Recent data indicates that the Bitcoin Fear & Greed Index has rebounded into the neutral zone following a recovery rally in the cryptocurrency’s price.

Bitcoin Fear & Greed Index Now Shows A Value Of 51

The “Fear & Greed Index” is an indicator developed by Alternative to gauge average sentiment among traders in the Bitcoin and broader cryptocurrency markets. This metric assesses sentiment based on five factors: trading volume, market cap dominance, volatility, social media sentiment, and Google Trends.

This index employs a numerical scale from zero to a hundred to represent trader sentiment. Values above 53 indicate greed among investors, while those below 47 reflect fear. The area between these thresholds indicates a neutral sentiment.

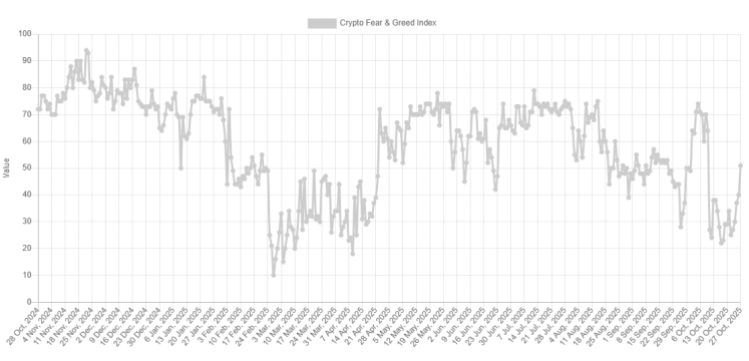

Here’s the current state of Bitcoin market sentiment as per the Fear & Greed Index:

The image above shows that the index currently stands at 51, indicating that trader sentiment is nearly balanced. This represents a significant shift in market sentiment compared to just a few days prior.

The chart illustrates that the Fear & Greed Index was in the fear zone recently, reflecting the pessimism among traders due to the bearish price movement BTC experienced.

At one point, the index even dropped to 22, representing a state of “extreme fear.” This level, occurring below 25, signifies a high degree of bear sentiment amongst investors. A similar region for the greed side, known as “extreme greed,” exists above 75.

Historically, these extreme sentiments have played a crucial role for Bitcoin and other cryptocurrencies, as they often mark significant tops and bottoms. Notably, there is an inverse relationship—extreme fear typically indicates a bottom, while extreme greed indicates a top.

Since hitting the extreme fear low earlier this month, BTC has been on an upward trajectory, suggesting that the contrarian sentiment signal may once again be at play.

The cryptocurrency’s sharp recovery over the last few days could be a key reason for the Fear & Greed Index’s return to neutral territory.

However, Bitcoin traders currently seem undecided about whether bullish movements will follow. It remains unclear if they will lean towards greed or continue to express caution about the recovery.

BTC Price

As of this writing, Bitcoin is trading at around $114,900, reflecting a 3.6% increase over the past week.