The recent price movements of Bitcoin have led a key on-chain profitability indicator to enter a phase reminiscent of 2022, which was followed by a prolonged downturn. One analyst warns that if the price dips below $70,000, it could trigger a similar “year-long” reset.

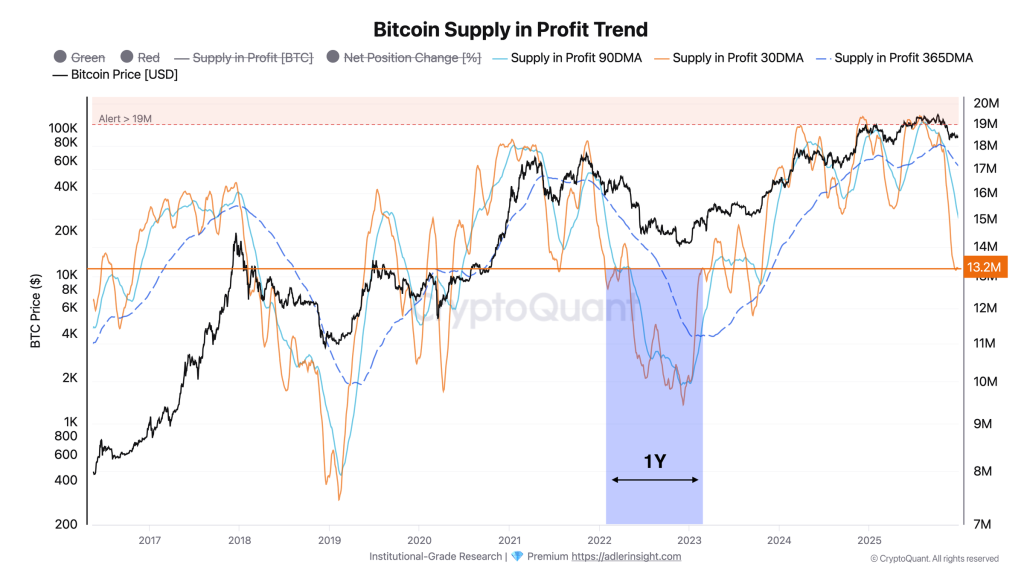

In a brief dated Dec. 30, Axel Adler Jr. highlighted that Bitcoin’s “Supply in Profit” metric is currently at a pivotal moment, particularly after BTC found stability in the $87,000–$90,000 range following the pullback from October’s peak. This metric, which measures the quantity of BTC held above its acquisition cost, has seen a drastic decrease from over 19 million BTC in October to around 13.2 million BTC, resulting in a notable gap between short- and medium-term moving averages.

