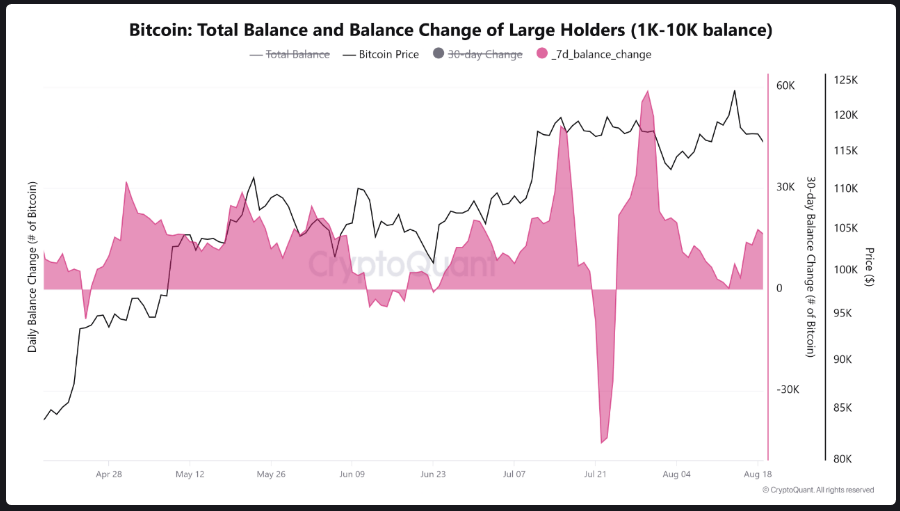

According to reports from CryptoQuant, large investors are actively accumulating assets while smaller investors are exiting the market.

Related Reading

In the last week, wallets associated with major Bitcoin players have acquired over 16,000 BTC amid a price drop.

Meanwhile, retail investors have been selling into market weaknesses, incurring losses and widening the gap between large holders and smaller traders.

Analysts interpret this as a potential signal that the market may be nearing a local bottom.

Seasonal Pressure and Federal Reserve Expectations

The timing of these actions complicates the situation. Historically, September has not favored market performance. Data from the past 35 years indicates that the S&P 500 has averaged a 1% decline during this month, a pattern often mirrored by Bitcoin.

Add to this a Federal Reserve meeting scheduled for September 15-16, where traders anticipate an 80% likelihood of a 0.25% rate reduction, and you create a mix of uncertainty.

For some, a rate cut represents potential relief for risk assets; for others, historical trends undermine any short-term optimism. Regardless, volatility appears inevitable.

BlackRock Transfer Sparks Selling Fears

Against this macro environment, a notable transaction raised concerns. BlackRock transferred over 10,584 BTC—worth approximately $1.20 billion—to Coinbase in a single day.

Such movements typically attract attention. Transfers to exchanges often suggest an intention to sell, which led to an immediate market response.

Bitcoin fell to just above $112,000, a level that previously served as a springboard for the rally that pushed prices to the all-time high of $124,000 in August.

Traders are closely monitoring this price point, pondering whether it can provide stability once again.

However, technical indicators present a mixed narrative. The relative strength index reads 32.90, nearing the oversold territory, which may indicate a drawn-out selling trend.

On the other hand, the MACD remains weak, with its line below the signal line, indicating continued negative momentum. This divergence in indicators leaves traders uncertain about whether the next significant move will be upward or downward.

Related Reading

Crypto Market at a Crossroads

If $112,000 holds, a rebound could be forthcoming. If it fails, the downside may accelerate, especially if institutional sell-offs of Bitcoin occur.

Combining whale accumulation, seasonal trends, and an impending Fed decision presents a short-term outlook that resembles a winding path rather than a straightforward trajectory.

At this point, the struggle is evident: it’s a contest between confidence and fear, with the outcome likely hinging on events before the month concludes.

Featured image from Unsplash, chart from TradingView