As of September 23, 2025, Bitcoin is trading close to $113,000, recovering from a significant mid-month dip. The overarching narrative concerning US policy has transformed considerably this year, particularly after President Trump’s executive order to establish a Strategic Bitcoin Reserve in March.

The reserve currently contains approximately 198,000 BTC from forfeited assets, but a pivotal moment will arrive should Congress pass a bill to solidify and expand its framework.

Utilizing advanced chain prompts, market context, BTC supply, and OTC data through ChatGPT, we’ve forecasted Bitcoin’s price response to various legislative scenarios. The analysis reveals key insights based on flow mathematics and market signals for traders to monitor.

Sponsored

Sponsored

What Congress is Discussing

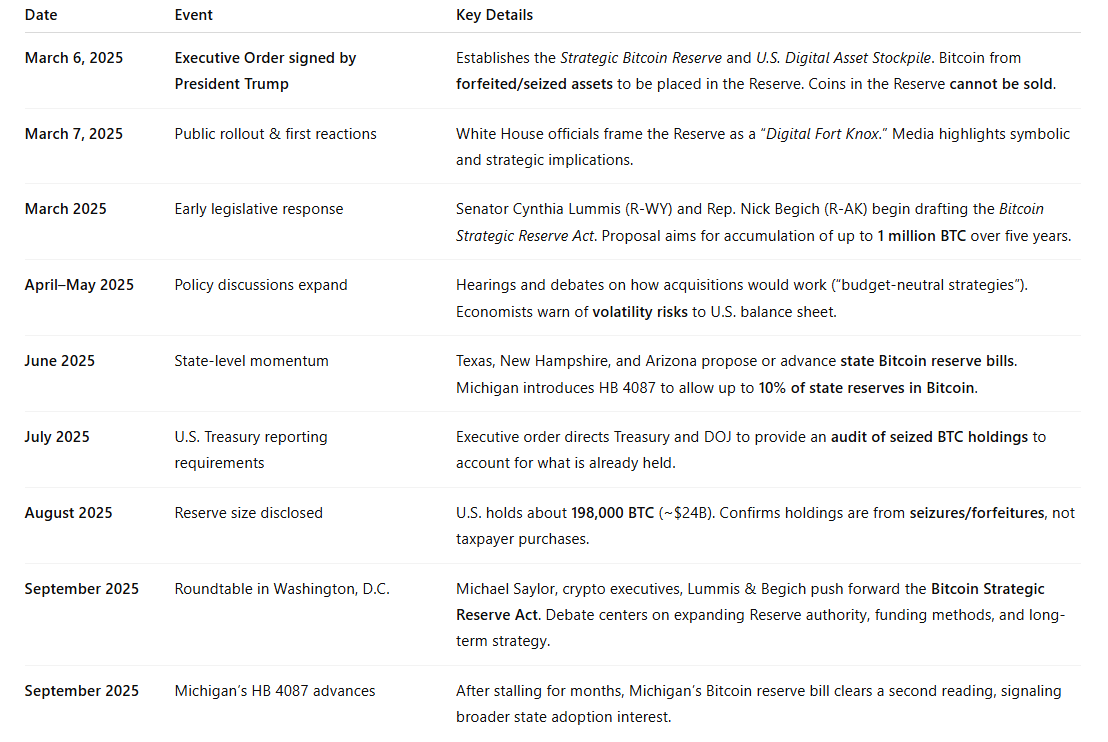

- Executive order (March 2025): Created the Strategic Bitcoin Reserve and US Digital Asset Stockpile, placing seized Bitcoin under permanent federal custody and banning any sales.

- Pending legislation: Senator Cynthia Lummis and Rep. Nick Begich proposed the Bitcoin Strategic Reserve Act, with some drafts suggesting the accumulation of up to 1 million BTC over five years.

- Key distinction: The executive order can be revoked by a future president; legislation would formalize the reserve, outline reporting standards, and possibly mandate new purchases.

Why Mandatory Bitcoin Purchases Alter Everything

After halving, the new Bitcoin issuance stands at approximately 164,250 BTC annually (~450/day). A congressional mandate to acquire 200,000 BTC per year (~550/day) would surpass the new supply.

If long-term holders or miners don’t sell aggressively, government demand would need to draw coins from both OTC and exchange reserves.

- OTC supply: Estimated at around 155,000 BTC in August 2025, a sharp decline from 2021.

- Exchange balances: Currently hovering at about 2.9 million BTC, showing a declining trend.

- Outcome: Any large government initiative would tighten liquidity and necessitate higher clearing prices.

