Bitcoin is currently priced around $107,000 following a recent flash crash. While it has stabilized to avoid further drops, it has not yet managed to surpass the $110,000 mark. Notably, renowned crypto analyst Titan of Crypto has shared an in-depth analysis via Gaussian Channel on X, indicating that Bitcoin’s macro bull structure remains intact despite the recent fluctuations. His post featured a Bitcoin price chart, illustrating how Bitcoin’s position in relation to the Gaussian Channel provides a clear perspective on the ongoing cycle.

Related Reading

Bull Market Intact Above Gaussian Channel

According to Titan of Crypto he noted that Bitcoin’s position above the Gaussian Channel signifies strength in the long-term trend. The weekly candlestick price chart below shows that the green channel corresponds to bullish phases, while red zones represent bearish downturns, exemplified by the 2022 bear market.

As of now, the upper band is around $101,300 and is trending upwards. Thus, Bitcoin’s price around $107,000 indicates it hasn’t broken into the Gaussian channel, and its overall market structure remains sound. This suggests that the current pullback from the October 6 all-time high above $126,000 is merely a temporary pause within a larger bull market.

Bitcoin Gaussian Channel. Source: Titan of Crypto on X

Despite the favorable reading from the Gaussian Channel, Titan of Crypto emphasized that this indicator should not serve as a trading trigger. “It’s not a buy signal, it’s a macro context indicator,” he stated. Being above the Gaussian Channel doesn’t necessarily imply an increase in buying. It simply indicates that the bull market structure remains intact.

The Gaussian Channel is most effective when used alongside other indicators like trading volume, moving averages, and on-chain accumulation trends to confirm directional momentum.

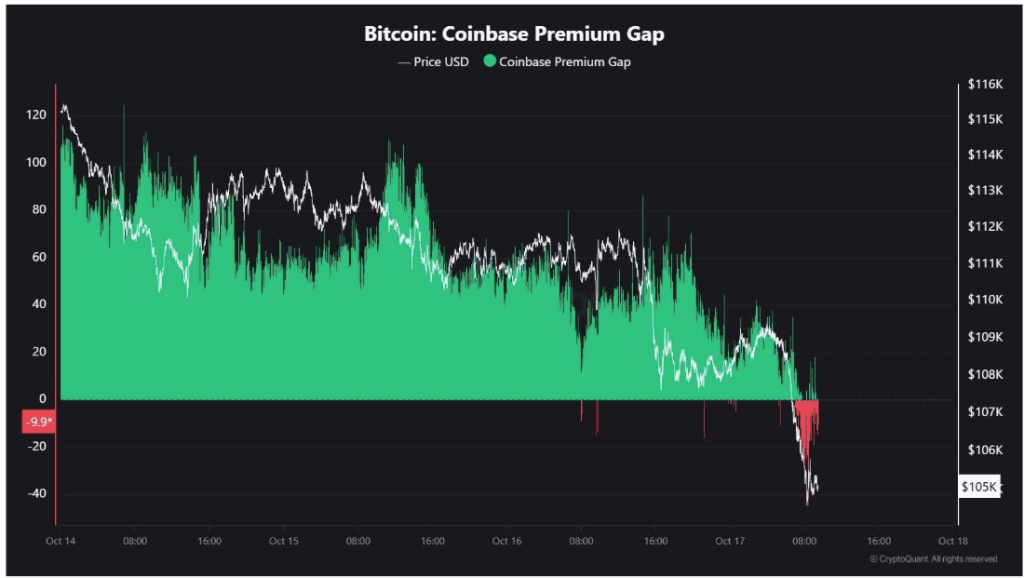

Coinbase Premium Gap Turns Red

In terms of other indicators, on-chain data from CryptoQuant has revealed that the Coinbase Premium Gap, which compares Bitcoin’s price on Coinbase to other exchanges, has turned red. As illustrated in the chart below, Coinbase’s Premium Gap sharply declined from positive premium levels above +60 earlier in the week to as low as -40 when Bitcoin’s price dropped to $101,000.

Interestingly, the Coinbase Premium Gap has now increased to about -10 at the time of writing, indicating that US investors are beginning to adopt a bullish stance once more. This can be perceived as a bullish signal, similar to the dips in US demand recorded between March and April before Bitcoin’s price surged over 60% to attain new all-time highs.

Related Reading

However, a mere red Coinbase Premium Gap shouldn’t be taken at face value. It should be considered alongside other metrics, including ETF inflows, trading volume, liquidity, and derivatives funding rates. At the time of writing, Bitcoin was trading at $107,120.

Featured image from Vecteezy, chart from TradingView