The Bitcoin Bull Score Index from CryptoQuant has surged from 20 to 50 in just four days, indicating a rapid escape from bearish territory for the asset.

Bitcoin Bull Score Index Returns to Neutral Zone

In a recent update on X, Julio Moreno, CryptoQuant’s head of research, discussed the current trend in the analytics firm’s Bull Score Index. This metric essentially provides insight into Bitcoin’s current market phase.

The index aggregates several critical on-chain metrics to assess its value. Among these metrics are the Market Value to Realized Cap (MVRV) Ratio, which tracks the average profitability of investors on the network, and Stablecoin Liquidity, which gauges the capital held in fiat-pegged tokens.

A Bull Score Index value of 60 or above indicates that most underlying metrics are signaling bullish sentiment. Conversely, a value of 40 or below suggests that Bitcoin is experiencing a bearish phase according to these indicators.

Here’s the chart shared by Moreno, illustrating the trend of the Bitcoin Bull Score Index over the past year:

The chart shows that the Bitcoin Bull Score Index was as low as 20 just four days ago, but has since climbed sharply to 50. This suggests that on-chain metrics are currently indicating neutral market conditions for the asset.

This change comes just as the Federal Open Market Committee (FOMC) begins its two-day meeting on Tuesday. The price of BTC has also been moving sideways in anticipation, revealing that the market is somewhat divided regarding the potential outcomes of this event.

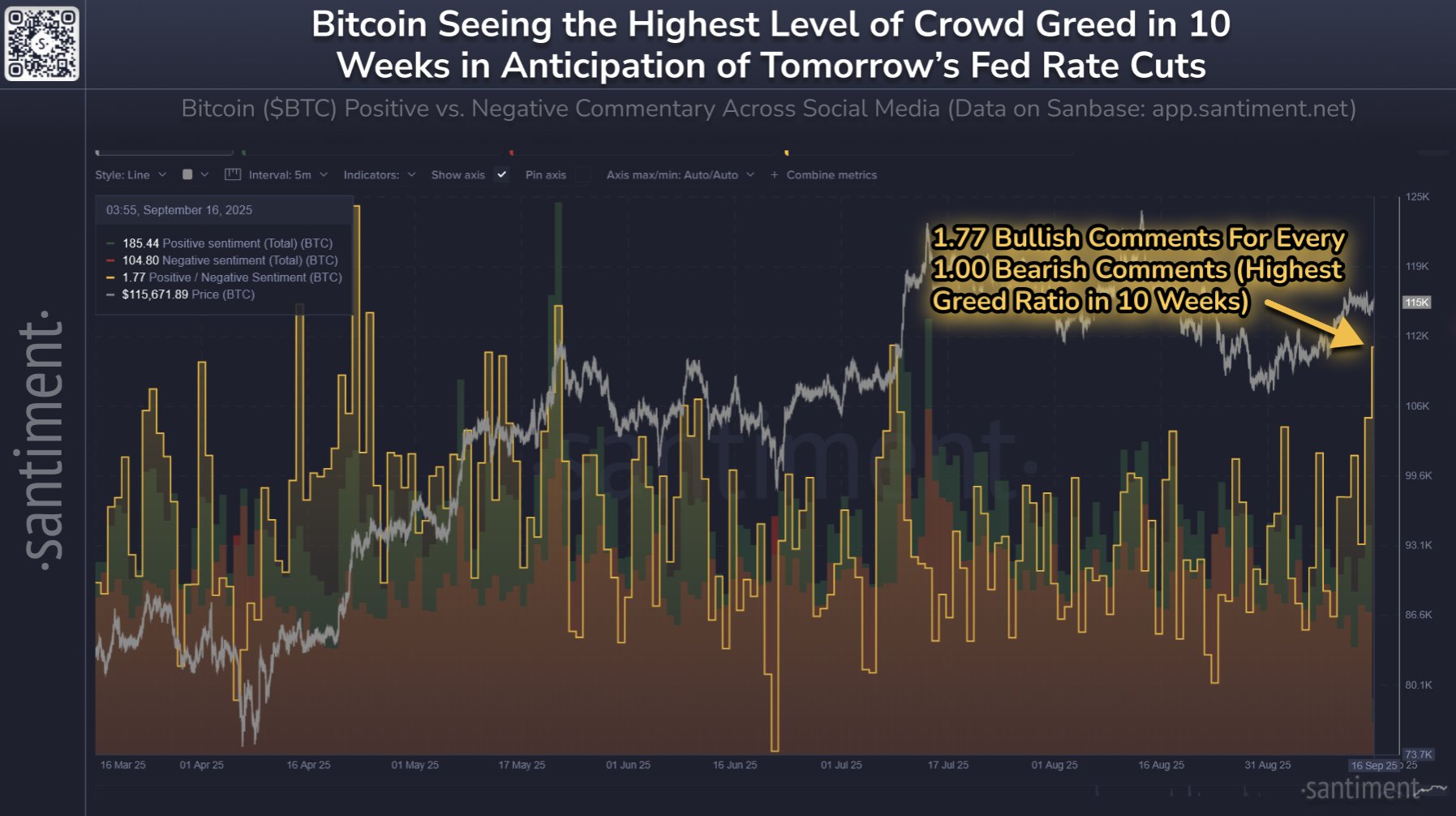

Analytics firm Santiment has provided insights in an X update about how social media users are perceiving the meeting.

In the chart, Santiment illustrates the “Positive/Negative Sentiment,” a metric that measures the ratio of bullish to bearish posts about Bitcoin across major social media platforms.

This metric has recently surged to a value of 1.77, indicating there are 1.77 positive comments for every negative remark related to the cryptocurrency. This marks the most bullish sentiment among retail traders on social media in approximately 10 weeks.

While some level of excitement is typical, excessive enthusiasm often signals caution. The analytics firm notes, “historically, markets tend to move in the opposite direction of retail expectations.”

BTC Price

As of this writing, Bitcoin is trading around $115,700, having risen more than 2.5% over the past week.