In the wake of Bitcoin’s (BTC) severe sell-off on October 9, where the leading cryptocurrency by market cap plummeted to $102,000 before regaining much of its value, recent on-chain metrics indicate a discernible drop in Bitcoin network usage throughout most of 2025.

Are Bitcoin On-Chain Fundamentals Weakening?

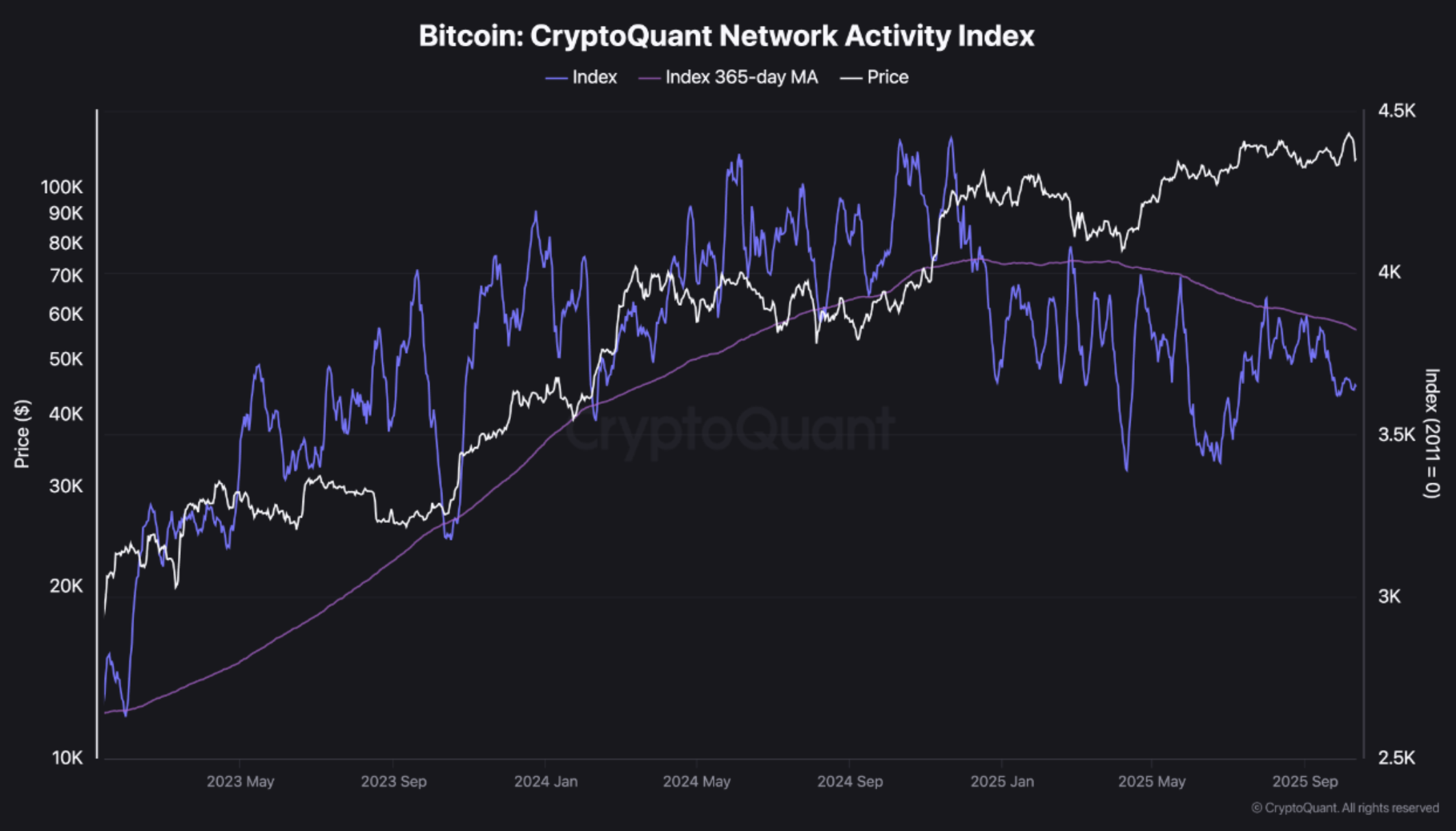

As highlighted in a CryptoQuant Quicktake post by contributor TeddyVision, Bitcoin’s Network Activity Index has largely remained below its 365-day moving average (MA) for the majority of 2025. This trend points to a structural decline in the on-chain activity of the Bitcoin network.

Related Reading

For those unfamiliar, the Bitcoin Network Activity Index assesses user interactions on-chain by monitoring metrics such as transaction numbers, active addresses, and transfer volumes. An increasing index implies a rise in organic use and adoption, whereas a decreasing one signifies reduced network involvement.

It’s worth noting that Bitcoin’s network activity surged ahead of its price during 2023-24. Back then, the Bitcoin price experienced genuine growth largely due to authentic on-chain transactions.

However, 2025 has seen a significant shift in this trend. Most of this year has featured Bitcoin liquidity moving off-chain, causing on-chain activity to decline. Consequently, the Network Activity Index has fallen beneath the 365-day MA.

Despite this, BTC’s price has stabilized between $100,000 and $120,000, leading to a growing discrepancy between the digital asset’s market valuation and its underlying network fundamentals. The CryptoQuant analyst commented:

Capital continues to rotate but does not expand—most investments are happening off-chain through ETFs, custodians, and synthetic means, while true on-chain demand remains low.

TeddyVision explained that the recent capital shifts within the Bitcoin market do not signify strength, but rather represent “momentum running on fumes.” The analyst further noted that if Bitcoin network usage stagnates while prices continue to rise, market valuations cease to reflect genuine adoption and start to depend on speculation.

In summary, while Bitcoin isn’t facing imminent collapse, the decline in network usage indicates weakened fundamentals. However, there may still be hope for BTC’s future.

A recent post by crypto analyst Titan of Crypto mentioned that the Bitcoin bull market isn’t finished yet, asserting that a bear market will only commence if Bitcoin falls below the 50-day Simple Moving Average (SMA) on the weekly chart.

Will Q4 2025 Be Bullish for BTC?

Despite the recent flash crash to $102,000 potentially unsettling BTC advocates, various industry experts remain optimistic that the digital asset will persist in achieving new all-time highs in the final quarter of 2025.

Related Reading

Crypto market specialist Ash Crypto recently forecasted that BTC could rise as high as $180,000 in Q4 2025. Similarly, new information from Binance indicates that BTC might be on track to reach $130,000.

In a related prediction, noted crypto analyst Egrag recently estimated that BTC requires only a slight catalyst to surge to $175,000. At the time of writing, BTC is trading at $114,076, reflecting a 0.8% increase over the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant, X, and TradingView.com