Farside Investors reports that U.S. investors contributed nearly $32 billion to U.S. crypto exchange-traded funds in 2025, despite a decline in market activity as the year progressed.

Related Reading

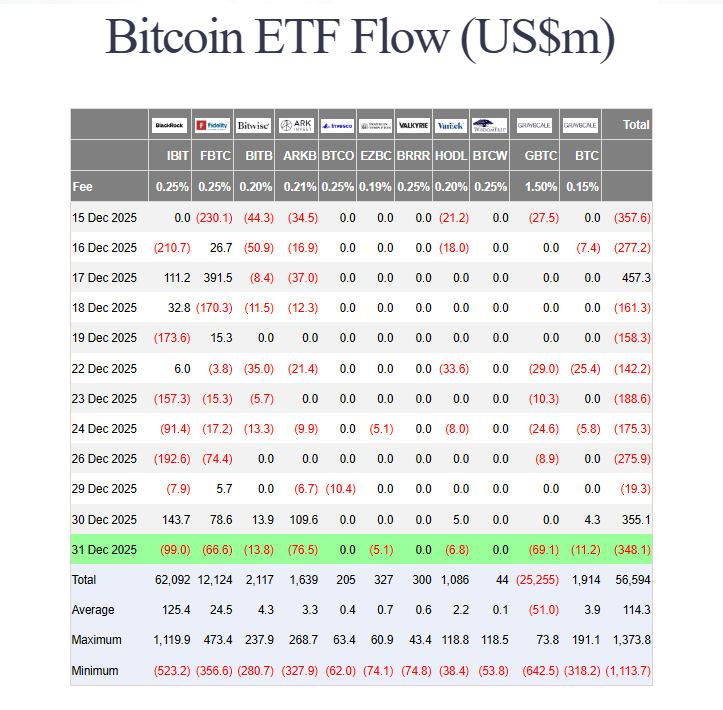

Spot Bitcoin ETFs attracted the largest portion, securing $21.4 billion in net inflows, which is lower than the $35 billion that flowed into Bitcoin ETFs in 2024.

Blackrock Leads in Inflows

BlackRock’s iShares Bitcoin Trust ETF, IBIT, captured the majority of the activity, bringing in approximately $24.7 billion—about five times more than its closest competitor, Fidelity’s FBTC.

Analysts observed that IBIT ranked highly among all ETF flows, trailing only a few broad index funds and a significant treasury bond fund.

Excluding IBIT’s figures, the broader category of spot Bitcoin ETFs actually ended the year with around $3 billion in combined outflows.

Grayscale’s Bitcoin product recorded nearly $4 billion in losses over the year. Bitcoin’s value was below its starting point for 2025, having opened the year just under $93,500.

Ethereum Demand Strong Yet Slowing

Reports indicate that while Ethereum ETFs attracted genuine interest, the growth appears to be inconsistent. BlackRock’s iShares Ethereum Trust, ETHA, reached nearly $12.6 billion in inflows, followed by Fidelity’s FETH at $2.6 billion, and Grayscale’s Ethereum Mini Trust ETF with around $1.5 billion.

However, public on-chain data revealed limited renewed interest in spot Bitcoin and Ether ETFs during the final month of the year, suggesting that inflows may decelerate into 2026.

Ether ETFs benefitted from their novelty and offered a regulated means for investors to hold ETH, though recent days have seen a slowdown in buying activity.

Spot Ether ETFs, which became widely tradable post their July 2024 launch, accumulated $9.6 billion in their first complete year. Meanwhile, spot Solana ETFs—launched in late October—added $765 million by year-end.

Altcoin ETFs Indicate Interest, Not Hype

Litecoin and XRP ETFs commenced trading in the latter part of the year, providing investors with more regulated altcoin investment choices.

These figures are minimal in comparison to Bitcoin and Ether’s inflows. Solana’s $765 million illustrates early interest that has yet to evolve into a consistent flow of assets. These products are still being evaluated by the market.

Related Reading

Global Trends Present a Different Perspective

Industry analysts noted that crypto ETFs listed globally experienced $2.95 billion in net outflows in November, with approximately $179 billion invested in crypto ETFs worldwide by the end of that month.

Regulatory bodies and exchanges acted swiftly this year under new SEC leadership, which was more open to approvals, thereby promoting institutional adoption in the U.S.

Featured image from Unsplash, chart from TradingView