As Bitcoin (BTC) maintains trading within the low $110,000 range, recent on-chain data indicates a new influx of demand has entered the market. Importantly, the Net Position Change (NPC) for the newest cohort of BTC investors has returned to positive numbers, igniting optimism for a potential bullish trend for the cryptocurrency.

Bitcoin NPC Shifts Back Into Positive Numbers

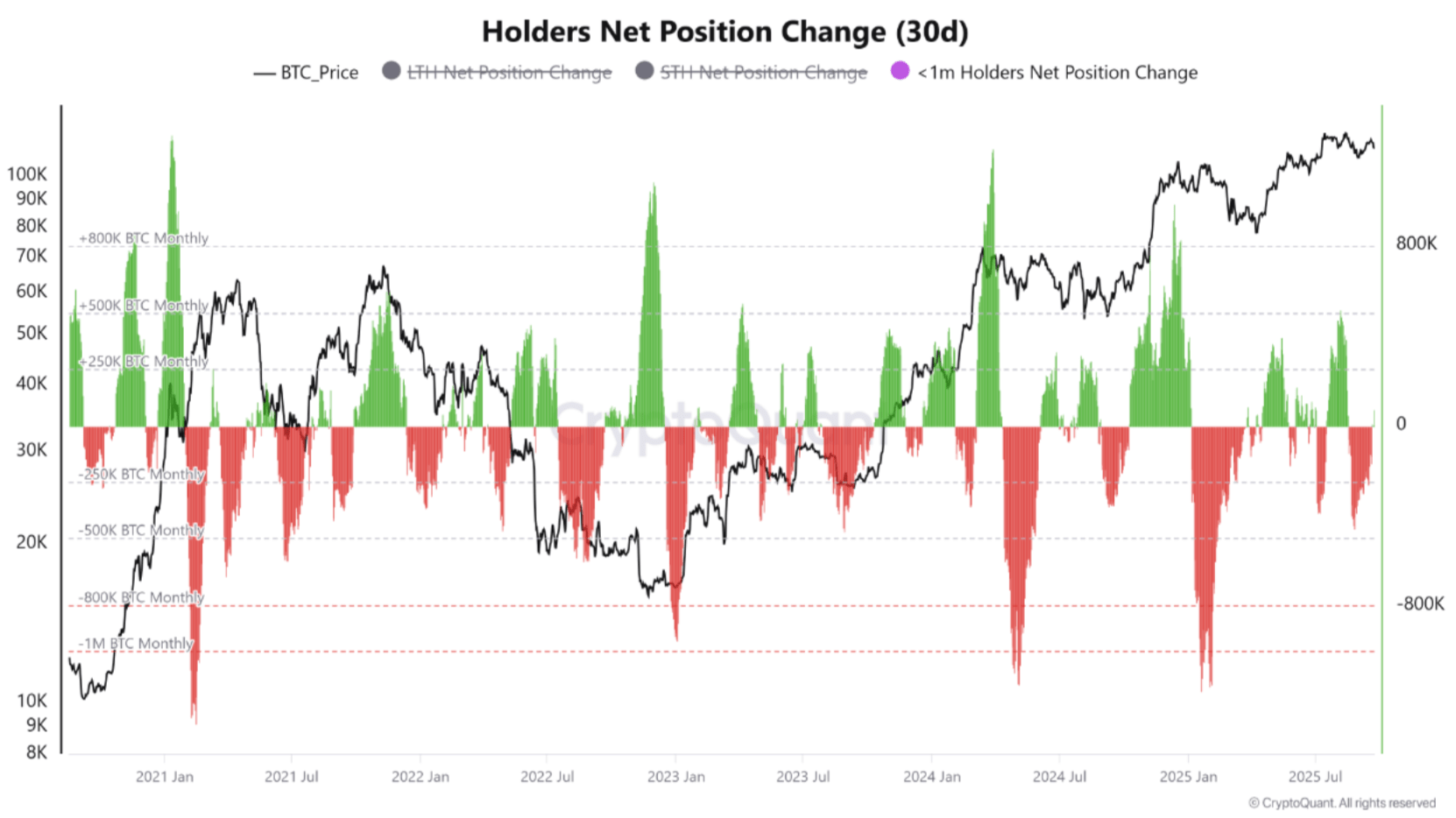

According to a post on CryptoQuant Quicktake by contributor Crazzyblockk, the NPC for Bitcoin holders who have held the cryptocurrency for less than a month has decisively transitioned into positive territory. This shift suggests that fresh demand is entering the market at an increasing pace.

Related Insights

Crazzyblockk noted that the supply held by wallets younger than one month experienced a 30-day change, peaking at +73,702 BTC on September 23. The subsequent chart illustrates this increase following a stretch of negative activity.

It’s significant to note that the new capital flowing into the Bitcoin market aids in absorbing the supply being liquidated by long-term holders (LTH). LTH generally refers to those who have retained their BTC for more than six months.

At the moment, LTH are selling their BTC at a rate near -145,000 BTC, a typical behavior seen in a bullish market where early investors take profits. The analyst highlighted that the selling pressure being matched by strong demand from new participants indicates the sustainability of the rally.

The CryptoQuant contributor emphasized that the accumulation trend isn’t restricted to just the newest cohort. In addition to the less than one-month group, short-term holders (STH)—those with BTC for less than six months—are also increasing their holdings.

The STH NPC has shifted to +159,098 BTC, highlighting strong demand for the leading cryptocurrency by market capitalization across a variety of investors based on their market tenure. Crazzyblockk commented:

The current situation—where profit-taking from long-term holders is being absorbed by a new and eager batch of buyers—represents a classic feature of a robust bull market. The positive shift in the youngest holder group serves as a leading signal of increasing market engagement and indicates strong confidence among new investors. This strong demand framework highly supports ongoing price increases in the near to mid-term.

Concerns Surrounding BTC

While the interest in BTC from younger investors is promising, some worries persist regarding the asset’s short-term price movements. For instance, inflows onto exchanges for BTC remain high, heightening fears of increased selling pressure.

Related Insights

Additionally, recent on-chain data indicates that the current rally for BTC is predominantly being driven by retail investors, with Bitcoin whales—those holding large amounts of BTC—being noticeably absent from this price surge.

That said, the fundamentals for the digital asset continue to improve, as Bitcoin network activity recently reached a new peak for 2025. At the time of writing, BTC is trading at $112,804, reflecting a 0.2% decline in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com