As Bitcoin (BTC) stagnates around the $113,000 mark, Ethereum (ETH) continues to demonstrate strength, showcasing a distinct divergence in price movements between the two leading cryptocurrencies by market capitalization. This variation has led some investors to contemplate shifting from BTC to ETH in order to seize the latter’s bullish trajectory.

Bitcoin Faces Correction Risks – Is ETH Secure?

According to a CryptoQuant Quicktake analysis by contributor XWIN Research Japan, on-chain data indicates underlying vulnerabilities in BTC’s price trend. In contrast, ETH displays significant resilience even as the wider crypto market’s momentum wanes.

Related Reading

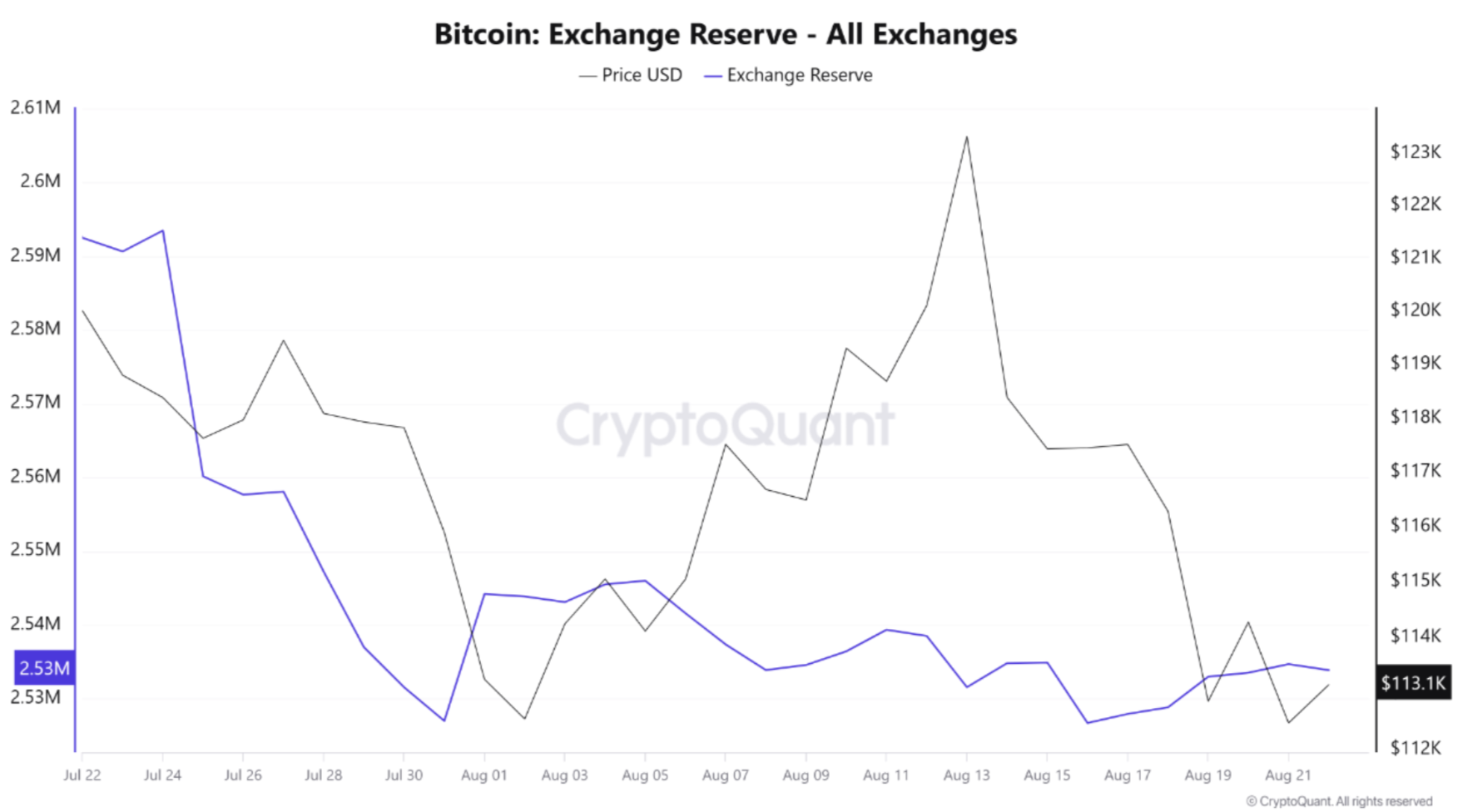

Currently, Bitcoin’s exchange reserves are around 2.53 million BTC, with little indication of decrease despite recent volatility. For context, BTC has dropped 5.4% over the last week.

Historically, decreasing exchange reserves indicate BTC being moved off exchanges for long-term holding, which lessens short-term selling pressure. However, this time, the reserves remain stable, suggesting that a considerable portion of BTC supply is still liquid and primed for selling.

Stable exchange reserves—coupled with BTC’s recent decline from $123,000 to $113,000—have raised concerns about a potential short-term correction. Meanwhile, ETH’s on-chain metrics present a contrasting narrative.

