Here’s the rewritten content while keeping the original HTML tags intact:

Reasons to Trust

Stringent editorial standards emphasizing accuracy, relevance, and neutrality

Developed by industry professionals and thoroughly vetted

Pursuing the highest standards in journalism and publishing

Stringent editorial policies that prioritize accuracy, relevance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Top analyst Miles Deutscher believes the crypto market’s current stagnation is being misunderstood. In a recent video entitled “Why The Crypto Bull Run Is Far From Over (Data Says This Happens Next),” the commentator—who boasts over 630,000 followers on X—insists that macroeconomic and market structure indicators suggest an ongoing cycle, with Ethereum likely to lead even if Bitcoin pauses.

Is The Crypto Cycle Over?

Deutscher begins by countering a growing narrative suggesting Bitcoin “may have hit a peak,” acknowledging that the current spot price actions “objectively seem weak.” Nevertheless, he maintains, “I don’t think the cycle is finished,” detailing what he believes constitutes a real peak—something he asserts has yet to occur.

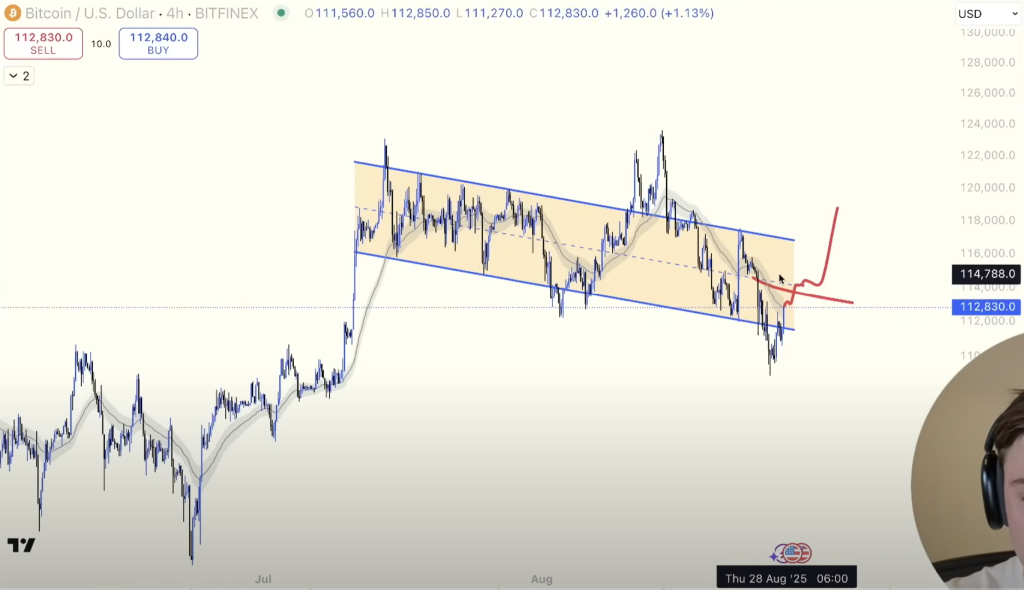

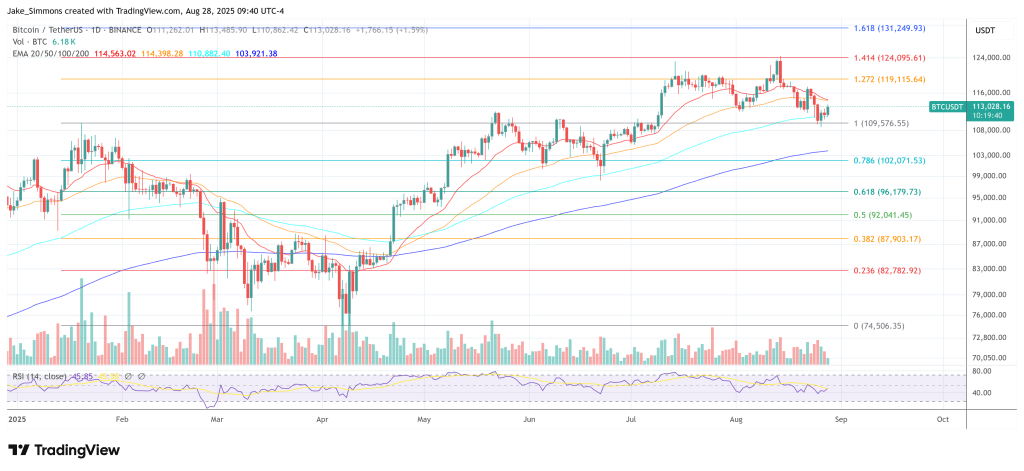

In the short term, he observes that BTC has dipped below a key support level but is trying to regain the mid-range, pointing out a near-term “bearish retest at the H4 money noodle.” He identifies the $111.5k mark as critical, with a rebound above approximately $114k needed to restore market structure. To clarify, he describes his “noodle” as a custom moving-average trend indicator: “just our unique indicator that essentially functions as a moving average.”

While Bitcoin appears “slightly overextended,” Deutscher notes that Ethereum’s daily trend “tells a much different story.” He argues that ETH is undergoing traditional compression beneath significant resistance near its previous all-time high while “trending above the money noodle,” a setup he believes paves the way for “the next significant upward movement” if the daily trend support remains intact.

