Investment in cryptocurrency products remained stable during last Friday’s significant flash crash, showing strong inflows over the past week.

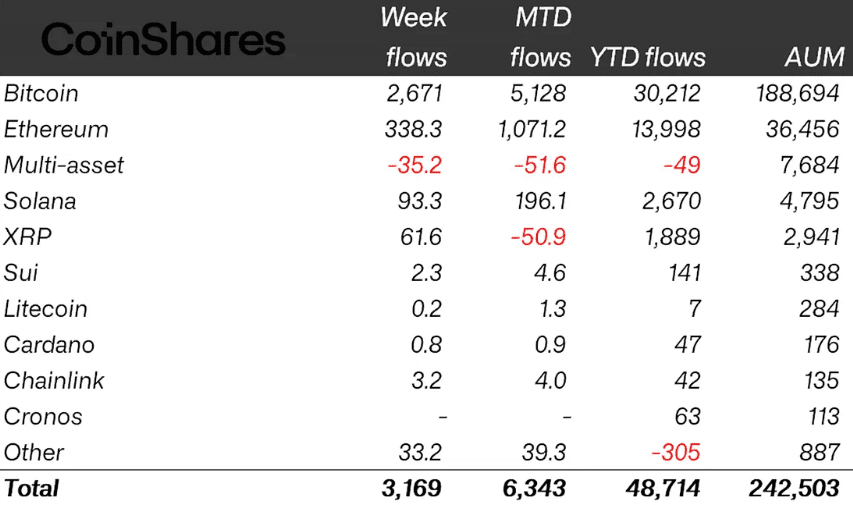

Crypto exchange-traded products (ETPs) saw inflows of $3.17 billion last week, despite the market downturn triggered by new tariff threats from US President Donald Trump, as reported by CoinShares on Monday.

“On Friday, there was minimal response with a mere $159 million in outflows,” noted CoinShares head of research James Butterfill, underscoring the resilience of crypto funds to market panic following the sell-off and $20 billion in liquidations.

In addition to strong weekly inflows, crypto funds achieved a new record by surpassing total inflows from last year, rising to $48.7 billion year-to-date.

Trading volumes reached new peaks during Friday’s market turmoil

CoinShares also reported a record high in weekly trading volumes for crypto funds, which surged to $53 billion, including $15.3 billion on Friday alone.

However, total assets under management (AUM) fell over the past week, dropping from $254 billion to $242 billion.

Bitcoin (BTC) funds led the week’s inflows with $2.7 billion, pushing year-to-date inflows to a new peak of $30.2 billion, still about 30% lower than last year’s total of $41.7 billion.

“Volumes during Friday’s price correction hit a record high of $10.4 billion for the day, while flows only reached $0.39 million,” noted Butterfill.

Ether funds faced the largest outflows

While Ether (ETH) investment products experienced $338 million in net inflows last week, they also recorded the largest single-day outflow among major crypto assets on Friday, amounting to $172 million.

Butterfill pointed out that investors perceived Ether funds as the “most vulnerable” during the market correction.

Meanwhile, altcoin investment products experienced a noticeable decline. Solana (SOL) funds garnered $93.3 million, and XRP (XRP) products attracted $61.6 million, both significantly down from the previous week’s $706.5 million and $219 million, respectively.

Related: Luxembourg sovereign wealth fund invests in Bitcoin ETFs with a 1% stake

Butterfill noted that the decrease in SOL and XRP inflows occurred despite the increasing excitement surrounding upcoming SOL and XRP ETF launches in the US.

As the US enters its third week of shutdown, at least 16 crypto ETFs await approval should the shutdown extend into November.

According to ETF analyst and NovaDius Wealth Management president Nate Geraci, a “flood” of spot crypto ETFs is expected once the government shutdown concludes.

Magazine: ‘Debasement trade’ will boost Bitcoin, Ethereum DATs will prevail: Hodler’s Digest, Oct. 5 – 11