Chainlink’s (LINK) native token from Oracle network made a strong comeback alongside the wider crypto market after Federal Reserve Chair Jerome Powell’s dovish comments in Jackson Hole, Wyoming.

LINK surged 12% in the past 24 hours, reaching $27.8, its highest price since December. Bitcoin (BTC) rose by 3.5% during the same timeframe, while the broader CoinDesk 20 index increased by 6.5%.

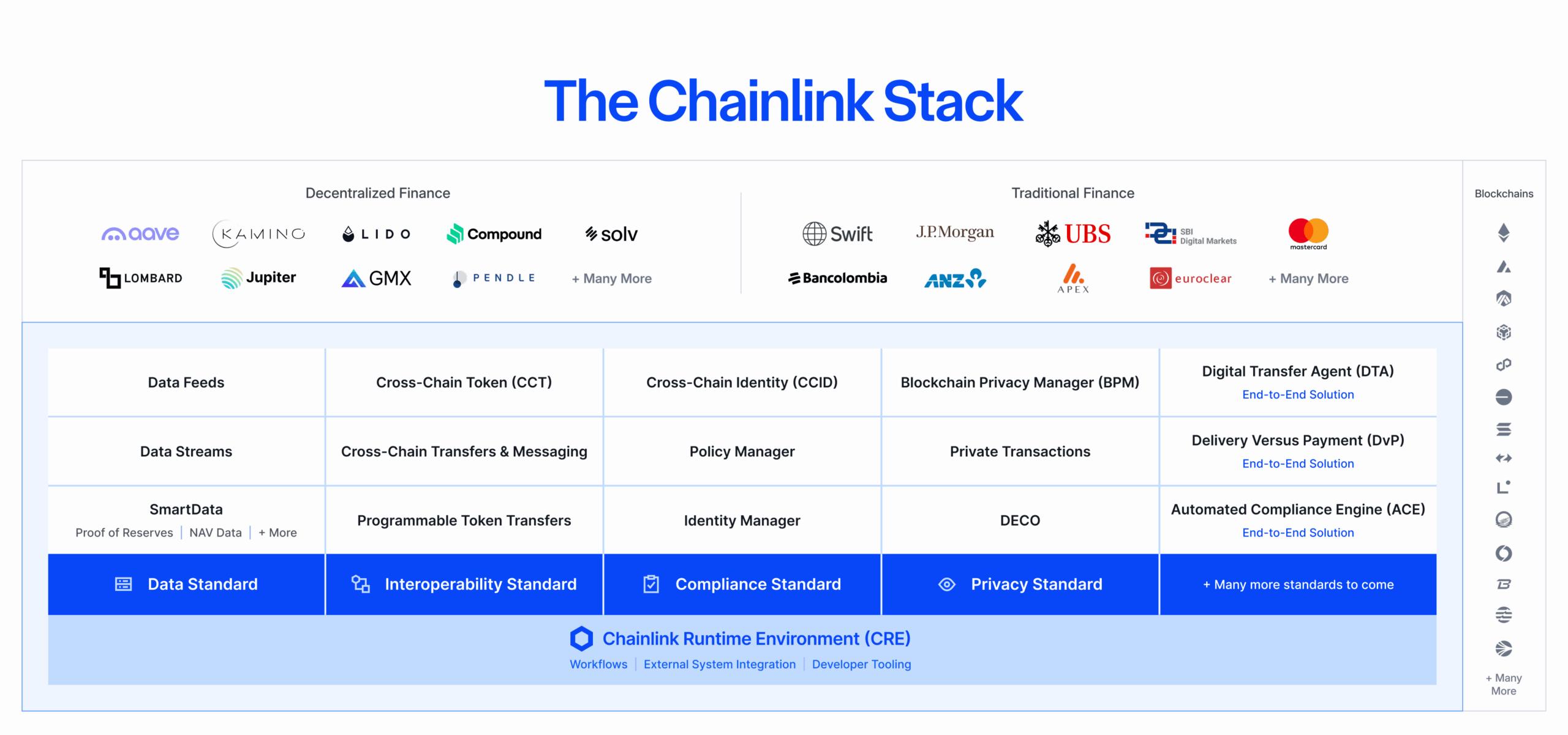

In protocol-specific developments, Chainlink secured two significant security certifications this week: ISO 27001 and a SOC 2 Type 1 attestation, marking a first for a blockchain oracle platform. The audits, conducted by Deloitte, examined Chainlink’s price feeds, proof-of-reserve services, and the Cross-Chain Interoperability Protocol (CCIP).

The oracle provider states this move enhances confidence in its data services and could improve adoption among banks, asset issuers, and decentralized finance protocols.

Additionally, the Chainlink Reserve, which regularly acquires LINK tokens in the open market using protocol revenues, purchased 41,000 tokens on Thursday, valued at approximately $1 million at that time. This brought total holdings to 150,778 tokens, equivalent to around $4.1 million at current prices.

Technical analysis

- Support Levels: Strong defense established at $24.15 with high-volume confirmation, as per CoinDesk Research’s technical analysis data.

- Resistance Penetration: Consistent advancement through $25.00, $25.50, and $26.00 levels, with volume confirmation from institutional participants.

- Trading Volume Analysis: Notable volume surge to 12.84 million during the breakout phase, five times the 24-hour average of 2.44 million units.

- Consolidation Patterns: Extended tight range consolidation between $24.70 and $25.10 before an explosive breakout driven by institutional activity.

- Momentum Indicators: Ongoing upward trajectory featuring measured advance characteristics and signals of institutional accumulation from corporate treasury operations.

Disclaimer: Some parts of this article were generated with the help of AI tools and reviewed by our editorial team to ensure accuracy and compliance with our standards. For more details, see CoinDesk’s full AI Policy.