Bitcoin (BTC) is experiencing a decline in momentum, with the leading cryptocurrency dropping to $103,528 earlier today amid a growingly uncertain global macroeconomic environment. Recent data from Binance indicates that BTC is currently in a crucial transition phase within its price cycle.

Bitcoin’s Decline – When Will It Stabilize?

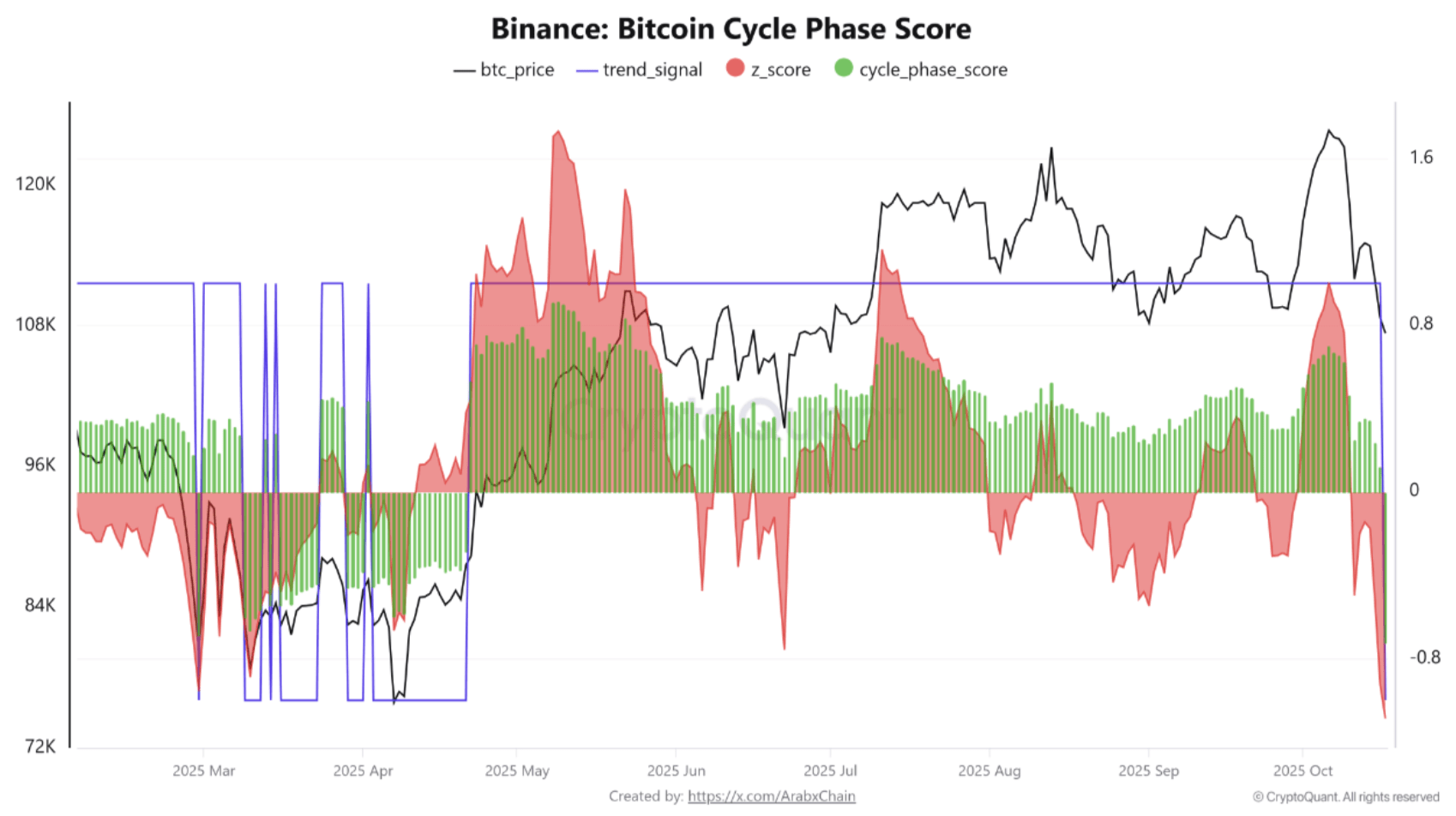

A CryptoQuant QuickTake post by contributor Arab Chain points out that Bitcoin is navigating a significant transition phase within its market cycle. The Bitcoin Cycle Phase Score has recently dipped into negative territory, correlating with a price drop from $124,000 to approximately $107,000 in just 24 hours.

Related Insights

The Cycle Phase Score incorporates market trends and short-term momentum (Z-Score) to illustrate Bitcoin’s current phase. Positive scores reflect upward momentum, while negative scores indicate short-term weakness or corrective action.

The decrease in the Cycle Phase Score suggests that the BTC market has lost some of its upward traction that it enjoyed during the first two weeks of October. Transitioning into negative territory signifies the onset of a structural correction phase after weeks of consecutive gains.

The analyst noted that a trend_signal of -1 confirms BTC’s price has fallen below the 200-day moving average, and it is likely to remain below this benchmark until it can definitively surpass the $106,780 level.

A negative Z-score similarly indicates that Bitcoin’s price is trading well below its short-term average, further substantiating the prevailing short-term selling pressure. Arab Chain remarked:

From an analytical perspective, this shift can be seen as a rebalancing phase within the ongoing cycle, rather than the onset of a long-term downtrend. The recent pullback follows a robust period of price growth, typically accompanied by a brief pause in momentum before the primary trend resumes.

Arab Chain concluded by stating that if BTC’s price stabilizes above $105,000 in the forthcoming days, the Cycle Phase Score indicator may return to the positive range. Such a development could signal the conclusion of the current price correction phase.

Could BTC Drop Below $100,000?

As BTC hovers near the mid $100,000 range, concerns are increasing in the market that the digital asset may drop below the psychologically significant $100,000 threshold. Moreover, on-chain data does not offer much optimism, as Bitcoin network activity has recently slipped below the 365-day average.

Related Insights

Furthermore, crypto analyst CryptoBirb recently indicated that the present BTC bull cycle is likely nearing its conclusion. The analyst expressed that Bitcoin is nearly 99.3% through its current cycle.

Nevertheless, whale accumulation of BTC remains strong. Businesses acquired a total of 176,000 BTC for their treasuries during Q3 2025. As of now, BTC is trading at $105,484, marking a 5.1% decrease in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com