Certainly! Here’s a rewritten version of the content while keeping the HTML tags intact:

Summary

- The projected price range is between $115K and $120K; in an optimistic scenario, targets could reach $125K to $130K, whereas a pessimistic outlook suggests a drop to $110K or even $100K based on predictions from Bitcoin analysts.

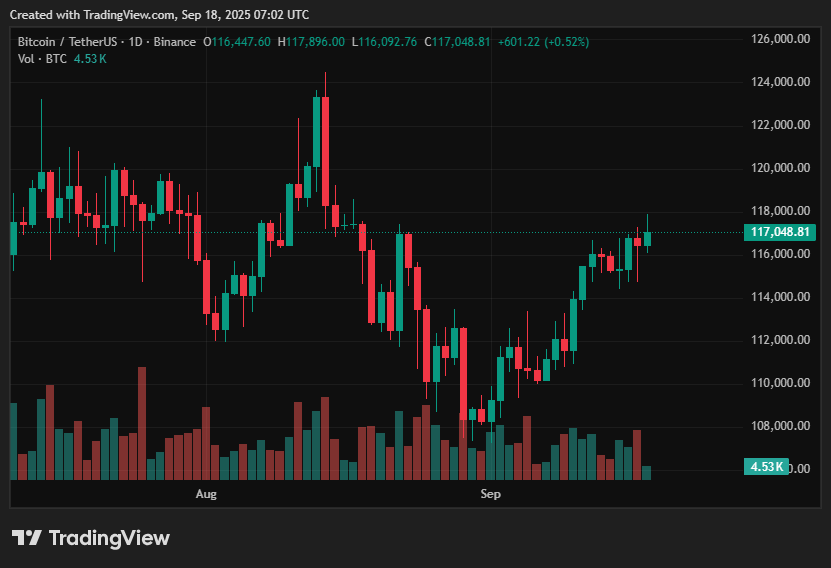

- As of September 18, 2025, Bitcoin is trading near $117,000 after the Federal Reserve’s 25 basis point rate cut elicited a dovish market reaction.

- The intraday trading range lies between $116K and $118K, with stronger open interest in futures and increased trading volumes.

- Significant withdrawals from exchanges are evident in on-chain flows, leading to a decreased supply.

- Institutional interest and inflows into spot ETFs contribute to a bullish outlook; a breakout towards $125K–$130K appears feasible.

- Potential risks include profit-taking, historical downturns in September, a stronger USD/yields, and a breach of the $115K support level.

In light of the U.S. Federal Reserve’s recent 25-basis-point rate cut, anticipation surrounding Bitcoin price forecasts has escalated, with the cryptocurrency trading at roughly $117,000 as of September 18, 2025.

Risk assets experienced swift repricing following the cut and the Fed’s dovish guidance; in the crypto market, this resulted in heightened spot volumes, increased futures open interest, and stimulated interest in spot ETFs. While the macro movement has reduced some immediate policy risks, investors are left speculating whether further Fed rate cuts might be on the horizon this year.

Current Bitcoin Price Insights

On September 18, Bitcoin’s intraday fluctuations were tightly concentrated between $116K and $118K, with 24-hour spot volumes significantly surpassing those from the preceding week, indicating a slightly upward trading session.

Notable net withdrawals from centralized exchanges during September indicate a reduction in available spot supply, whereas derivative metrics (open interest) and exchange order flow suggest that traders are increasingly leveraging their positions. Following the Fed’s rate cut, Bitcoin (BTC) has remained range-bound yet slightly tilted upward, a trend explained by these collective indicators.

Positive Aspects for Bitcoin Pricing

The primary bullish catalysts include institutional demand for spot Bitcoin ETFs and reduced liquidity on exchanges. Bids within the $115K–$120K range have received robust support from recent net ETF inflows and significant U.S.-listed ETF acquisitions around the FOMC meeting.

As leveraged futures roll over and momentum traders align with the market movement, Bitcoin may soon revisit $120,000 and potentially target the $125K–$130K range if spot demand (from ETF creations and OTC purchases) remains strong and exchange withdrawals continue. Recent regulatory shifts and improvements in market infrastructure also bolster expectations for sustained institutional interest, strengthening the medium-term outlook for Bitcoin.

Factors that May Negatively Impact BTC Prices

Despite positive flows, risks persist. Bitcoin could revert to the low-$110K range or lower if it slips below the mid-$115K level, which could trigger profit-taking and short-term deleveraging in futures markets.

Plausible downside catalysts include any hawkish signals from the Fed, seasonal trends (September has historically been unfavorable), or unexpected increases in Treasury yields and USD strength.

Additionally, previously withdrawn supply may re-enter the market, exerting downward pressure on prices if interest in spot ETFs diminishes or if major token holders begin to sell.

Bitcoin Price Predictions from Current Position

The immediate key range for BTC is between $115K and $120K, with traders considering two potential scenarios:

Scenario A: A continued rise above $120,000, driven by ongoing ETF inflows and low liquidity on exchanges, suggests that the market could target the $125K–$130K range in the coming weeks. This forms the short-term BTC price forecast that traders are closely monitoring.

Scenario B: A pullback or failure to maintain momentum: If leveraged positions are liquidated, a drop below $115K (or a notable increase in U.S. yields) could drive prices down towards $110K and, in extreme cases, the $104K–$100K zone. As long as inflows into ETFs and withdrawal patterns remain robust, the market currently reflects a neutral to optimistic stance with an inclination toward upside volatility. Current data on ETF flows, metrics on exchange supply, and commentary from the Fed’s September 17 statements reinforce these scenario predictions and align with market expectations.

Disclosure: This article does not constitute investment advice. The information and materials presented on this page are intended for educational purposes only.