Ethereum has taken the spotlight in the crypto market once again, reaching a new all-time high above the $4,900 mark this past Sunday. This surge, which propelled ETH into new territory, underscored the strength of bullish sentiment following weeks of institutional accumulation and market momentum. However, the price quickly retraced, falling back to the $4,600 zone, where bulls are now working to establish support before the next advance.

Related Reading

This pullback has sparked discussions among analysts. Some perceive the retracement as a possible local top, warning that ETH may need to consolidate before attempting another breakout. Conversely, others maintain a bullish outlook, citing robust fundamentals and increasing institutional interest as indicators that Ethereum’s rally is just beginning.

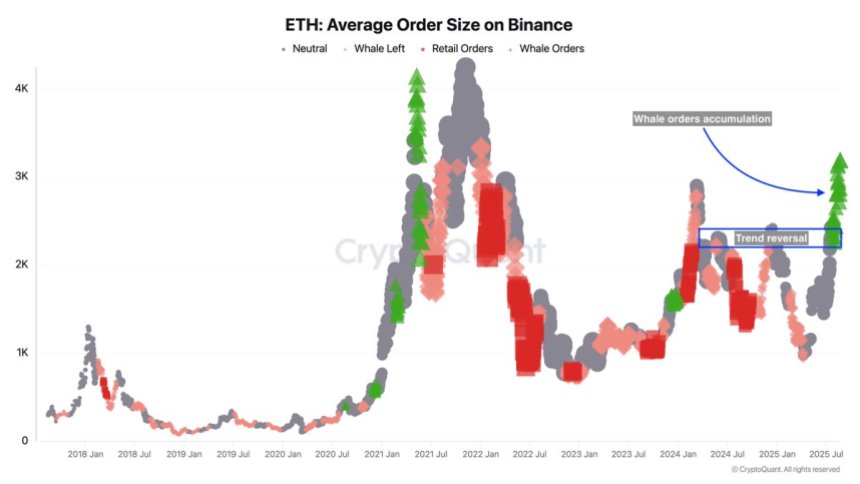

Bolstering the bullish argument, key on-chain data shows that Binance whales are heavily investing in Ethereum. Significant spot and futures orders linked to these entities have been pouring in, especially after ETH confirmed its upward trend. This consistent accumulation indicates confidence in Ethereum’s long-term prospects, even amid ongoing short-term volatility.

Binance Whales Accumulate Ethereum

Top analyst Darkfost notes that Ethereum’s Average Order Size on Binance chart offers clarity into the behavior of various market participants, differentiating retail investors from whales. Since July, there has been a notable increase in whale activity on Binance, reflecting a trend of large-scale accumulation, with significant spot and futures orders continuing to flow as ETH approaches the $5,000 level.

This trend is significant due to the timing of whale involvement. Unlike retail investors, who often invest early in anticipation of potential gains, whales typically enter once a bullish trend is confirmed.

Darkfost points out that this trend is currently observable, as whale orders began to accelerate after Ethereum reversed its previous downtrend and regained substantial bullish momentum. This reinforces the idea that larger players seek to minimize risk and find clearer signals before making significant capital investments.

As both retail and institutional investors align, the upcoming weeks could be crucial in determining whether ETH securely breaks into new price discovery. If whales continue to purchase at this rate, Ethereum’s rally could extend well past its 2021 peaks.

Related Reading

Testing Critical Support Level

Ethereum (ETH) is currently priced around $4,598 after a sharp decline from its recent all-time high near $4,900. Analyzing the 4-hour chart reveals that ETH is still maintaining a bullish trend, though momentum has waned following last week’s explosive increase.

The 50 SMA ($4,455) and 100 SMA ($4,435) are now converging just below current price levels, serving as immediate dynamic support. This cluster reinforces the bullish sentiment as long as ETH can maintain its position above it. A significant dip towards the 200 SMA ($4,068) would indicate a broader correction phase and may prolong the consolidation before another upward movement.

Related Reading

The recent pullback indicates that sellers are active near the $4,900–$5,000 zone, which now constitutes a key resistance level. A breakout above this threshold would pave the way for uncharted territory and likely enhance momentum, with targets potentially extending towards $5,200 and beyond.

On the downside, failing to hold the $4,450–$4,400 support range could shift sentiment bearish in the short term, with traders focusing on $4,200 as the next significant demand zone.

Featured image from Dall-E, chart from TradingView