After reaching a new all-time high (ATH) of $126,199 on Binance, Bitcoin (BTC) is currently stabilizing within the low $120,000s. Recent exchange metrics, including the Cumulative Volume Delta (CVD) Confirmation Score, indicate that BTC is enjoying robust underlying demand.

CVD Confirmation Indicates Strong Demand For Bitcoin

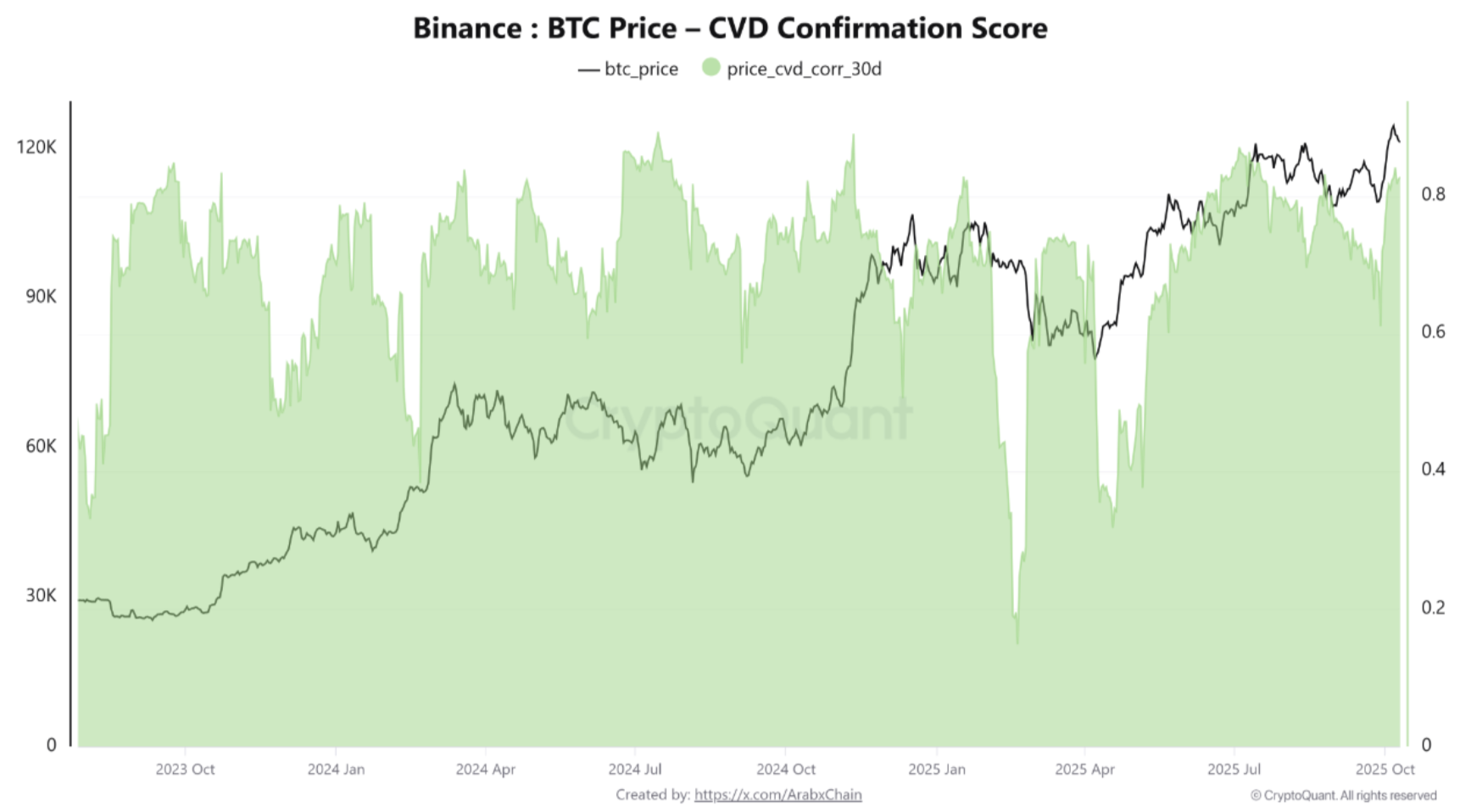

A CryptoQuant Quicktake report by contributor Arab Chain notes that Bitcoin’s CVD Confirmation Score—a 30-day rolling correlation between Bitcoin’s price and the CVD—suggests a significant resynchronization of the current trend.

Related Reading

For those unfamiliar, the CVD Confirmation Score measures the 30-day correlation between Bitcoin’s price and the CVD, which monitors the net difference between taker buy and sell volumes on exchanges. A high score (above 0.7) signifies that price increases are supported by actual buying pressure, whereas a low or negative score indicates weak or speculative trends.

Recent data from Binance shows that the CVD Confirmation Score currently fluctuates between 0.8 and 0.9, suggesting that the recent price rise is primarily fueled by genuine taker demand rather than just technical rebounds or short squeezes.

Historical data shows that when this metric has stayed above 0.7 for an extended period, price corrections are often shallow and short-lived, as new liquidity quickly absorbs any incoming supply of BTC.

The CryptoQuant analyst pointed out that if the CVD Confirmation Score remains above 0.7 and there is a decisive breakout above the $124,000 – $126,000 resistance zone, Bitcoin could potentially target as high as $135,000.

Conversely, a negative divergence, where BTC price rises while the CVD Confirmation Score dips below 0.4, should be regarded as a red flag, as it raises the chances of distribution or liquidation pressure.

On the other hand, the $112,000 – $115,000 and $108,000 – $110,000 ranges are noted as strong support levels for BTC. At these price points, the CVD Confirmation Score should remain stable to maintain the uptrend. Arab Chain added:

The underlying trend is bullish and bolstered by real inflows on Binance, the largest exchange worldwide. Keep an eye on three confirmation signals: CVD Confirmation stays high, open interest remains moderate, and funding does not become excessive. Any significant imbalance across these metrics will serve as the first signal of a momentum shift.

Is BTC Heading Towards A Correction?

While bullish sentiments prevail for BTC’s ongoing rally, some analysts are skeptical about the digital asset reaching new highs shortly. For instance, crypto analyst ZVN recently mentioned that BTC might experience a pullback before aiming for $150,000.

Related Reading

Similarly, fellow crypto analyst Dick Dandy recently forecasted that BTC could face a notable 60% price correction, potentially dropping to $43,900. As of now, BTC is trading at $118,791, down 1.8% over the last 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com