A 2022-Like Setup Looms For Bitcoin

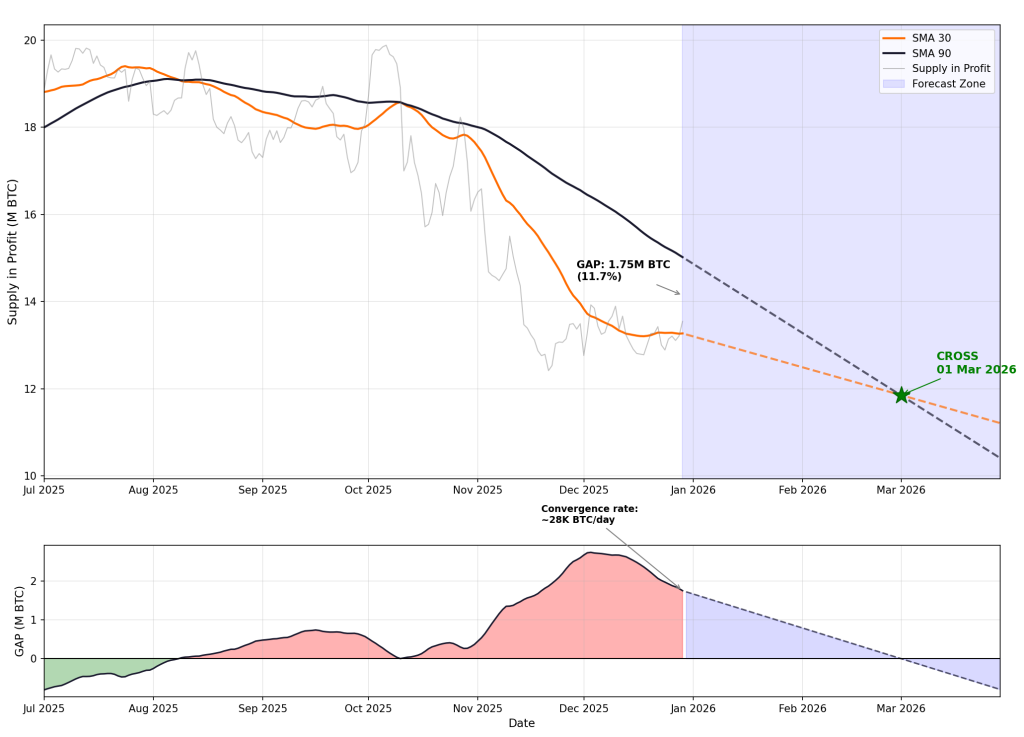

Adler points out the significance of the disparity between the 30-day and 90-day simple moving averages of Supply in Profit. Following the drop from the all-time high, the 30-day moving average has “significantly dropped below” the 90-day, yielding a gap of approximately 1.75 million BTC.

He observed that “a similar pattern was noted in 2022 before an extended bearish phase,” but emphasized an important difference this time: the 365-day moving average is still “at historically high levels,” suggesting that the long-term profit structure has yet to completely roll over.

Related Reading

The immediate question is whether the 30-day trend has reached its low point. Adler marked Dec. 18 as a possible local minimum for the 30-day average, stating it is now “beginning to rebound,” with confirmation dependent on a simple condition: Supply in Profit needs to remain above its 30-day average, which essentially requires BTC to maintain its current price levels or higher.

Adler’s forecast for a bullish recovery in this signal is notably precise: he estimates that the gap between the 30-day and 90-day averages is diminishing by roughly 28,000 BTC each day, primarily because the 90-day average is being mechanically pulled down as the high values from October exit the calculation.

“Why is the 90-day SMA declining while the price remains stable?” Adler asked in the brief’s FAQ. “This is a mechanical consequence of the moving average: earlier October values are now falling out of the 90-day window, during which Supply in Profit was peaking at 18–20 million BTC with prices ranging from $115,000 to $125,000. Even if current Supply levels remain stable, this pulls the average down.”

Related Reading

According to Adler, this rollover effect is likely to persist until late January, providing a “tailwind” that may enable the 30-day average to reclaim the 90-day average without requiring a dramatic increase in Supply in Profit. If the current rate of change continues, Adler anticipates a bullish crossover—where the 30-day average surpasses the 90-day average—by late February to early March.

The Invalidation: $70,000

However, this forecast is highly sensitive to price movements. Adler estimates that Supply in Profit has a “price elasticity” of 1.3x, indicating that a 10% drop in BTC value could lead to approximately a 13% decline in the supply held in profit. In his analysis, the market’s pivotal fault line lies at the $70,000 range.

“At what price does the crossover scenario get negated?” Adler inquired. “The critical threshold is below $70,000. At that price point, Supply would decrease to approximately 10 million BTC, causing the 30-day SMA to begin declining more rapidly than the 90-day SMA. The gap would cease to tighten and instead expand, indefinitely delaying the bullish signal.”

In such a situation, Adler indicated that the setup would resemble the dynamics of 2022: the disparity would broaden rather than narrow, pushing back the bullish crossover, with recovery potentially taking “up to one year.” On the other hand, he characterized a positive scenario as maintaining levels above $75,000–$80,000 through January, supporting Supply in Profit and sustaining the pace of convergence.

As of press time, BTC is trading at $88,102.

Featured image created with DALL.E, chart from TradingView.com