Related Reading

A crucial aspect of his argument is the cycle’s correlation with larger risk indicators. Citing a post by trader Nik (@cointradernik), he emphasizes that various risk-on ratios appear to be bottoming out, not peaking—US micro caps relative to small caps, emerging markets as compared to the FTSE 100, and ARK-style growth against gold—implying that the business cycle is still progressing rather than reversing.

In this framework, Deutscher argues it would be unusual for crypto to peak now unless it consciously separated from equities. He also highlights a supportive policy environment, pointing to political discourse that favors crypto assets and the potential for interest rate cuts later this year; he describes the current market “nervousness” as a product of timing uncertainty rather than a fundamental shift.

Related Reading

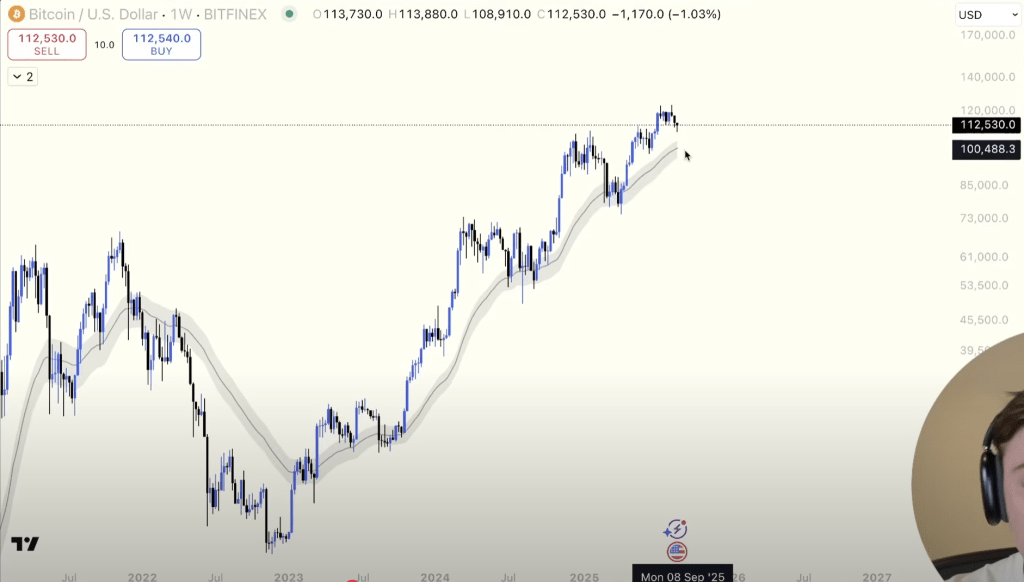

He further reflects on Bitcoin’s long-term pattern since 2023 as a sequence of “rally-base-rally” stages with consistent retests of a weekly trend marker. Within this model, he suggests that even a decline towards ~$100,000 would represent a normal bull-market correction, not a definitive breakdown, especially when comparing today’s relatively modest departures from long-term averages to those of 2021 and late-2024. “Anyone who thinks Bitcoin has peaked for this cycle at $124,000 will likely be surprised by the relative shallowness of this correction,” he states, underscoring that proximity to key moving averages limits the potential for a steep pullback.

The Altcoin Rotation

The most debated—and arguably the most significant—aspect of Deutscher’s analysis involves historical altcoin rotation. He asserts that previous cycles indicate that Ethereum tends to perform its best after Bitcoin peaks. “In 2017, when Bitcoin peaked, it fell 47% while Ethereum surged 100% higher in the following 30 days,” he claims. “In 2021, after Bitcoin topped, it fell 27% while ETH rallied…83% higher in the following month.”

While he is not asserting a Bitcoin peak at this point, he believes the crypto market is already displaying a “decoupling” where ETH and other altcoins are rising against BTC even as Bitcoin softens—evidence, in his view, that “relying on Bitcoin as the ultimate bullish indicator” for alts can be deceptive when Ethereum’s structure remains robust.

This perspective informs his trading strategy. Instead of merely longing Bitcoin at support, he states he’s increasingly utilizing BTC dips as “a setup to trade Ethereum because I anticipate Ethereum will outperform from here.” During a recent session, he revealed an expanding ETH long position in a public “fun trading account,” while emphasizing that “most traders would be better served focusing predominantly on spot” and that any use of leverage should be minimal, strategic, and within strict risk guidelines. “I’ve made mistakes in the past by being over-leveraged,” he warns.

Beyond trade setups and crypto cycle theory, Deutscher reiterates his fundamental premise: a genuine cycle peak typically aligns with a peak in the business cycle, declining breadth in risk assets, and blow-off dynamics, which he asserts are not present today. Summarizing his viewpoint, he concludes that neither Bitcoin nor altcoins have hit a peak “due to the current business cycle stage,” and even if Bitcoin marks a high sooner than he predicts, “I wouldn’t interpret that as the ultimate bearish signal for ETH and alts.”

As of the latest update, BTC was trading at $113,028.

Featured image created with DALL.E, chart from TradingView.com

Feel free to reach out if you need further adjustments!