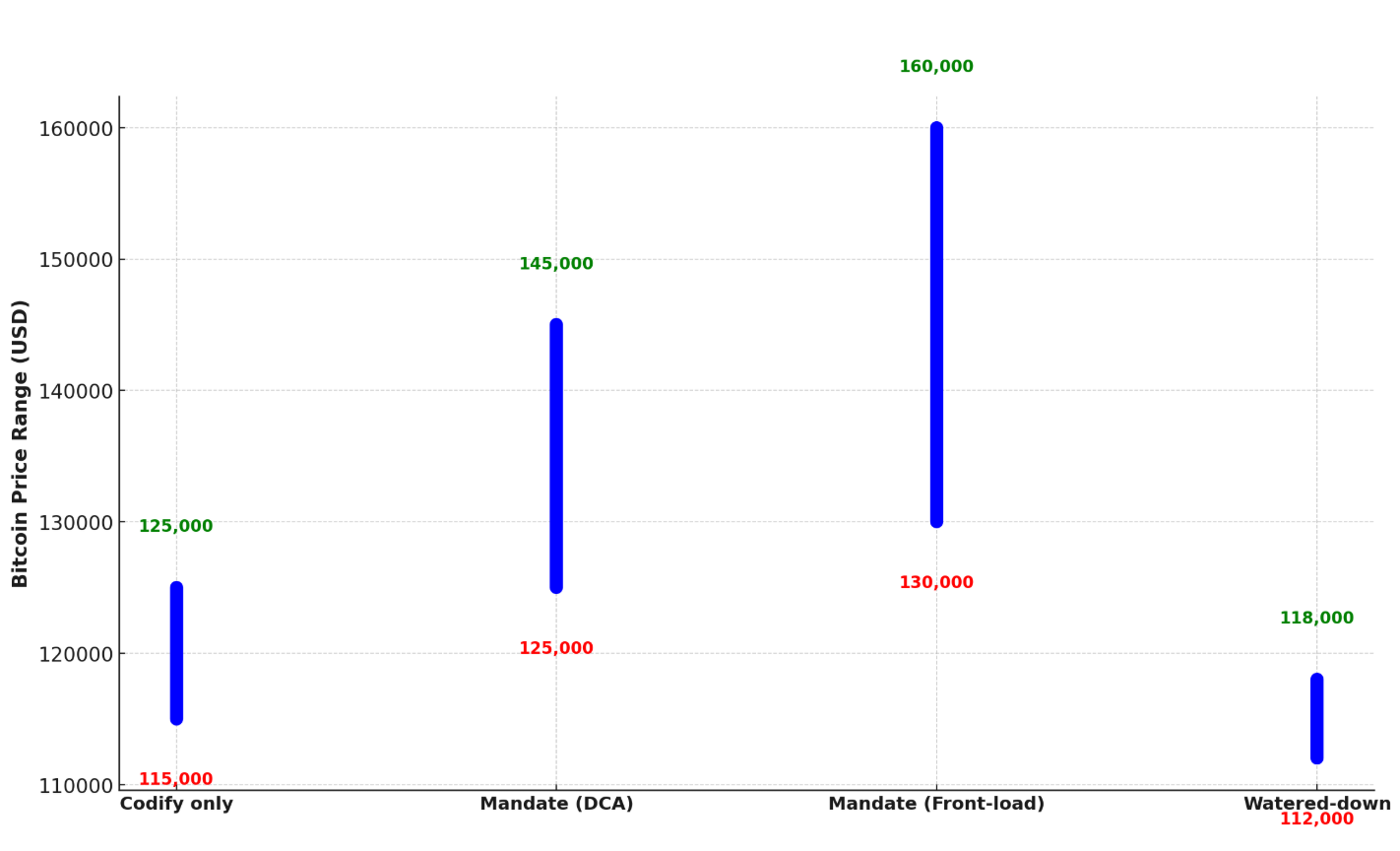

Four Bitcoin Reserve Scenarios To Evaluate

A. Only Codify

Sponsored

Sponsored

If Congress merely codifies the executive order without mandating purchases, the Reserve becomes politically entrenched. This would:

- Reduce the US regulatory risk premium.

- Encourage steady inflows into spot ETFs and corporate treasuries.

- Probably initiate a gradual increase but avoid a structural supply shock.

B. Mandate With Gradual DCA

If the law enforces ~200k BTC/year and the Treasury implements purchases gradually via OTC and ETFs, Bitcoin will see daily demand exceeding new issuance. Anticipate:

- Continuous upward momentum, interspersed with sharp surges on purchase execution days.

- Depletion of OTC inventory, necessitating a gradual shift of trading onto exchanges.

- Pullbacks will be viewed as buying opportunities due to persistent structural demand.

C. Mandate With Immediate Accumulation

An aggressive accumulation strategy would swiftly deplete OTC stocks and compel the Treasury to engage directly with exchange markets. This would:

Sponsored

Sponsored

- Trigger significant upward price adjustments, along with volatility spikes and wide slippage.

- Likely inspire similar bids from corporations, pension funds, and sovereign entities.

- Pose a risk of creating unsustainable short-term spikes followed by market consolidation.

D. Compromise Without Funding

If the legislation is more symbolic without any funding or purchase goals, initial news may lead to a brief uptick. However:

- Traders will probably sell off any gains.

- The market effect would mimic typical “sell the news” behavior.

Essential Trading Signals To Watch

- Legislative text: Watch for specific purchase targets in the final draft.

- Treasury announcements: Information regarding the start date and schedule of any buy initiative.

- ETF formations: Sustained net inflows exceeding $300M/day would validate structural demand.

- OTC market insights: Increased spreads and sourcing delays indicate supply pressure.

- Exchange liquidity: A contracting 1% order book depth suggests more slippage risk.

BTC Price Levels To Monitor

Sponsored

Sponsored

- Support: $110,000 (post-liquidation support), $100,000 (psychological barrier).

- Resistance: $116,000 (September peak), $125,000 (breakout point), and $150,000 (big psychological target if the mandate is approved).

Macro Factors

Federal Reserve strategies, the strength of the US dollar, and correlations with gold are crucial. A dovish Fed and a weakening dollar would enhance the benefits from reserve legislation, while a hawkish surprise might temper those effects.

Should Congress approve only codification, Bitcoin is likely to gain from diminished policy risk and enhanced ETF inflows, promoting a sustained upward trend.

If lawmakers establish a mandatory accumulation program, the flow math becomes clear. Government demand would exceed new supply, and considering OTC reserves are already tight, Bitcoin’s clearing price would have to escalate to draw out sellers.

The distinction between a modest policy tailwind and a comprehensive supply shock depends on the final wording of the legislation.

Traders should brace for both scenarios. Regardless, US legislation about a Strategic Bitcoin Reserve would signify a monumental shift in Bitcoin’s status as a sovereign reserve asset worldwide.