Key points:

Bitcoin selling is primarily driven by major sales from whales, rather than a shift in BTC’s market dynamics.

Even amidst market corrections, Ether and BNB continue to perform robustly on the charts.

Bitcoin (BTC) bulls are protecting the $110,530 support, yet bears are maintaining pressure. CoinShares indicated that last week saw $1 billion in net outflows from BTC exchange-traded products.

There appears to be a shift in investor focus from BTC to Ether (ETH). Month-to-date, ETH ETPs have seen inflows of $2.5 billion, while BTC has faced outflows of $1 billion.

Data from crypto intelligence firm Arkham, shared by analytics account Lookonchain, revealed that a whale entity deposited approximately 22,769 BTC ($2.59 billion) to Hyperliquid (HYPE) for sale, subsequently purchasing 472,920 $ETH ($2.22 billion) in spot and initiating a 135,265 $ETH ($577M) long position.

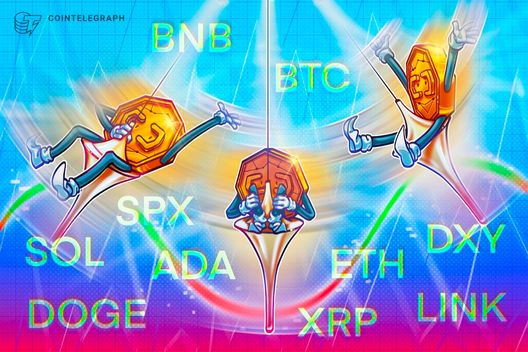

Crypto market data daily view. Source: Coin360

In contrast, Michael Saylor’s Strategy, the largest public BTC holder, acquired 3,081 BTC for $356.9 million, increasing the firm’s BTC holdings to 632,457 BTC, according to an SEC filing on Monday.

Will buyers manage to keep BTC above its critical support? Could ETH’s strength ignite an altcoin rally? Let’s delve into the charts of the top 10 cryptocurrencies to explore.

S&P 500 Index price prediction

The S&P 500 Index (SPX) sharply rebounded from the 20-day exponential moving average (6,392) on Friday, indicating solid buying on dips.

SPX daily chart. Source: Cointelegraph/TradingView

Buyers will endeavor to further consolidate their positions by pushing the price above 6,581. If successful, the index could ascend to 6,696.

Though the trend remains positive, the relative strength index (RSI) indicates a negative divergence. This suggests diminishing bullish momentum. The bears need to bring and maintain the price below the 20-day EMA to escalate selling, which could then plunge the index to the breakout level of 6,147.

US Dollar Index price prediction

The US Dollar Index (DXY) surpassed the moving averages on Thursday, but higher levels triggered significant selling from the bears.

DXY daily chart. Source: Cointelegraph/TradingView

The moving averages are gradually descending, and the RSI remains just below the midpoint, indicating a slight advantage to the bears. If the price dips below 97.50, the next support could be at 97 and then 96.37.

Buyers must swiftly push the price above the 99 level to indicate strength. The index may then rise to 100.50, where sellers are expected to re-enter. However, if buyers break through the 100.50 resistance, the rally could extend to the 102 level.

Bitcoin price prediction

BTC neared the critical support level of $110,530 on Monday, but a minor positive is that the bulls maintained the level.

BTC/USDT daily chart. Source: Cointelegraph/TradingView

Any recovery attempts are likely to encounter strong selling at the 20-day EMA ($115,639). If the price declines from the 20-day EMA, the risk of breaking below the $110,530 support heightens. In such a case, the BTC/USDT pair could drop to $105 and subsequently to the psychological level of $100,000.

On the other hand, if the price surpasses $117,500, it suggests a potential range formation. Bitcoin’s price may then oscillate between $110,530 and $124,474 for a time.

Ether price prediction

ETH reached a new all-time high of $4,956 on Sunday, but bulls were unable to maintain the elevated levels.

