Dogecoin (DOGE) has recently experienced a period of price stability as market dynamics continue to shift. As of now, DOGE is trading at $0.223, facing challenges in breaking away from a consolidation phase.

Despite the subdued price action, key indicators suggest that significant investors may assist the token in recovering its losses from July.

Dogecoin Investors Are Turning Bullish Again

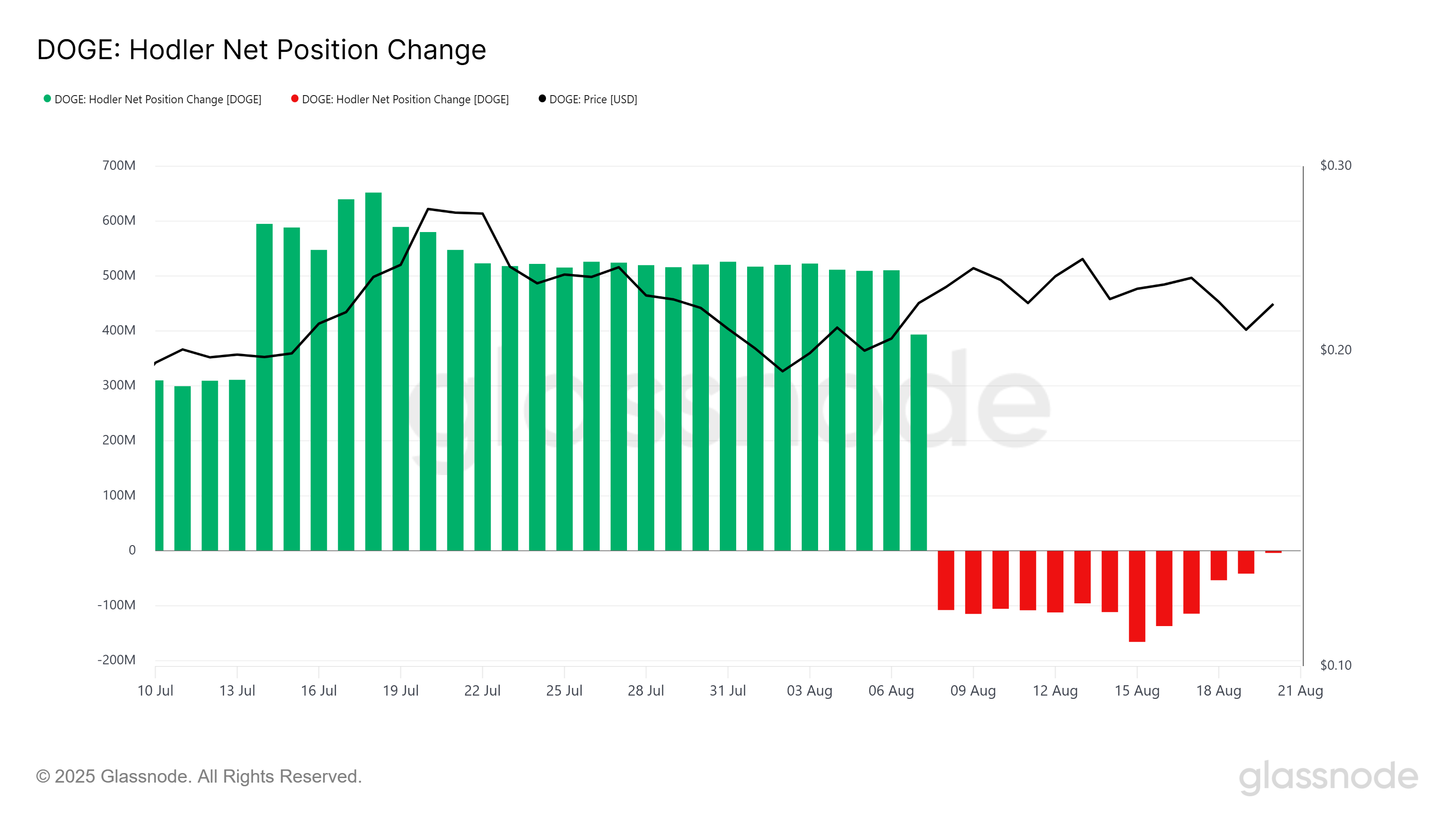

An analysis of the HODLer net position change indicates that long-term holders (LTHs) are becoming increasingly optimistic. The red bars, which typically signify selling pressure, have almost vanished, indicating a transition towards accumulation rather than distribution.

