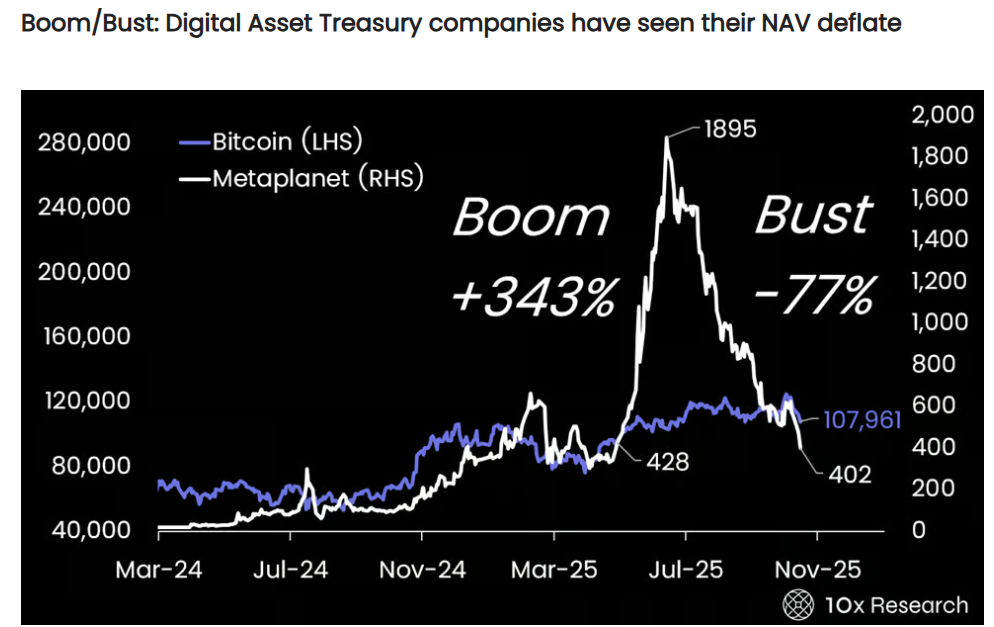

A recent report by 10X Research estimates that retail investors have lost approximately $17 billion due to their investments in Bitcoin treasury companies.

This loss highlights a significant decline in investor interest towards Digital Asset Treasury Companies (DATCOs). Companies like MicroStrategy and Metaplanet have experienced substantial stock declines alongside Bitcoin’s drop in value.

Sponsored

Bitcoin Treasury Firms Wiped Out $17 Billion in Retail Wealth

As noted in the report, numerous investors turned to these DATCOs for indirect exposure to Bitcoin. These firms often issue shares above their actual Bitcoin holdings, using the capital raised to purchase more BTC.

10X Research observed that this strategy proved effective when Bitcoin’s price was on the rise, as stock valuations frequently exceeded the asset’s spot price increases. However, as market enthusiasm waned and Bitcoin’s upward momentum slowed, these premiums collapsed.

Consequently, investors who bought in during the height of inflated valuations have collectively lost around $17 billion. The firm also estimated that new shareholders overpaid for Bitcoin exposure by about $20 billion via these equity premiums.

These figures are not surprising, considering that BeInCrypto reported global companies have raised over $86 billion in 2025 for cryptocurrency purchases.

This amount surpasses the total value of US initial public offerings for this year.

Despite this substantial inflow, the performance of Bitcoin-related equities has recently underperformed compared to the broader market.

