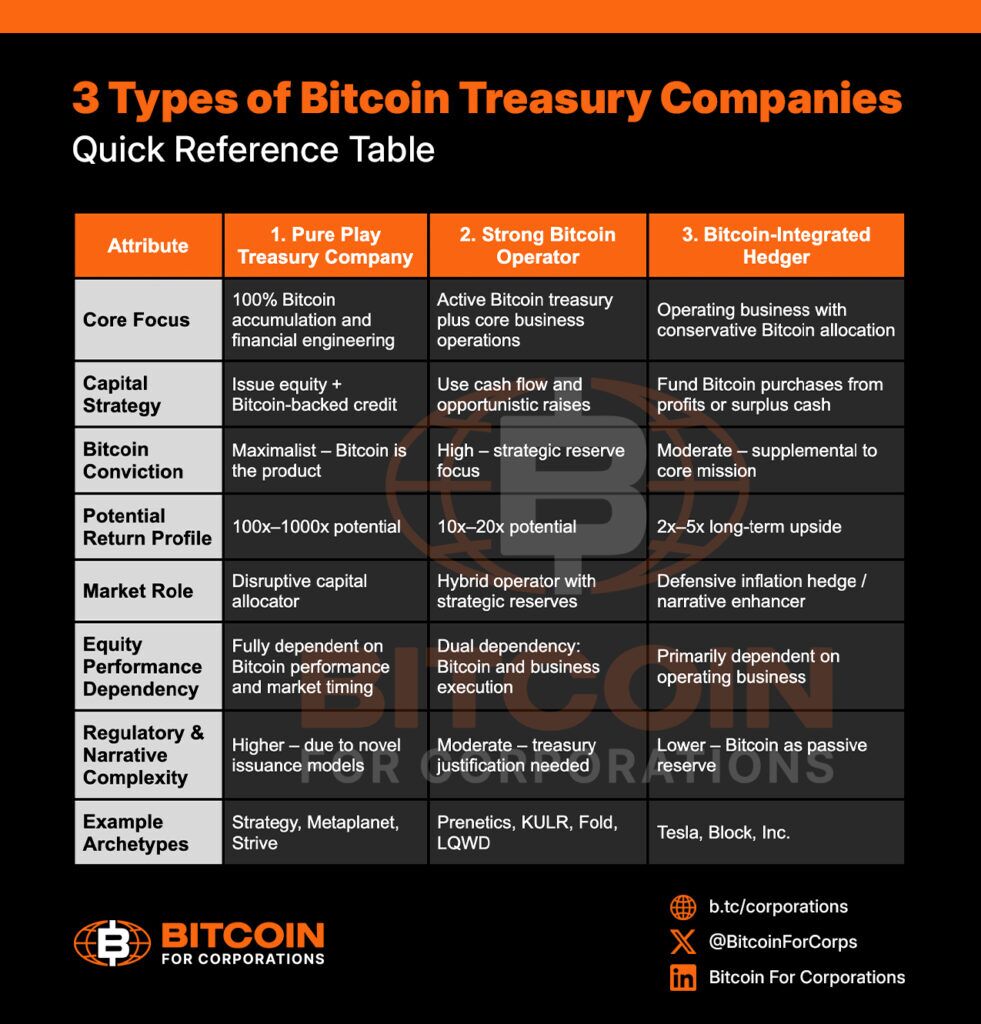

Yet, not all Bitcoin treasury companies operate similarly. Recently, Michael Saylor, Executive Chairman of Strategy (formerly MicroStrategy), articulated a distinct taxonomy to help navigate this landscape: a three-tiered system that distinguishes dabblers from dominators.

Each tier presents unique incentives, risks, and anticipated outcomes. For investors, analysts, and executives, grasping this framework is crucial for evaluating capital strategies in the Bitcoin era.

1. The Pure Play Bitcoin Treasury Company

This model represents the highest level of conviction—a company singularly dedicated to amassing and optimizing Bitcoin as its principal strategic asset. Bitcoin is not merely a reserve; it forms the essence of the business.

Pure plays are designed for one purpose: capital transformation via Bitcoin. They secure equity and issue Bitcoin-backed credit, using the generated funds to further increase their Bitcoin reserves. Their growth is unbound by traditional business metrics or fiat performance standards, deriving instead from superior monetary design.

