According to several on-chain analysts, Bitcoin’s long-term holder group seems to have ceased net selling, a change that might alleviate a significant source of structural supply pressure as we approach 2026.

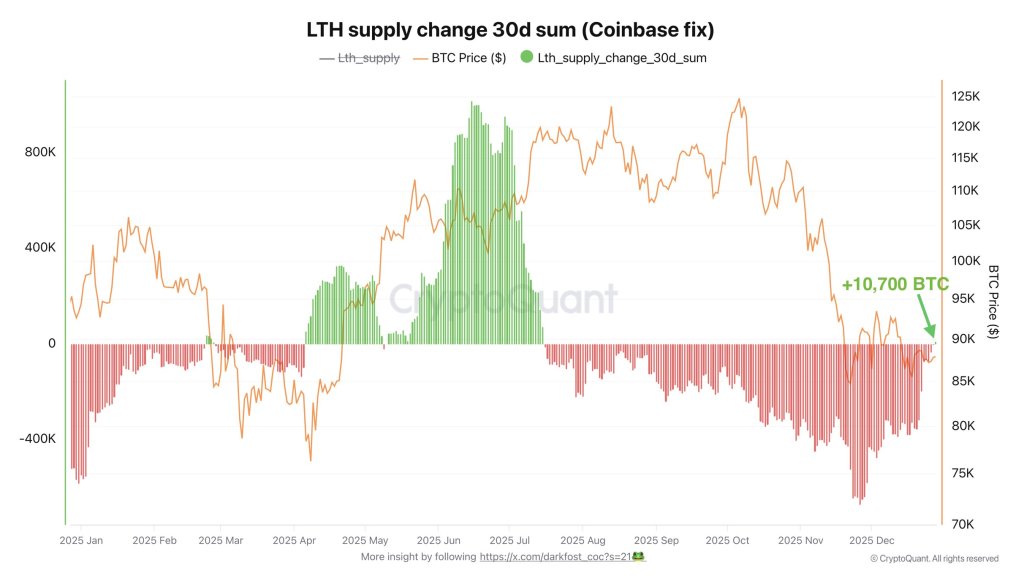

This alteration is based on a supply-change analysis of long-term holders (those holding coins for over six months), which had been in negative territory for months but has recently shifted to a slight positive, as noted by on-chain analyst Darkfost.

Is This The Bitcoin Bottom Signal?

Darkfost claims that recent assertions regarding long-term holders “selling more than ever” misinterpret the actual data, particularly when significant movements linked to exchanges distort the overall picture. “In this chart, which I modified to exclude the nearly 800,000 BTC movement from Coinbase that was affecting LTH data, we can see a distinct shift in supply change,” Darkfost explained. “Since July 16, the monthly LTH supply change (30-day total) had persistently remained in a distribution phase until recently.”

Related Reading

Simply put, this meant that the proportion of supply held by long-term holders had been decreasing throughout much of the latter half of 2025, a situation often associated with consistent sell pressure as older coins enter the market. Darkfost indicated that this trend seems to have come to an end, at least for now.

“We have transitioned back into positive territory, with approximately 10,700 BTC moving into long-term held coins,” Darkfost noted, describing it as “a very modest change,” but “not insignificant.” This suggests that long-term holders have reduced their distribution enough for their total holdings to begin rising again, even as short-term holders “continue to maintain their BTC,” according to Darkfost’s insights.

CryptoQuant CEO Ki Young Ju supported this perspective in a brief post, stating, “Bitcoin long-term holders stopped selling.”

Related Reading

Matthew Sigel, head of digital research at VanEck, described this shift as a significant change in positioning pressure via X. “BTC: Long-term holders have become net accumulators, reducing a major Bitcoin headwind and ending, for the time being, the largest sell pressure event from this group since 2019,” Sigel commented.

Esteemed expert James Van Straten provided historical context for the significance of this movement, noting that the extent of the distribution “similarly marked the 2019 bottom,” suggesting that this current transition is noteworthy, even if it doesn’t guarantee a repeat.

Darkfost also highlighted recurring patterns with such shifts. “Historically, such changes have often foreshadowed the onset of consolidation phases or even bullish recoveries, depending on how the broader trend unfolds,” he stated, focusing on conditions rather than certainties.

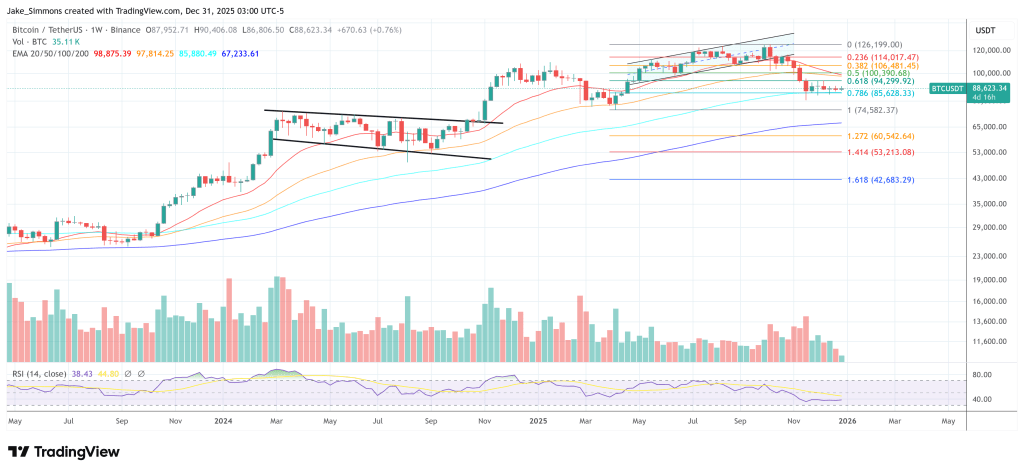

As of the latest update, BTC was trading at $88,623.

Featured image created with DALL.E, chart from TradingView.com