BlackRock’s fund, concentrating on the leading cryptocurrency, has now outpaced the holdings of Strategy and is ranked second globally in reserves, at least among known entities.

While this represents a significant milestone in mainstream acceptance, caution is warranted, as centralization was not the original vision proposed in the whitepaper.

Making History

The on-chain analysis platform shared its most recent report, showcasing a historic accomplishment by BlackRock’s iShares Bitcoin Trust (IBIT) ETF. Since its launch in January of last year, the exchange-traded fund has accumulated over 781,000 bitcoins, an astonishing amount worth over $88 billion at the current price of around $113,000.

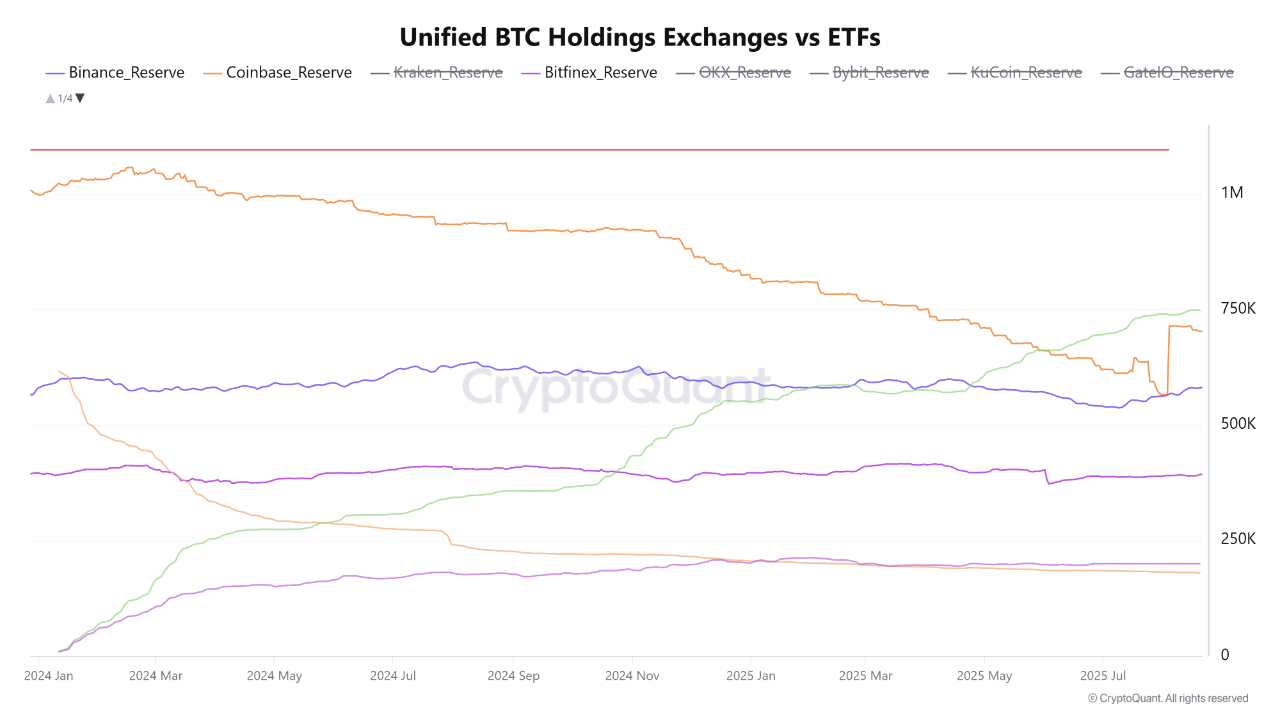

Based on CryptoQuant’s data, the ETF has been spearheading the accumulation effort since May 2025, overtaking the holdings on Coinbase. By August, this lead was firmly established, making the fund the largest Bitcoin holder, surpassed only by the anonymous Satoshi Nakamoto’s wallet.

The latest figures indicate a substantial lead over Coinbase, with even Binance lagging behind, holding over 703,000 and 558,000 units respectively.

Additionally, the investment company’s fund has surpassed the massive Bitcoin treasury company Strategy, which currently holds 629,376 bitcoins, valued at around $71 billion, based on current market prices.

What makes BlackRock’s accomplishment even more remarkable is that the giant managed to dismantle the Saylor-led company’s five-year accumulation lead in just a year and a half, illustrating the rapidly growing institutional interest in the leading crypto asset.

What Does This Mean?

The continuous inflows into the ETF signify a notable market shift. Demand is no longer confined to retail exchanges and experienced investors, but is now extending to regulated financial products aimed at organizations.

The persistent buying pressure from the IBIT fund is creating an ongoing supply shock, as the capital from the ETF is mostly taken out of circulation, unlike exchanges that utilize their reserves for trading. This offers robust support for prices as the available supply declines.

This also indicates a behavioral shift among investors, as sentiments towards more traditional and compliant funds rise. With holdings in major exchanges decreasing, their conventional role as asset storehouses is making way for institutional demand.

While this denotes a new chapter for the original cryptocurrency, which has seen an incredible journey since its introduction in 2009, this corporate centralization contradicts its foundational ethos. The future implications of this trend remain uncertain, so ongoing observation will be essential for maintaining balance.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!