Hyperscale Data has revealed that the value held in its Bitcoin treasury now constitutes approximately 66% of the company’s overall market capitalization, based on the last closing stock price.

Summary

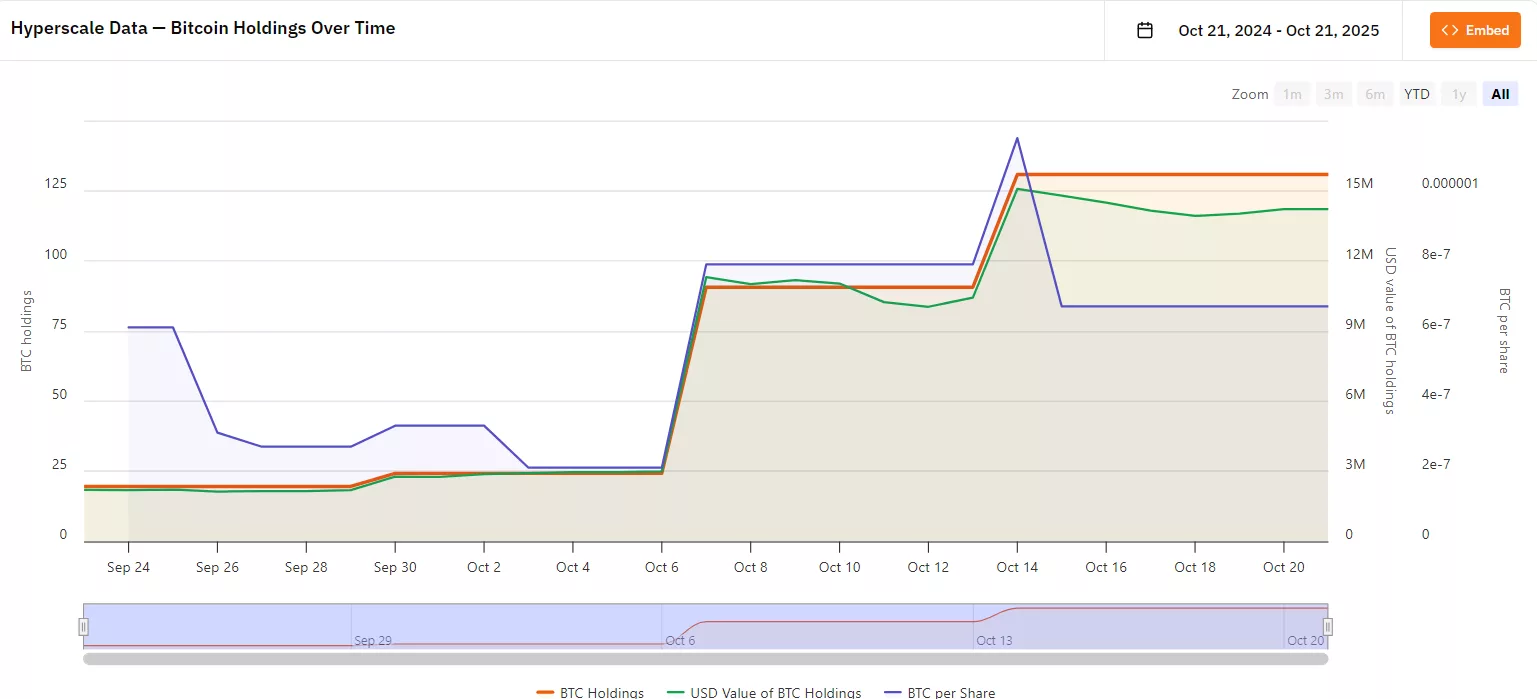

- Hyperscale Data’s Bitcoin assets have reached around 150.21 BTC ($16.3 million) through mining and purchases on the open market, along with $43.7 million in additional funds.

- The company is targeting a $100 million Bitcoin treasury, which would represent 100% of its market capitalization, and reports its progress weekly. It has successfully entered the ranks of the top 100 public companies based on Bitcoin holdings.

As per a press release from the company, its Bitcoin treasury includes assets and funds designated for purchases totaling approximately $60 million. This figure supposedly represents around 66% of the company’s total market cap, which is reported as $75 million according to Bitcoin Treasuries.

As of October 19, the subsidiary Sentinum reportedly managed a Bitcoin (BTC) treasury of about 150.21 Bitcoin ($16.2 million). This amount consists of 32.632 BTC acquired through mining operations, valued at approximately $3.52 million, in addition to Bitcoin obtained from open-market purchases.

The company has acquired up to 117.58 BTC to date. Its most recent acquisition occurred during the week of October 19, when it bought 15.88 BTC. Based on Bitcoin’s closing price of $108,666 on that date, these holdings are estimated to be worth $16.3 million.

Furthermore, the company asserts it has allocated about $43.7 million in corporate funds for Sentinum to purchase more Bitcoin from the open market. The company intends to continue investing using a strategy it refers to as “measured dollar-cost averaging,” designed to minimize the effects of market volatility while enhancing the value of its long-term reserves.

“The volatility in Bitcoin’s price has created significant opportunities for us to build our position in a methodical manner that ensures favorable long-term averages,” stated Milton “Todd” Ault III, Executive Chairman of Hyperscale Data.

Hyperscale Data’s aspiration to hold 100% of its market cap in BTC

Hyperscale Data has announced its commitment to continue acquiring Bitcoin to achieve its long-term objective of establishing a Bitcoin treasury valued at 100% of its market capitalization. As part of its wider strategy for digital asset treasuries, it aims to accumulate as much as $100 million worth of Bitcoin through both market purchases and self-mining efforts.

“Hyperscale will issue weekly reports every Tuesday morning, detailing its Bitcoin holdings as we progress toward our $100 million DAT target,” the company declared in its official communication.

According to data from Bitcoin Treasuries, Hyperscale Data has been acquiring Bitcoin for less than a month, having begun its Bitcoin holdings on September 23 of this year. Currently, its total Bitcoin assets amount to 130.8 BTC, valued at $14.18 million. With an average acquisition cost of $115,460, the company has reported a loss of approximately 6.02% following Bitcoin’s drop below $110,000.

When compared to more established Bitcoin treasury firms such as Strategy, Metaplanet, Tesla, and Galaxy Digital, it has considerable ground to cover. Nevertheless, it has succeeded in securing a position within the top 100 public companies that hold Bitcoin, ranking 98th with 131 BTC, surpassing both Mac House and Bitcoin Depot.

At the time of writing, Bitcoin has experienced a 2.5% decline in the past 24 hours, continuing a downward trend of 2.75% over the last week. The leading cryptocurrency by market capitalization is currently trading at $108,153 as it seeks to regain the $110,000 mark.