Sponsored

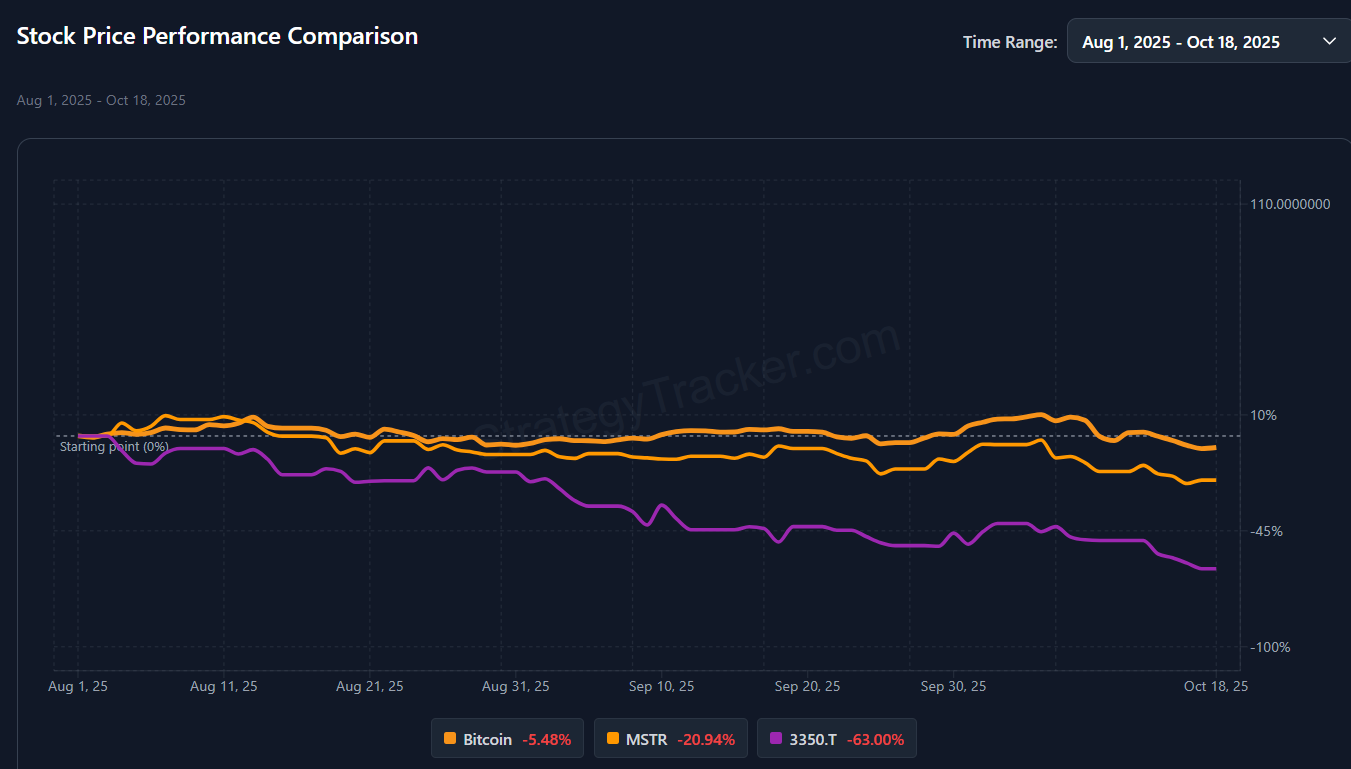

For context, MicroStrategy’s (formerly Strategy) MSTR stock has dropped more than 20% since August. Similarly, Tokyo-based Metaplanet, according to Strategy Tracker data, has lost over 60% of its value during the same timeframe.

Bitcoin DATCOs mNAVs Decline

Simultaneously, their market-to-net-asset-value (mNAV) ratios, which once indicated investor confidence, have also deteriorated.

Sponsored

MicroStrategy now trades around 1.4x its Bitcoin assets, while Metaplanet has fallen below 1.0x for the first time since implementing its Bitcoin treasury model in 2024.

“Those once-celebrated NAV premiums have collapsed, leaving investors holding the empty cup while executives walked away with the gold,” stated 10X Research.

Nearly one-fifth of all listed Bitcoin treasury firms reportedly trade below their net asset value across the market.

This stands in stark contrast to the recent record high of Bitcoin, which surpassed $126,000 this month before retracting after President Donald Trump’s tariff threats against China.

Sponsored

Nonetheless, Brian Brookshire, head of Bitcoin strategy at H100 Group AB, argued that mNAV ratios are cyclical and do not indicate long-term value. H100 Group AB holds the largest Bitcoin assets in the Nordic region.

“Most BTCTCs trading near 1x mNAV have only reached this level in the past couple of weeks. By definition, this is not a norm…even for MSTR, normal mNAV does not exist. It’s a volatile, cyclical phenomenon,” he said.

Nevertheless, analysts at 10X Research commented that the current phase signifies “the end of financial alchemy” for Bitcoin treasuries, where inflated share issuance once created the illusion of unlimited upside.

Given this, the firm stated that these DATCOs will now be evaluated based on earnings discipline instead of market excitement.

“With volatility decreasing and easy gains diminished, these firms must undergo a significant shift from marketing-driven momentum to genuine market discipline. The upcoming phase will focus on who can still produce alpha when investor confidence wavers,” concluded 10X Research.