This shift from selling to accumulating could pave the way for a recovery in Dogecoin over the coming weeks. With a decline in liquidations from LTHs, the market is likely to face reduced downward pressure. This transition, along with ongoing accumulation, showcases the confidence that key holders continue to have in Dogecoin’s potential.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

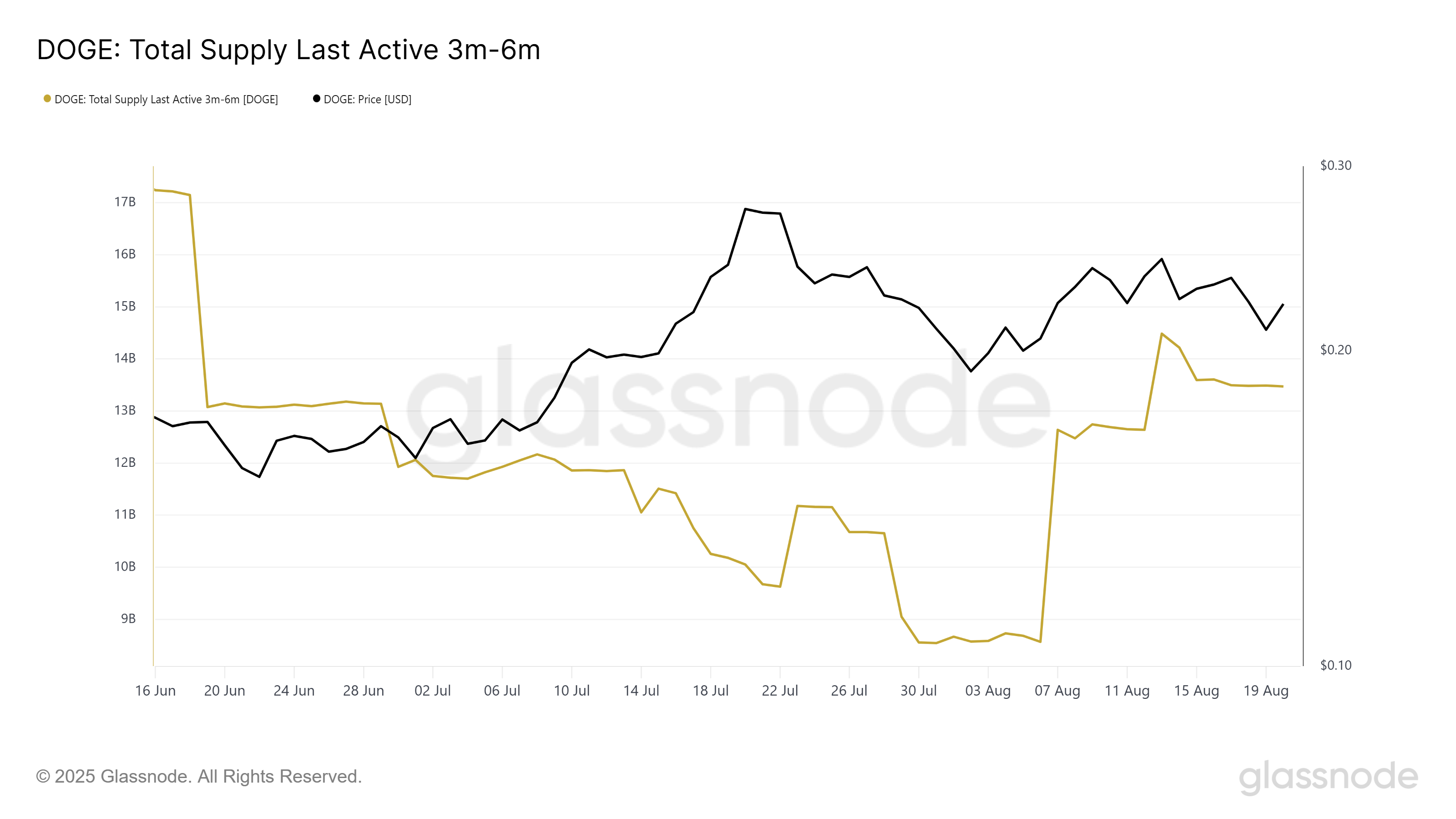

A broader market analysis shows that the supply of Dogecoin active between three and six months has significantly increased. In the past two weeks, mid-term holders have added 4.9 billion DOGE to their portfolios, amounting to over $1.97 billion.

This accumulation by mid-term holders indicates strong confidence in Dogecoin’s future price trajectory. These investors appear to be biding their time for favorable market conditions to capitalize on any potential price increases.

