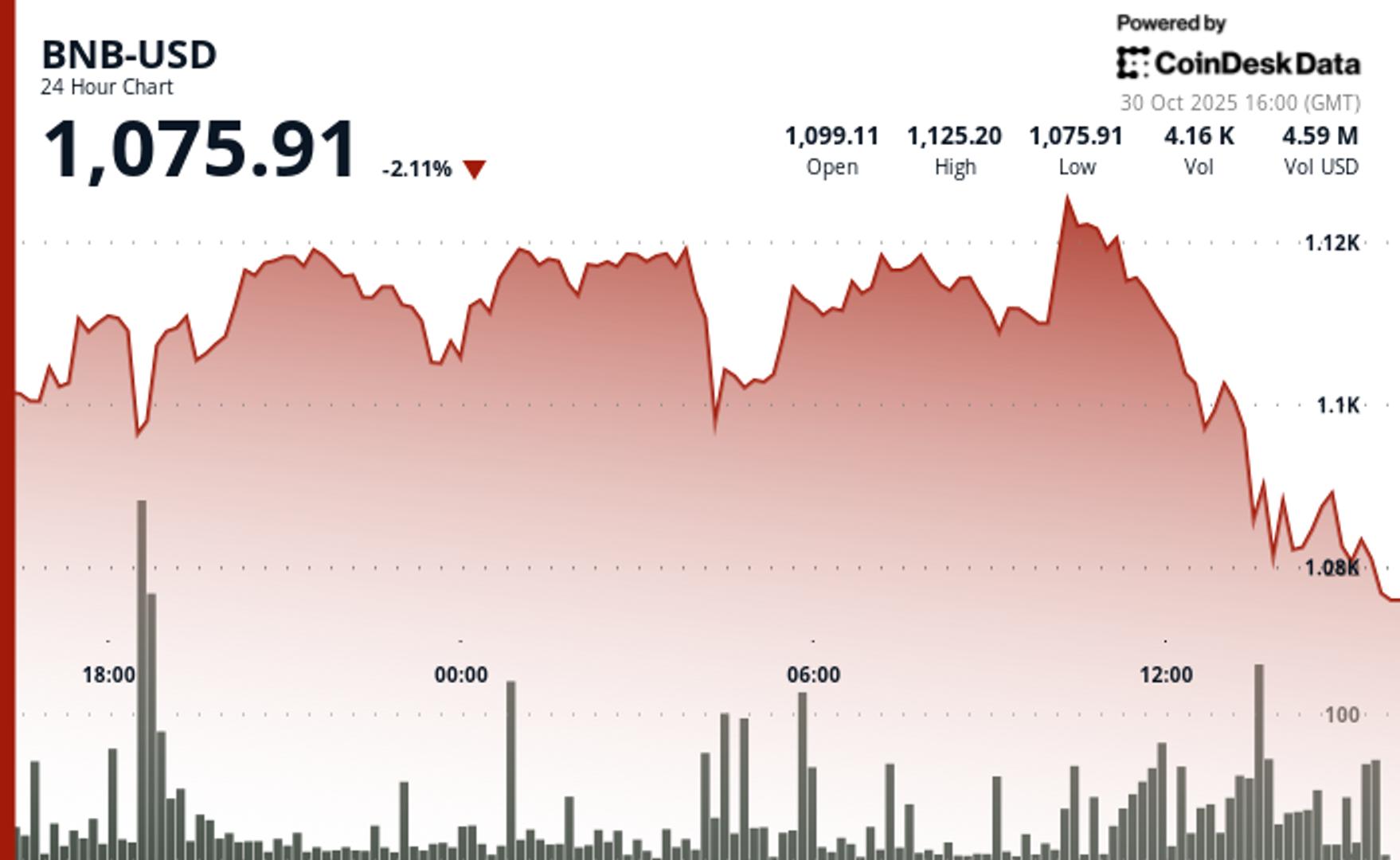

BNB has dropped over 2% in the last 24 hours, decreasing to $1,073 after failing to maintain crucial technical support around $1,095, according to technical analysis data from CoinDesk Research.

This decline coincides with a wider crypto market downturn influenced by shifting signals from the U.S. Federal Reserve, with the overall market falling by 4.7% based on the CoinDesk 20 (CD20) index.

The Fed’s expected interest rate cut of 25 basis points is coupled with remarks from Chair Jerome Powell indicating that further cuts in December aren’t assured, unsettling risk assets, including cryptocurrencies.

Consequently, 24-hour liquidations have surged past $1.1 billion, primarily affecting long positions, according to data from CoinGlass.

For BNB, the selloff escalated after repeated attempts to breach resistance near $1,115. As prices dipped below $1,095, selling pressure mounted, pushing the token down to an intraday low near $1,081 before stabilizing around $1,073. The price trend exhibited a series of lower highs, signaling waning momentum.

This decline seems to stem more from market dynamics rather than any specific news regarding BNB. The token’s technical breakdown reflects broader patterns seen in other major cryptocurrencies as traders assess central bank policies and prepare for the upcoming $13 billion options expiry on Friday.

BNB is currently up against short-term resistance around $1,087. A rebound beyond $1,095 may help mitigate the downtrend, but if selling continues, a retest of the $1,081 level remains likely.

Disclaimer: Some portions of this article were generated with assistance from AI tools and have been reviewed by our editorial team for accuracy and adherence to our standards. For further details, refer to CoinDesk’s complete AI Policy.