After a slight dip yesterday from its recent peaks, Bitcoin (BTC) is now being traded in the low $120,000 range. At the same time, there has been a notable shift in BTC’s miner correlation over the last few months, signifying a distinct alteration in market dynamics between miner activities and pricing trends.

Bitcoin Miner Correlation Turns Negative

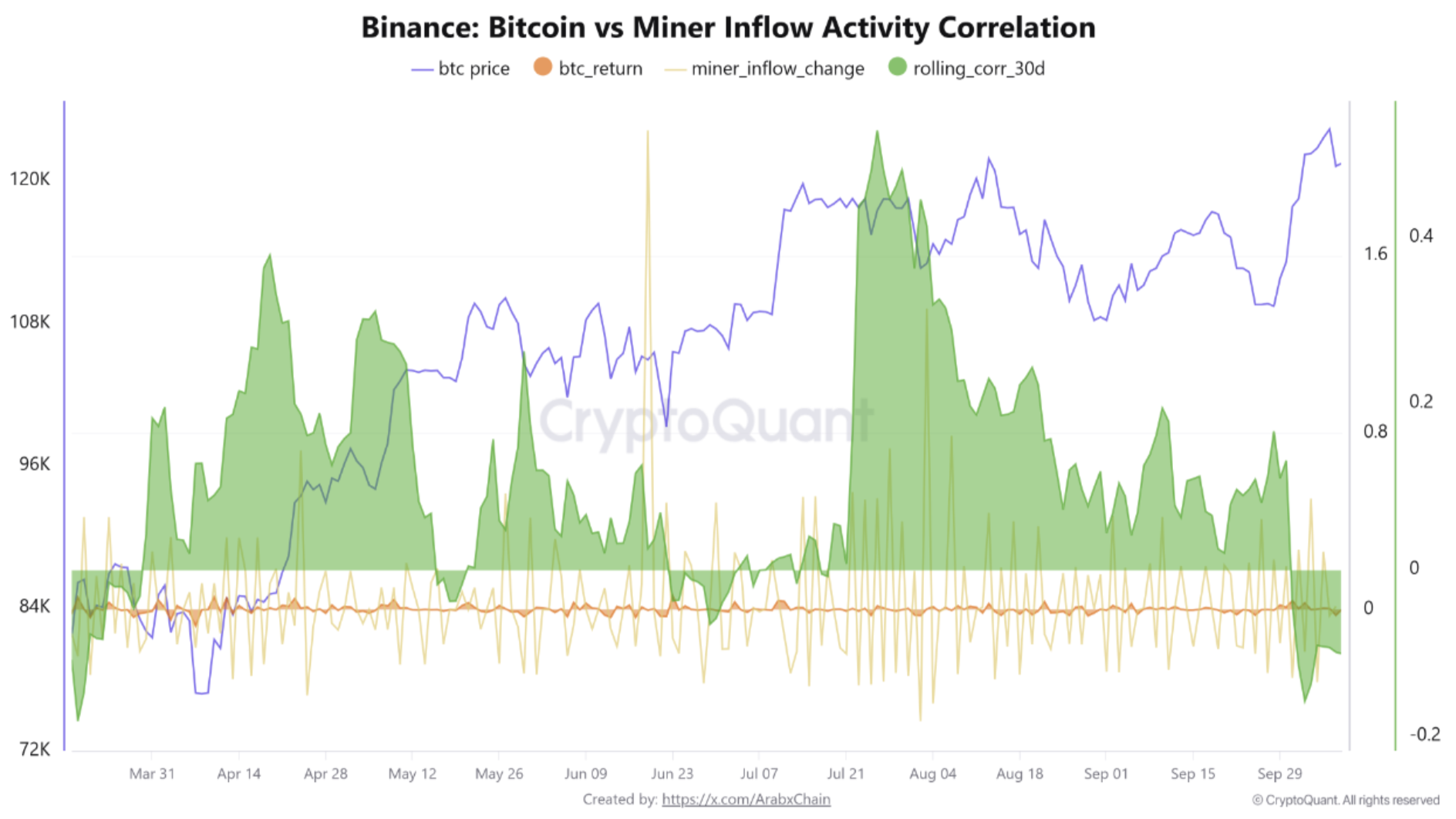

As reported in a CryptoQuant Quicktake post by contributor Arab Chain, new data from Binance highlights a significant transformation in the correlation between Bitcoin’s price and miner flows to the crypto exchange in recent times.

Related Reading

In particular, the 30-Day Rolling Correlation metric has dropped to its lowest point since March 2025. On October 3, this figure fell to -0.157, marking its lowest level in over five months. Since that time, it has hovered around the -0.10 mark.

For those unfamiliar, the 30-day rolling correlation indicator gauges how closely two variables, like Bitcoin’s price and miner flows, move in relation to each other over the past month. A positive value indicates they typically rise or fall concurrently, while a negative value signifies opposite movements.

It is noteworthy that the indicator previously operated within a positive range of 0.1 to 0.5 during Q2 2025. This transition from a positive to a negative value suggests that the recent increase in BTC price was not fueled by miner flows to exchanges.

This contrasts sharply with earlier cycles where miner flows to exchanges significantly influenced BTC’s price movements. In the current cycle, the positive price movement is likely driven by heightened demand from both investors and institutions. Arab Chain further commented:

Historically, during price increases, miners often sent larger volumes of Bitcoin to exchanges to sell and realize profits, establishing a positive correlation between price and miner flows—meaning as prices grew, so did flows.

Arab Chain noted that the diminishing correlation signals a period of “price independence,” where miners choose to retain their BTC instead of selling it during price rises. Such a reduction in miner signals is typically seen as a bullish indicator, as it lowers BTC’s circulating supply.

However, should the correlation shift back to a strongly positive state, it might indicate a resurgence of selling pressure, leading to a potential medium-term price correction. Currently, the BTC market appears to maintain a healthy equilibrium between demand and supply.

BTC Needs To Defend This Level

After BTC dropped to the low $120,000 range, some cryptocurrency analysts assert that the leading cryptocurrency must uphold the $120,600 threshold to prevent further decline. Nonetheless, not all analysts currently hold a bearish outlook on BTC.

Related Reading

For instance, crypto entrepreneur Arthur Hayes forecasts that US President Donald Trump could propel BTC to $250,000 by the end of 2025. As of now, BTC is trading at $121,375, reflecting a 0.8% decrease in the last 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com