Defining Characteristics:

- Bitcoin serves as the product, treasury, and strategy

- No legacy operations to distract or subsidize

- Capital raised directly translates to Bitcoin acquired

- Structured to thrive in low- or negative-yield fiat scenarios

Strategic Advantage:

- Ability to offer high-yield credit products in fiat-restricted markets (e.g., Swiss francs, yen, euros)

- Category leadership in domestic capital markets (e.g., Smarter Web in the UK, Metaplanet in Japan)

- Scalable framework: equity issuance + short-duration BTC-backed credit = continuous BTC accumulation

Examples:

Saylor’s Perspective:

“These are the next Mag-7 stocks. They have the potential to grow from a billion to a hundred billion, even a trillion.”

Pure plays are the apex predators of Bitcoin capital markets. They can yield returns of 100x or 1,000x due to their dominance in their category while amplifying Bitcoin-denominated value through prudent issuance and strategic foresight.

2. The Strong Bitcoin Operator

This tier embodies a hybrid model—companies that exhibit substantial Bitcoin exposure and strategic intent, though not full commitment.

Strong Bitcoin operators sustain an existing business model while also accumulating BTC and possibly issuing Bitcoin-backed instruments. Their conviction remains substantial, but operational complexity or regulatory restrictions hinder total alignment.

Defining Characteristics:

- BTC is an important component, but not the central business

- Occasional issuance of Bitcoin-backed instruments

- Continued investments in non-Bitcoin-related operations

Strategic Advantage:

- Wider appeal to investors seeking diverse exposure and risk

- Potential to transition into a pure play over time

- Favorable position in equity markets tied to BTC performance

Expected Outcome:

- Strong equity appreciation (10x–20x over the cycle)

- Less likely to become mega-cap disruptors

- Robust, yet not dominant

These firms can succeed in the Bitcoin landscape, but their potential is limited by competing interests. Often, they find themselves caught between traditional shareholder expectations and Bitcoin-centric capital innovation.

3. The Bitcoin-Integrated Hedger

At the lowest tier are companies that view Bitcoin merely as a passive hedge on their balance sheets. They are not actively building around it, issuing Bitcoin-backed debt, or educating the market; they simply hold it.

This structure is increasingly favored by firms wishing for long-term Bitcoin exposure without altering their operational framework notably. As Bitcoin appreciates, it may provide stability to market value—boosting equity even when the main business lags.

Defining Characteristics:

- No issuance or Bitcoin-native strategy

- Bitcoin is regarded as a treasury reserve

- Business operations continue unaffected

Strategic Role:

- Optionality with minimal risk

- Enhances balance sheet resilience

- Acts as a long-dated call option on Bitcoin

Expected Outcome:

- Limited downside, moderate upside

- 2x–4x returns over extended periods

- Equity performance increasingly correlates with BTC, but passively

This model does not revolutionize capital markets. However, it provides a superior hedge compared to fiat holding or underperforming fixed income investments.

Why It Matters

This hierarchy is more than just terminology. It dictates who thrives in the Bitcoin era.

- Pure plays drive the reimagining of financial infrastructure. They don’t merely store value—they redefine the cost of capital.

- Strong operators harness Bitcoin’s rise but remain limited by structures from the fiat era.

- Hedgers protect against fiat erosion but lack the strategic posture to lead.

The gap between tiers is significant. A hedger may conserve value. A strong operator may outperform. Yet only a pure play is agile enough to rewrite the rules.

The Bigger Picture: Bitcoin as the New Base Layer

Saylor does not view this as a mere corporate phenomenon. He perceives it as a comprehensive transformation of credit, equity, and capital markets.

“Bitcoin treasury companies are the engines, the drivers, the dynamos powering up that network.”

In his perspective, a new financial system is arising where:

- Savings accounts yield 8%, not 0%

- Credit is underpinned by Bitcoin, rather than fiat or real estate

- Equity indexes incorporate Bitcoin-native capital structures

Companies that adopt the pure play model today will anchor this envisioned future. They will evolve into the new financial institutions—issuing digital credit, directing capital flows, and accelerating Bitcoin-denominated value creation beyond what traditional models can achieve.

Watch the Full Interview

George Mekhail, Managing Director of Bitcoin For Corporations engages with Michael Saylor to explore Bitcoin’s role in capital disruption, balance sheet redefinition, and the evolution of 21st-century economics.

Disclaimer: This content was produced on behalf of Bitcoin For Corporations. This article is intended solely for informational purposes and should not be regarded as an invitation or solicitation to acquire, purchase or subscribe for securities.