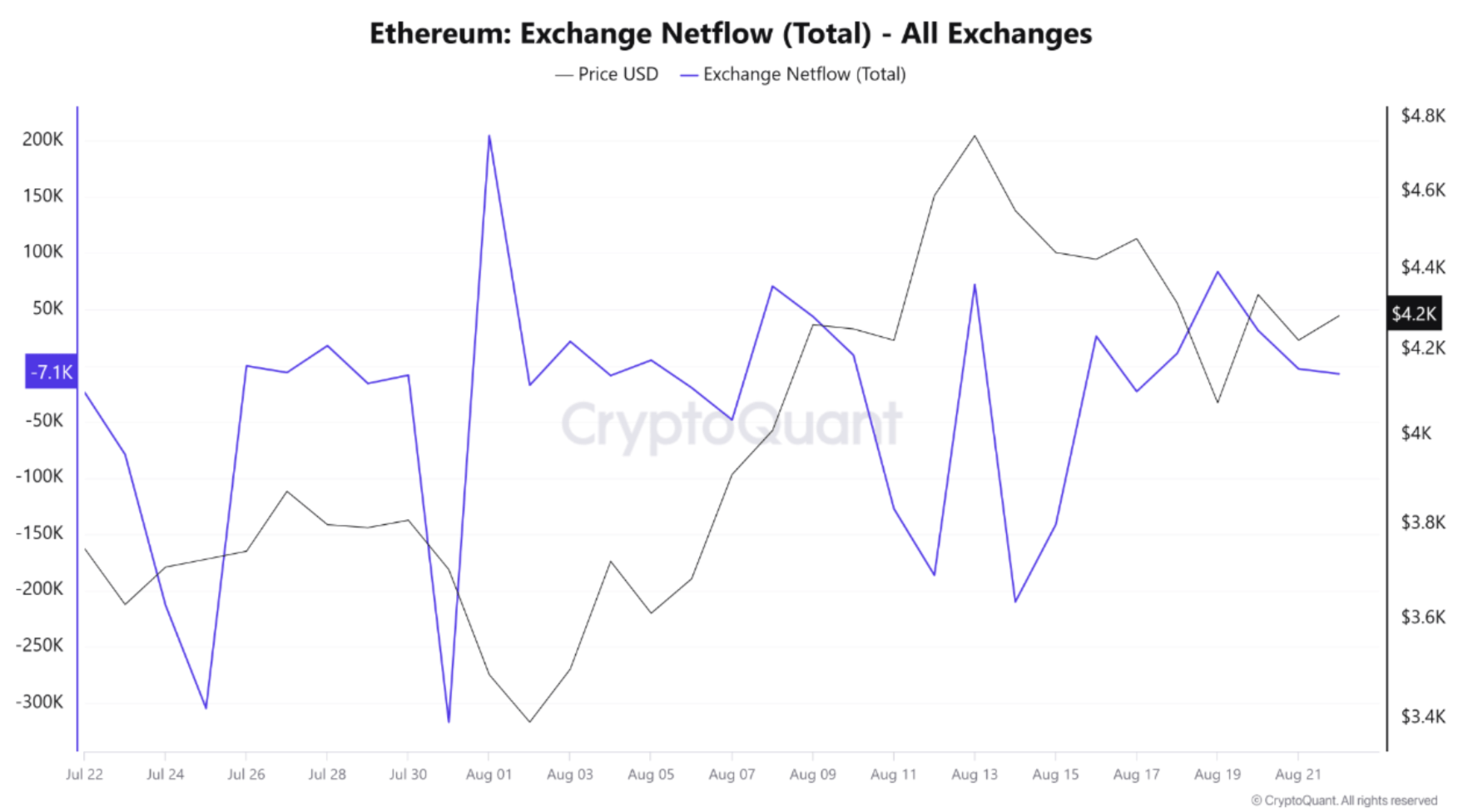

In contrast to BTC, ETH has consistently shown significant net outflows from exchanges, including several spikes exceeding 300,000 ETH in late July and mid-August. XWIN Research Japan noted:

Outflows typically indicate coins moving into cold storage, staking, or institutional custody, thereby tightening the available supply in the open market. ETH’s price has ranged from $4,150 to $4,400, aligning with the outflow trend and strengthening a bullish outlook of a potential supply shock.

In summary, while BTC is consolidating with persistent sell-side liquidity, ETH’s declining exchange balances suggest increasing institutional demand. These contrasting dynamics imply that capital may be shifting from BTC to ETH.

Divergent Trends Between BTC And ETH

Aside from exchange reserves, various indicators also point towards additional downside threats for BTC and escalating institutional interest in ETH, underlining the market’s preference for Ethereum over Bitcoin.

Related Reading

For example, prominent crypto analyst Xanrox has recently made a bold price forecast for BTC, suggesting it could plummet down to $60,000 – nearly a 50% decrease from its current market value.

At the same time, large investors continue to amplify their exposure to ETH, rapidly increasing their holdings as ETH’s relative strength against BTC improves. Just yesterday, an Ethereum whale went long on $300 million worth of ETH on-chain.

From a technical perspective, indicators also appear favorable for ETH, with a potential rebound to $4,788 appearing plausible. Currently, BTC is trading at $112,283, reflecting a 0.7% decrease over the previous 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com