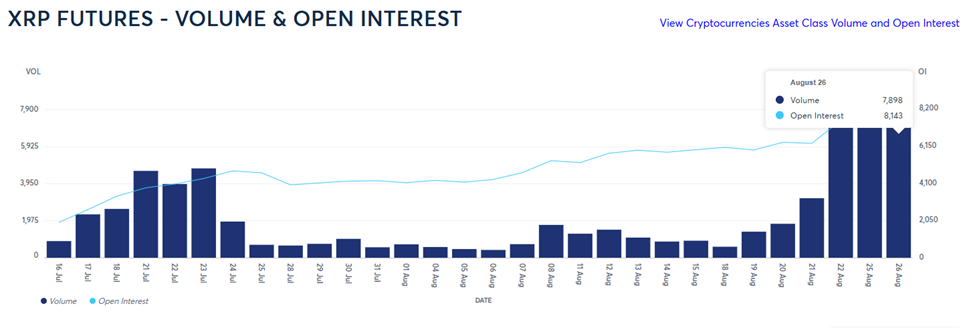

XRP has set a new landmark on Wall Street’s largest cryptocurrency trading platform, the Chicago Mercantile Exchange (CME). Ripple’s native token achieved the distinction of being the fastest CME contract in history to exceed $1 billion in open interest (OI).

This milestone was reached in just over three months since its launch in May 2025.

Record Futures Growth Ignites New Speculation About Spot XRP ETF Approval

The CME Group confirmed the accomplishment in an update on August 26, calling it a sign of growing maturity in crypto derivatives markets.

“Our Crypto futures suite has just surpassed $30 billion in notional open interest for the very first time. Our SOL and XRP futures, along with ETH options, have each crossed $1 billion in OI, with XRP setting the record as the fastest-ever contract to reach this milestone in just over 3 months. This indicates significant market maturity, accompanied by new capital inflows,” CME announced.

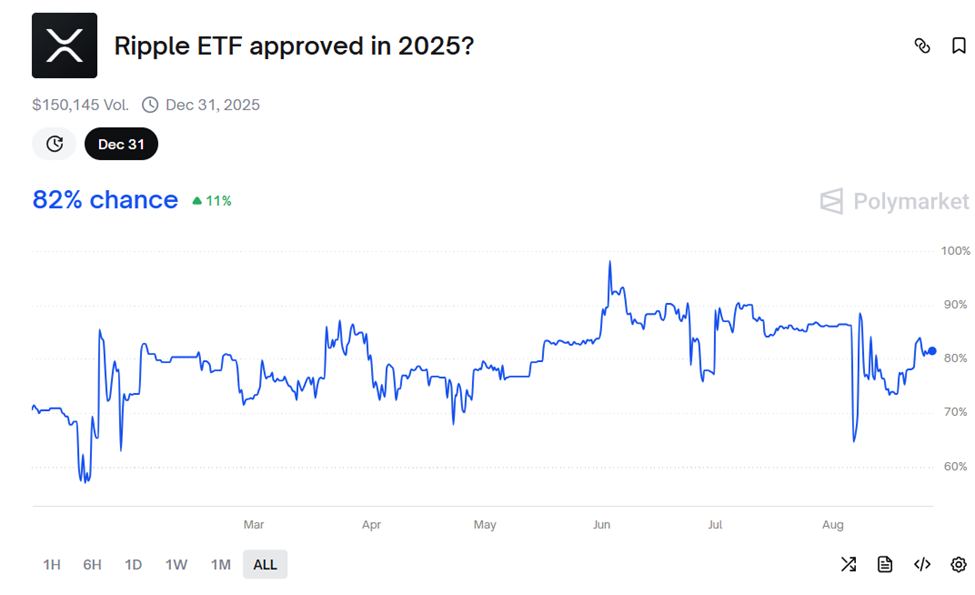

The rapid growth of XRP on CME has sparked speculation around the possibility of a spot XRP ETF.

Nate Geraci, president of the ETF Store, pointed out that XRP already holds over $800 million in futures-based ETFs, suggesting that the demand for spot products may be underestimated.

“CME Group states that XRP futures contracts have exceeded $1 billion in open interest… the fastest contract to achieve this. There’s already over $800 million in futures-based XRP ETFs. Perhaps people are underestimating the demand for spot XRP ETFs,” he commented.

Prediction markets seem to align with this sentiment, currently estimating an 82% likelihood that a Ripple-backed ETF will be approved before the close of 2025.

This milestone occurs amidst XRP’s complex market standing. With a market capitalization of about $178 billion, XRP ranks as the third-largest cryptocurrency globally.

On paper, it surpasses the market capitalization of asset management behemoth BlackRock, which was valued at $176 billion at the time of writing.

However, according to Nate Geraci, it remains one of the most criticized assets among professionals. Pro-XRP lawyer John E. Deaton echoed this sentiment.

“XRP is the most detested cryptocurrency by institutional and professional traders/investors while being beloved by retail investors,” wrote Deaton.

This divide between institutional doubt and grassroots support has long characterized XRP’s path.

Retail investors have embraced XRP for its utility potential, leading to the phrase “XRP has a cult-like following.”

Conversely, institutions have remained cautious, influenced by Ripple’s recent but lengthy legal disputes with US regulators.

Futures Momentum Meets Uncertainty Over XRP’s Long-Term Worth

However, not all are convinced that XRP’s futures triumph will result in long-term value.

Some critics argue that stablecoins, smart contracts, and oracle solutions like Chainlink have overshadowed XRP’s initial purpose as a bridge currency.

They assert that bridge tokens face inherent limitations, as every purchase for transactions is countered by an immediate sale, creating neutral demand pressure.

The XRP Ledger has also faced criticism for its limited adoption and functionality compared to more advanced networks.

While the activity on CME is notable, investors are increasingly anxious about the price of XRP.

As of the latest update, XRP was trading at $3.00, having increased by over 3% within the last 24 hours.

XRP’s ascent to $1 billion in open interest indicates significant capital inflow into the asset. This could be driven by speculation, hedging, or interest in potential regulatory advancements.

If regulators approve a spot ETF, it would serve as a vital test of whether XRP’s dedicated retail base can lead to sustained institutional uptake.

The post XRP Futures ETF Becomes Fastest CME Contract to Hit $1 Billion Open Interest appeared first on BeInCrypto.