Changpeng ‘CZ’ Zhao, the former CEO of Binance, asserts that Bitcoin is on track to be the global reserve currency. His claim is being substantiated by the increasing number of companies and nations that are integrating BTC into their treasuries.

Summary

- Changpeng “CZ” Zhao stated that Bitcoin is poised to become the ‘global reserve currency.’

- As of August 2025, over 300 organizations globally have incorporated BTC into their financial portfolios.

On August 29, Changpeng “CZ” Zhao indicated that Bitcoin (BTC) is making significant strides towards becoming a global reserve currency. The former CEO of Binance noted that a growing number of entities, especially from traditional finance, are adding the world’s largest cryptocurrency to their balance sheets at an unprecedented rate.

“We’ve witnessed this evolution, and it’s encouraging to see both traditional financial industries and nations embracing Bitcoin, alongside other cryptocurrencies,” CZ remarked.

“I believe we’ve come a long way,” he concluded.

As a long-time advocate of BTC, CZ highlighted when the asset achieved a new all-time high on July 14, surpassing the $122,000 mark, that this was merely the beginning for BTC to reach new heights.

“It took three years to reach an ATH of $1,000 again in January 2017. We were thrilled. Now, that amount is just a small fragment, less than 1% [of today’s Bitcoin value],” Zhao shared in his July post.

Having been an early BTC adopter in 2014, CZ compared his excitement during the July rally to the moment BTC hit $1,000 back in 2017. This comparison was validated just a month later when the asset achieved its latest ATH at $124,128.

How many entities have started stockpiling Bitcoin?

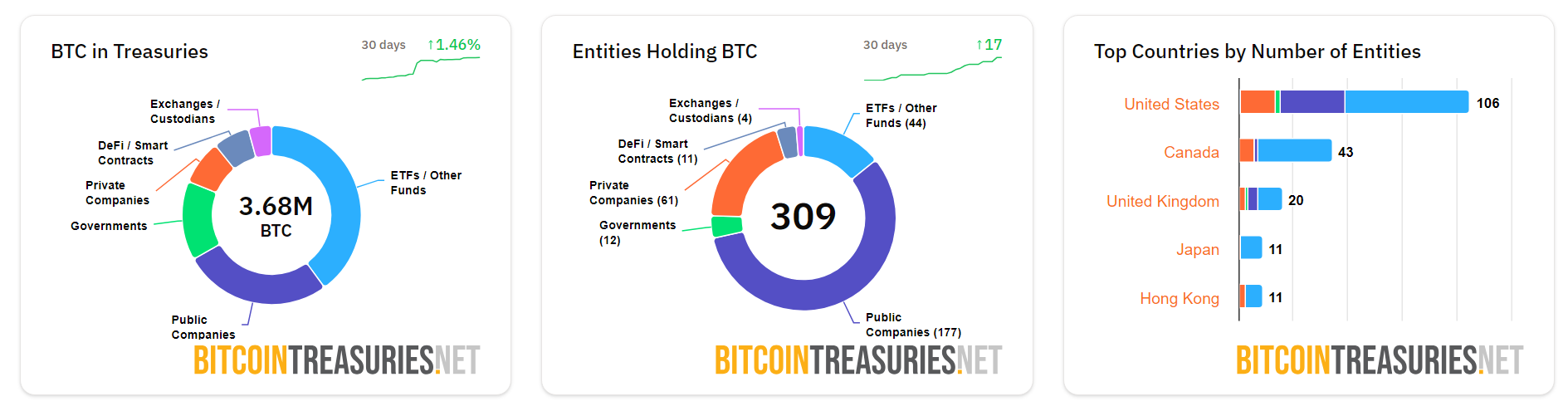

According to data from BTC Treasuries, there have been 17 new entities adopting Bitcoin treasuries recently, bringing the total to 309 entities holding BTC in their financial statements. More than a third of these are public companies, with 177 corporations maintaining BTC holdings.

In comparison, only 37 new companies began accumulating BTC for their corporate treasuries throughout 2024, whereas 51 new companies have already added BTC in the first half of 2025 alone. By mid-2025, over 35 public companies possessed at least 1,000 BTC each, an increase from 24 at the end of Q1 2025. This trend is further propelled by stock price increases that often follow major corporate moves to accumulate BTC.

Michael Saylor’s Strategy remains the top holder of BTC among treasury companies, with 632,457 BTC on its balance sheet, constituting about 3% of all existing BTC.

Currently, there are 3.68 million BTC held in treasuries across ETFs, funds, crypto exchanges, public and private companies, and government entities. In contrast, the total BTC in circulation globally is roughly 19.9 million, indicating that a substantial amount is still available for acquisition.