A new update from crypto analyst Stockmoney Lizards on X indicates that the current Bitcoin setup provides bears with “the perfect opportunity” to short the market down to $40,000. Accompanied by a chart, his message illustrates Bitcoin’s decline below a significant resistance level since it fell below $100,000, forming what looks like a clear continuation pattern for traders anticipating further losses.

Yet, while the chart draws parallels with a similar bearish pattern from 2022, the analysis behind his post suggests a more nuanced outlook on Bitcoin’s potential trajectory.

What Bears Believe Is Finally Here

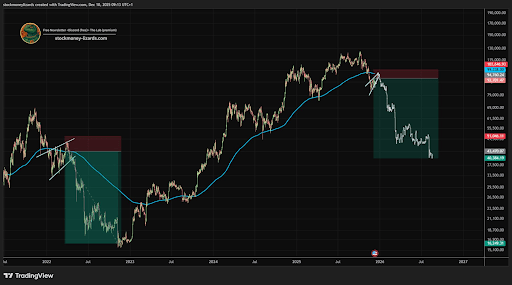

In the chart he provided, Stockmoney Lizards illustrated how Bitcoin’s recent breakdown mirrors the 2022 scenario, where the price action rejected a significant resistance level and plummeted into what later constituted a large accumulation zone. The current setup exhibits a similar rejection slightly above the $100,000 mark, followed by a drop beneath the weekly EMA50. This movement positions Bitcoin in a region analogous to where accumulation occurred in the previous cycle.

Overlaying this new price action with the former suggests that the downward trajectory seems almost predetermined, giving the impression that Bitcoin is preparing for a natural decline to as low as $40,000 in the forthcoming weeks and months. Currently trading at $90,240, a fall to $40,000 would entail a loss of approximately 55% of its value from this point, effectively negating all progress made over the previous two years.

Bitcoin Price Chart. Source: @StockmoneyL On X

Why The Ideal Short Isn’t The Analyst’s Core Message

Following the post’s popularity, Stockmoney Lizards clarified that his message was misconstrued. His suggestion for traders to short to $40,000 was intentionally hyperbolic, and market dynamics don’t play out that way.

He confirmed that he doesn’t anticipate a plunge into a severe bear market. Instead, he envisions Bitcoin potentially consolidating, possibly testing local lows, but not undergoing a sustained breakdown. Additionally, he mentioned that the worst-case scenario would involve touching the weekly EMA200, a point where bull markets typically do not conclude. His main midterm forecast is for Bitcoin price to move higher.

Before the bearish prediction, Stockmoney Lizards had previously shared another analysis indicating Bitcoin was nearing a major technical pivot at the weekly EMA50 indicator.

Bitcoin Price Chart. Source: @StockmoneyL On X

This earlier chart provided a clearer picture of his actual position. He anticipated that Bitcoin was nearing a significant technical pivot and expected upward movement heading into the end of December and Q1 2025. As a result, the weekly EMA50 is the level Bitcoin must reclaim to initiate its next phase of bullish momentum.

Featured image generated by Dall.E, chart sourced from Tradingview.com