DOGE Price Could Look At Recovery

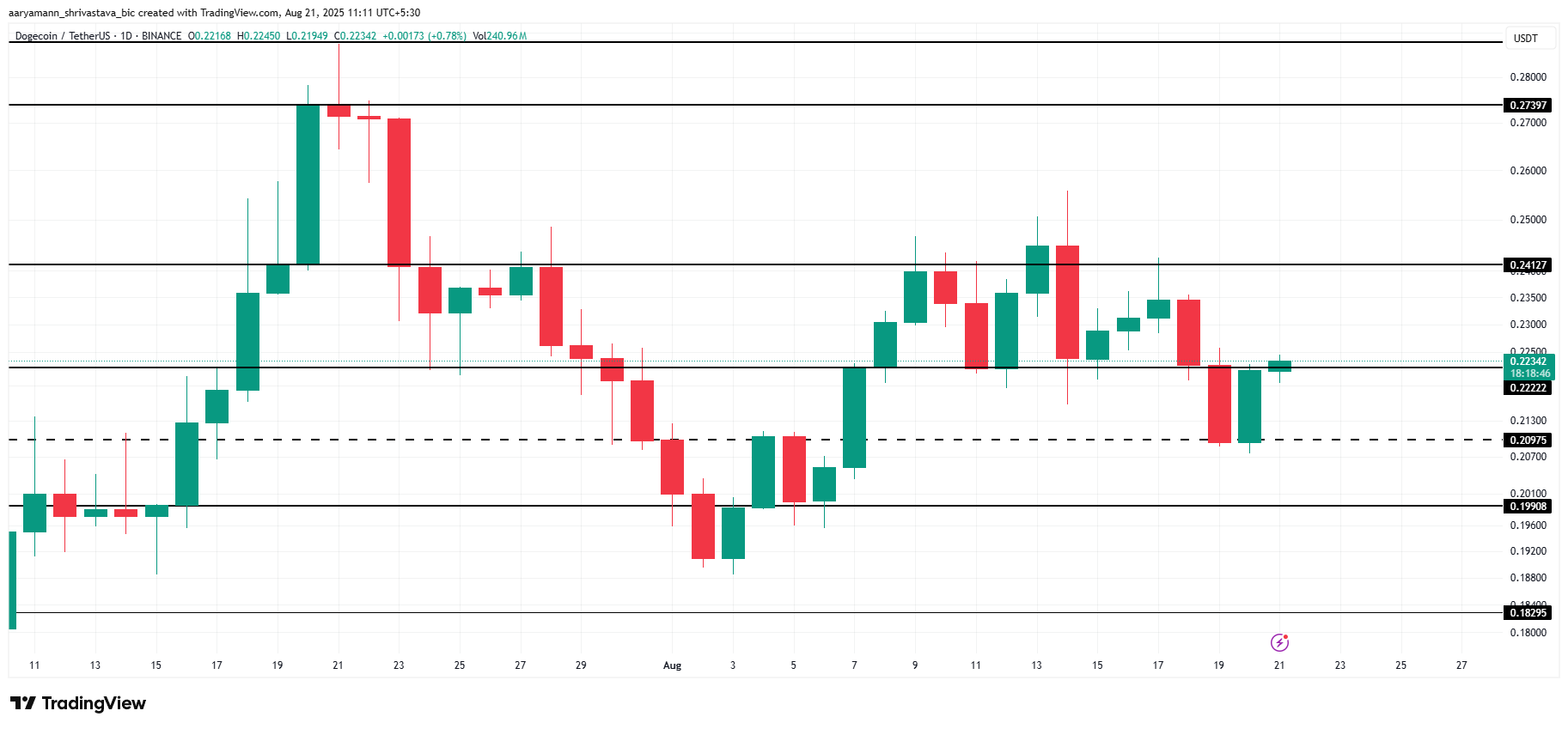

Currently priced at $0.223, Dogecoin needs to maintain the support level of $0.222 to uphold its recovery prospects. Recent trends indicate that DOGE aims to bounce from this support level and target the $0.241 resistance. Successfully breaking above this resistance could initiate a rally toward $0.273, aiding Dogecoin in recovering losses from July.

Should Dogecoin break past $0.241 and establish it as support, it would reinforce bullish momentum. In such a scenario, the next crucial target would be $0.273, presenting further opportunities for gains for holding investors. The positive sentiment among mid-term holders could significantly influence this price movement.

However, if Dogecoin fails to hold the $0.222 mark and drops below it, it may revisit levels of $0.209 or even $0.199. A further decline would negate the current bullish outlook, compounding the losses experienced in recent weeks. Therefore, sustaining the $0.222 support is essential for any chance of recovery.

The post 4.9 Billion DOGE Maturing Could Drive Dogecoin Price To Recover July Losses appeared first on BeInCrypto.