ETH/USDT daily chart. Source: Cointelegraph/TradingView

The price retraced on Monday, indicating profit-taking by short-term traders. The ETH/USDT pair may decline towards the 20-day EMA ($4,349), a critical level to monitor. If the price rebounds off the 20-day EMA with vigor, the bulls will make another attempt to drive the pair above $5,000. If successful, the Ether price could surge to $5,500.

Conversely, a break below the 20-day EMA could sink the Ether price to vital support at $4,060.

XRP price prediction

XRP (XRP) has developed a descending triangle pattern, which will complete upon breaking and closing below $2.73.

XRP/USDT daily chart. Source: Cointelegraph/TradingView

The slightly declining 20-day EMA ($3.04) and RSI just below the midpoint provide no clear advantage to either bulls or bears. If the price declines from the 20-day EMA, sellers will make another attempt to drive the XRP price below $2.73. If successful, the pair could plummet to $2.33.

The bearish setup will be negated if there is a break and close above the downtrend line, which could propel the XRP price to $3.40 and then to $3.66.

BNB price prediction

BNB (BNB) soared to a new all-time high on Friday, demonstrating that bulls are firmly in control.

BNB/USDT daily chart. Source: Cointelegraph/TradingView

Profit-taking near $900 caused the price to retract to the breakout level of $861, which is a crucial level to monitor. If the price rebounds from $861 and surpasses $900, the BNB/USDT pair could rocket towards $1,000.

Sellers must pull and keep the BNB price below the 20-day EMA ($838) to weaken bullish momentum. This could pave the way for a deeper correction to the 50-day SMA ($779).

Solana price prediction

Solana (SOL) is facing resistance at the $210 level, but a positive note is that bulls have not yielded significant ground to bears.

SOL/USDT daily chart. Source: Cointelegraph/TradingView

The SOL/USDT pair has formed an ascending triangle pattern, which will complete on a break and close above $210. If that occurs, Solana’s price could initiate the next upward movement towards $240 and then its target of $265.

This optimistic outlook will be invalidated if the price continues to decline and breaks below the uptrend line, which could result in a drop to $155, where buyers are anticipated to re-enter.

Related: XRP price fails to overcome $3: Is a breakout still possible?

Dogecoin price prediction

Dogecoin (DOGE) sharply increased from the $0.21 support on Friday and surpassed the 20-day EMA ($0.22). However, the bulls could not uphold the elevated levels.

DOGE/USDT daily chart. Source: Cointelegraph/TradingView

The flat 20-day EMA and RSI near the midpoint indicate a balance between supply and demand, likely keeping the DOGE/USDT pair within the $0.21 to $0.26 range for several days.

The initial sign of strength will be a break and close above $0.26, which may propel Dogecoin’s price to $0.29. A break and close above $0.29 could open the door for a rally to $0.35. Conversely, a decline below $0.21 could sink the pair to $0.19 and then to $0.16.

Cardano price prediction

Cardano (ADA) rebounded off the 20-day EMA ($0.86) on Friday, but bulls face challenges in maintaining elevated levels.

ADA/USDT daily chart. Source: Cointelegraph/TradingView

Both moving averages show an upward trend, indicating an advantage for buyers, but the negative divergence on the RSI signals that upside momentum is waning. If the price closes below the 20-day EMA, the risk of falling below the 50-day SMA ($0.80) increases, potentially leading the ADA/USDT pair to drop to $0.70.

Buyers will need to drive the Cardano price above the $1.02 resistance to resume an upward trend towards $1.17.

Chainlink price prediction

Chainlink (LINK) declined from $27 on Saturday, suggesting that bears are strongly defending the level.

LINK/USDT daily chart. Source: Cointelegraph/TradingView

Sellers will aim to pull the price down to the 20-day EMA ($23.37), a crucial level to watch. If the LINK/USDT pair rebounds from the 20-day EMA with momentum, the bulls will attempt another push to clear the overhead resistance. If successful, the Chainlink price could rally to $31.

However, if there is a break and close below the 20-day EMA, it suggests that bulls are exiting, potentially deepening the correction to $20.84.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.