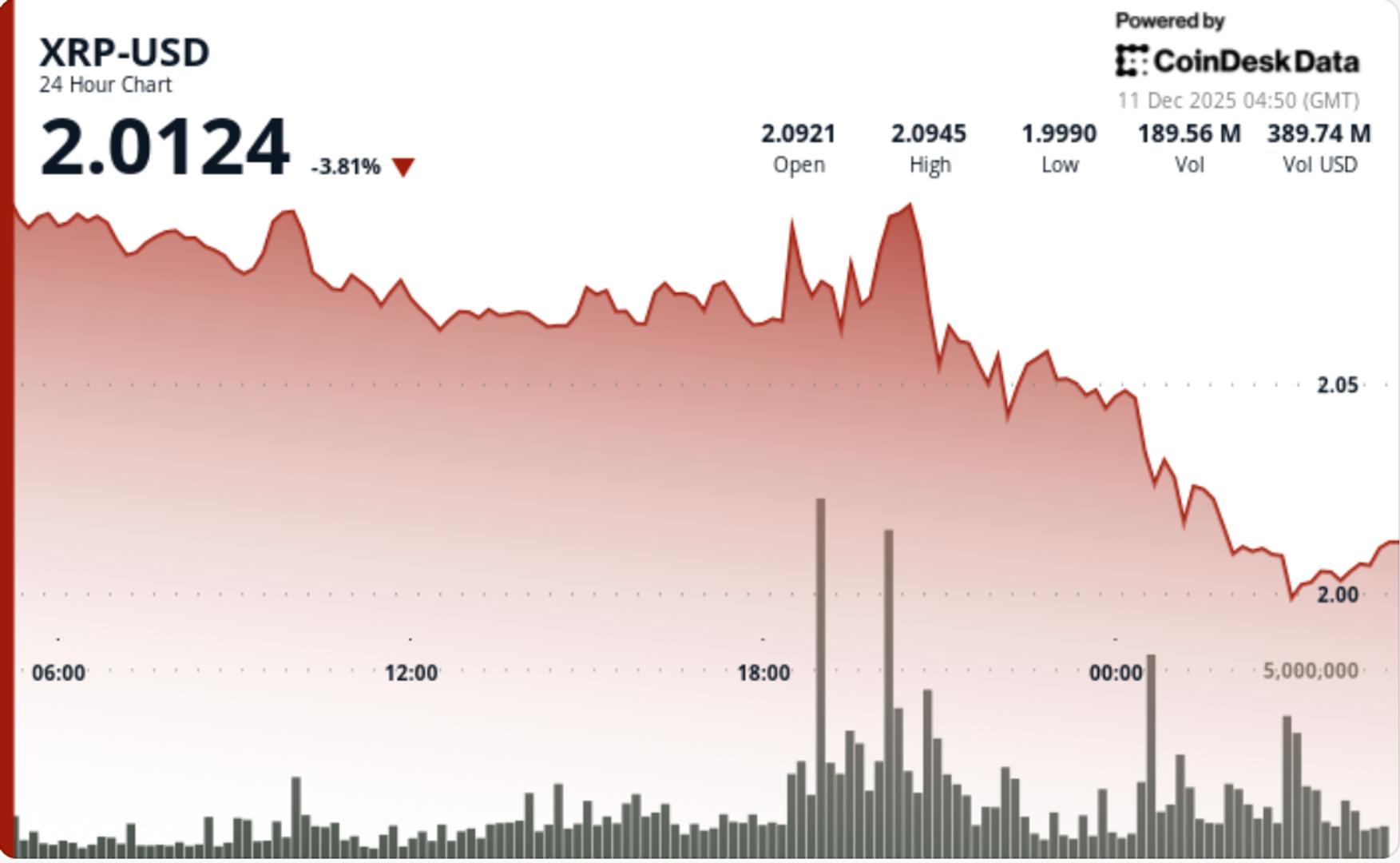

Institutional flows surged over 50% above trend on Wednesday as XRP struggled to break through the $2.09–$2.10 resistance barrier. Sellers pushed the token down from resistance, leading to a return to the $2.00 psychological level, with the broader market remaining in a multi-week compression while ETF inflows quietly reduce supply beneath the surface.

Key Points to Consider

- XRP fell from $2.09 to $2.00, a 4.3% drop during the session, underperforming the overall crypto market by about 1%.

- The rejection was significant: a 172.8M volume spike (205% over the daily average) occurred just as XRP hit $2.08, turning the move into a failed breakout. The selloff was not driven by retail panic.

- Overall session volume was 54% above the 7-day average — indicating classic institutional distribution above resistance rather than emotional selling.

- Exchange balances decreased from 3.95B to 2.6B tokens in the past 60 days, further compressing supply even as the spot price struggled to maintain the breakout attempt. This divergence is contributing to an increasingly asymmetrical structure as XRP trades within a narrowing multi-month triangle.

News Overview

- U.S. spot XRP ETFs attracted over $170 million in weekly inflows, continuing a streak of zero outflows.

- Significant spot selling persists around the $2.09–$2.10 region, where XRP has now faced multiple rejections.

- Market makers indicated rising distribution pressures prior to yesterday’s movement, with substantial offers positioned above $2.10.

- Exchange supply continues to decrease, now at 2.6B tokens, further reinforcing long-term supply constraints.

- Despite ETF backing, XRP underperformed relative to broader crypto as CD5 dropped 3.1% for the day — indicating the movement was specific to the token rather than driven by broader market conditions.

Price Action Overview

XRP declined 4.3% from $2.09 to $2.00

• Intraday range: 5.4% as resistance rejection triggered high-volatility correction

• Volume: 172.8M peaked at 19:00 UTC (up 205% above daily average)

• Multiple rejections at $2.08–$2.10 created a solid resistance level

• Late-session stabilization formed higher lows near $1.999–$2.005

• Relative performance: lagged the broader crypto market by approximately 1%

Technical Insights

- Support: $2.00 psychological level. Below this, there is a weak zone at $1.95, aligned with previous demand clusters.

- Resistance: $2.09–$2.10 serves as a primary barrier—this session established a clear supply zone. A close above $2.10 could shift the entire structure to a short-term bullish outlook.

- Volume Structure: 54% above weekly averages = indicative of institutional flows, not random noise. The 172.8M spike coinciding with the failed breakout confirms active sellers defending the resistance level.

- Pattern: A multi-month triangular compression is tightening as exchange supply decreases. Price remains in the middle range; confirmation of neither breakout nor breakdown is evident.

- Momentum appears bearish in the near term following the clear rejection. Bounce attempts were capped below $2.08 on decreasing volume, indicating weak follow-through.

What Traders Are Monitoring

- Will the $2.00 level withstand another test? A clean break could lead to a swift decline towards $1.95.

- ETF inflows remain the strongest counterbalance to spot weakness — any slowdown could eliminate the support.

- A breakout necessitates multiple hourly closes above $2.10 with sustained volume above 100M.

- Compression is now extremely tight — the next movement is expected to be larger than previous ones.

- The decline in exchange balances is a potential factor: thinner supply = quicker swings once direction is confirmed.