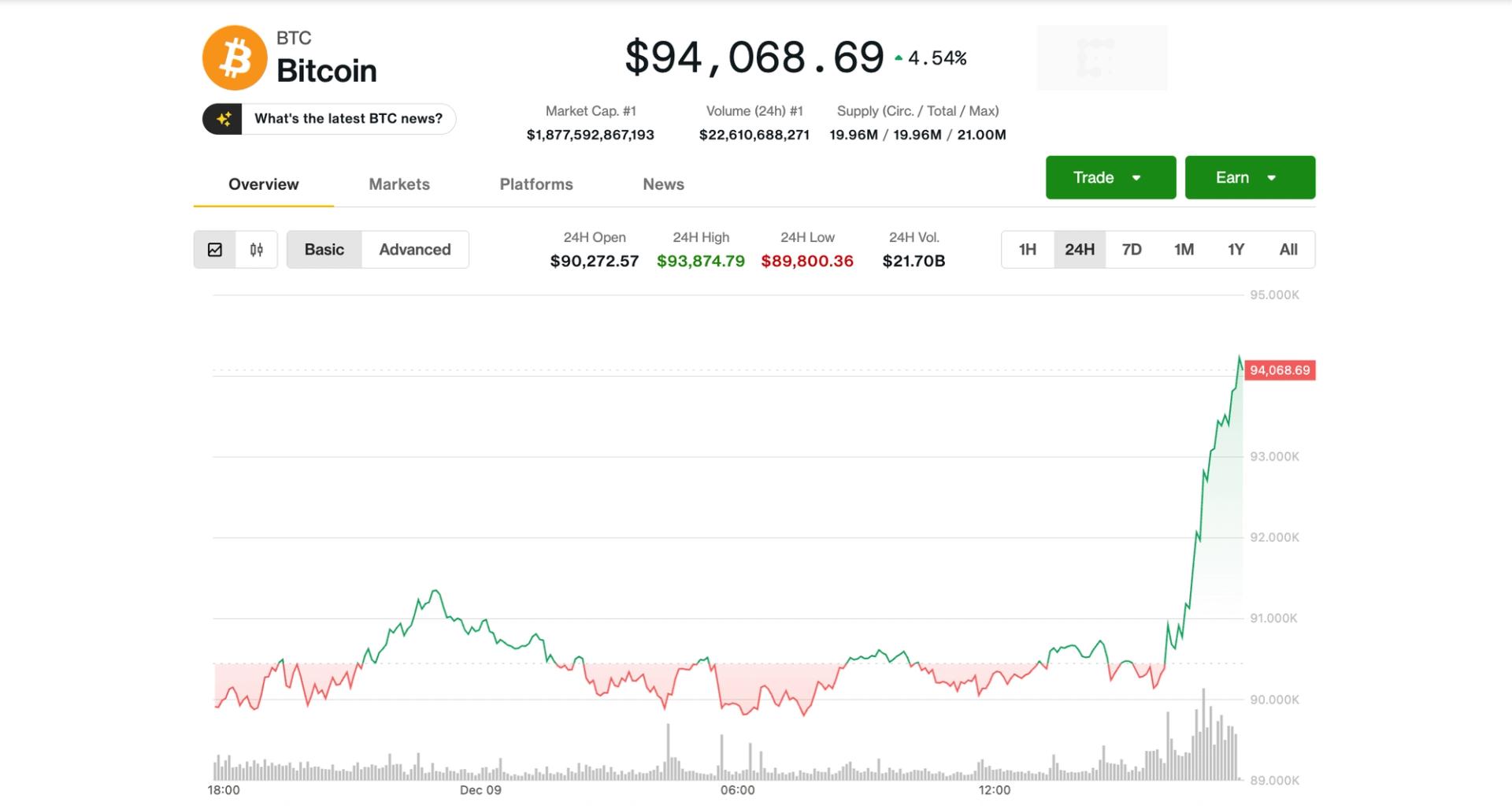

What began as a sluggish morning for U.S. crypto markets has swiftly changed course, with Bitcoin reclaiming the $94,000 mark.

After hovering just above $90,000 earlier in the day, the leading cryptocurrency surged back to $94,000 shortly after 16:00 UTC, rising by over $3,000 in under an hour, equating to a 4% increase over the past 24 hours.

Ethereum’s Ether experienced a 5% increase during the same timeframe, while native tokens of and Chainlink rose even higher.

The movement occurred as silver soared to new record highs above $60 per ounce.

While the broader equity markets remained stable, crypto-related stocks mirrored Bitcoin’s rise. Digital asset investment company Galaxy (GLXY) and Bitcoin miner CleanSpark (CLSK) led the pack with gains exceeding 10%, while Coinbase (COIN), Strategy (MSTR), and BitMine (BMNR) saw increases of 4%-6%.

Although there wasn’t a singular, clear cause for the sudden upward movement, Bitcoin has been largely declining alongside the opening of U.S. markets for several weeks. Today’s shift in trend could indicate a potential buyer fatigue.

Vetle Lunde, chief analyst at K33 Research, highlighted “deeply defensive” positions in the crypto derivatives markets, as investors remain wary of further downturns, with crowded positions possibly spurring the rapid recovery.

Additional signs of capitulation in the bear market emerged on Tuesday, with Standard Chartered’s bullish analyst Geoff Kendrick reducing his price projections for Bitcoin for the coming years.

The Coinbase bitcoin premium, indicating the difference in Bitcoin’s spot price between U.S.-based Coinbase and offshore exchange Binance, has also turned positive in recent days, suggesting a resurgence in demand from U.S. investors.

The Federal Reserve is anticipated to decrease benchmark interest rates by 25 basis points during its two-day meeting concluding on Wednesday. While market participants largely expect the rate cut, more lenient financial conditions, combined with a resilient U.S. economy, could enhance risk appetite across markets.