The cryptocurrency market has maintained its upward trend, with Bitcoin and a majority of altcoins showing gains as crucial indicators surged.

Summary

- The cryptocurrency market rally persisted on Monday.

- Bitcoin’s price surged to $92,500, while Ethereum held steady above $3,000.

- The Crypto Fear and Greed Index moved into the neutral territory.

The price of Bitcoin (BTC) surged to $92,500, representing a nearly 15% increase from its lowest point in November. Ethereum (ETH) maintained its position well above the critical resistance level of $3,000, as the total market capitalization of all tokens exceeded $3.25 billion.

Ongoing crypto market rally as Fear and Greed Index rises

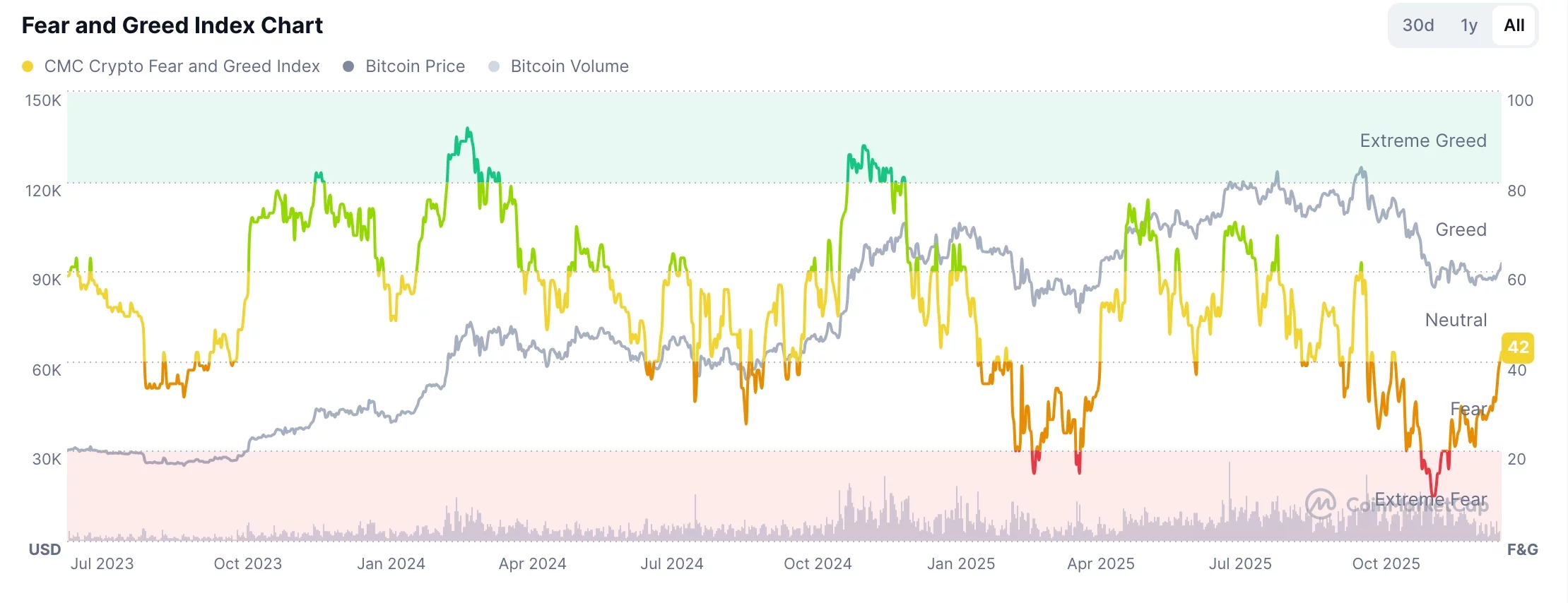

The current cryptocurrency price surge aligns with the Fear and Greed Index exiting the extreme greed zone. Data from CoinMarketCap illustrates that the index has climbed from its November low of 10 to 42, marking its highest point since September.

The Crypto Fear and Greed Index gauges industry sentiment through various metrics, including the price momentum of Bitcoin and altcoins, volatility, derivatives market activity, and Bitcoin’s relative market value.

Inspired by a similar measure from CNN Money, this index assesses critical factors such as stock price strength, breadth, put and call options, and market volatility. It has risen from an extreme fear level of 5 in November to 45 today.

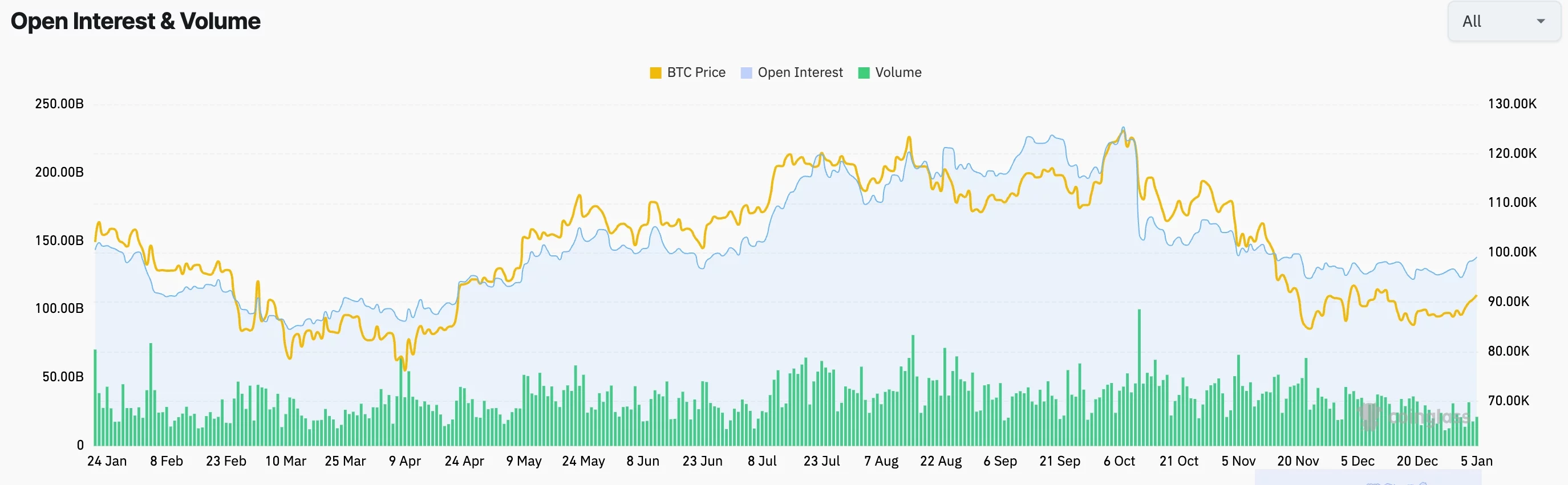

Rebound in futures open interest

The sustained rally in the cryptocurrency market also coincides with an increase in futures open interest. Data from Coinglass reveals that open interest has grown by 1.433% in the last 24 hours, surpassing $140 billion, the highest level seen in over a month.

The increase in open interest is a positive sign for cryptocurrencies, indicating that investors are leveraging their trades. Higher leverage typically results in greater potential gains.

Recently, open interest has experienced a significant downward trend following events on October 10, during which over 1.6 million traders were liquidated, resulting in losses exceeding $20 billion after President Donald Trump threatened tariffs on Chinese imports.