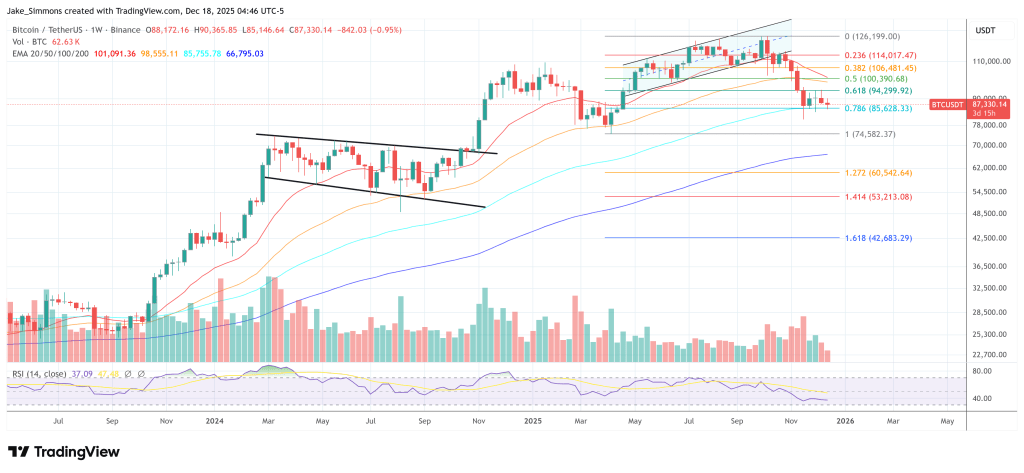

Julien Bittel, head of macro research at Global Macro Investor (GMI), shared a bitcoin “oversold RSI” roadmap on X, emphasizing the market’s close tracking of this indicator. He related this setup to a broader perspective suggesting that the cycle could extend into 2026, a view that would make the traditional “four-year cycle” framework irrelevant.

“Many have requested an update on this chart, so I’m posting it here for those interested,” Bittel stated, presenting a chart of bitcoin’s average price trend following an RSI dip below 30, with this breach indicated as t=0. “This illustrates the typical BTC trajectory following an oversold RSI reading, starting with RSI dipping below 30 at t=0.”

Can Bitcoin Skyrocket To $180,000 In Just 90 Days?

Bittel mentioned that the overlay aligns with the current market conditions. “So far, it’s been quite accurate,” he stated. The “average market path” trajectory shows a significant rise in the weeks that follow. According to the chart, a sharp rally may occur within 90 days after t=0, potentially pushing the BTC price close to the $180,000 mark.

Related Reading

However, Bittel stressed that the chart should not be seen as a precise prediction. “No, it won’t be exact,” he clarified, adding that “if the bull market isn’t already finished, this chart provides a valuable perspective.” He cautioned that the rebound could be inconsistent: “bases often require time to form and typically encounter volatility before a substantial uptrend begins.”

He clearly reiterated the conditional aspect of the framework. “If you believe the bull market is done and we’re facing a year of downturn, this chart isn’t for you. Move along…”

Bittel emphasized that the well-known cycle narrative shouldn’t be taken for granted. “Unless you think the four-year cycle is still relevant, which we don’t, this chart should maintain its contextual validity over time,” he articulated. “As previously explained, based on our research on the business cycle, current financial conditions, and overall liquidity expectations, the likelihood points toward this cycle progressing well into 2026.” In such a scenario, he noted, “the four-year cycle is effectively finished.”

Bittel also challenged the widespread notion that bitcoin’s patterns are fundamentally linked to the halving events. “Remember, the four-year cycle has never been about the halving, despite common belief; it has always been influenced by the public debt refinancing cycle,” he asserted, mentioning that this dynamic was delayed by a year post-COVID. He now suggests that the cycle is “officially disrupted” due to the increasing average maturity of the debt term structure.

He depicted the macro environment through the lenses of debt-service pressures and liquidity responses. “The larger issue is that there remains a significant interest burden that needs to be monetized, which has outpaced GDP growth,” Bittel stated.

Responses across the crypto community on X ranged from enthusiastic to doubtful. The ₿itcoin Therapist commented: “$180,000 BTC in 90 days.”

Related Reading

LondonCryptoClub (@LDNCryptoClub) conveyed that the chart “aligns with our analysis,” linking the narrative to what it termed the Fed’s “not QE QE” dynamics and “liquidity maneuvers” between the Treasury and the central bank. The account still expected rough times ahead—“noise and fluctuations into year-end (which implies negative liquidity)”—prior to “these fundamental factors allowing BTC to reconnect with the bullish trend,” adding that “current sentiment is sufficiently pessimistic, paving the way for a BTC bounce to be the most unpopular trade to kick off 2026!”

Others took a more sardonic approach. “Precision-grade hopium here,” remarked doug funnie (@cryptoklotz), though he still outlined a conditional path forward: “I still believe that as long as BTC persists (i.e., doesn’t settle in the $70k range and starts to decline), there’s a feasible route to new highs sooner in 2026. We just need to navigate the ‘transition zone’ of four-year deterministic sellers exhausting, before facing an awkward scenario as the music continues.”

Charles Edwards, founder of Capriole Investments, criticized the statistical basis, advocating for a wider data set: “Now rerun this with 100 occurrences, not just 5 during upward trends.”

For traders, Bittel’s post effectively merges a tactical indicator with a broader forecast: the RSI sub-30 template may outline the path for recovery, but only “if the bull market isn’t already ended,” and only in a realm where, according to his perspective, “the balance of probabilities” leans toward a cycle that extends well into 2026.

As of the latest update, BTC was priced at $87,330.

Featured image created with DALL.E, chart from TradingView.com