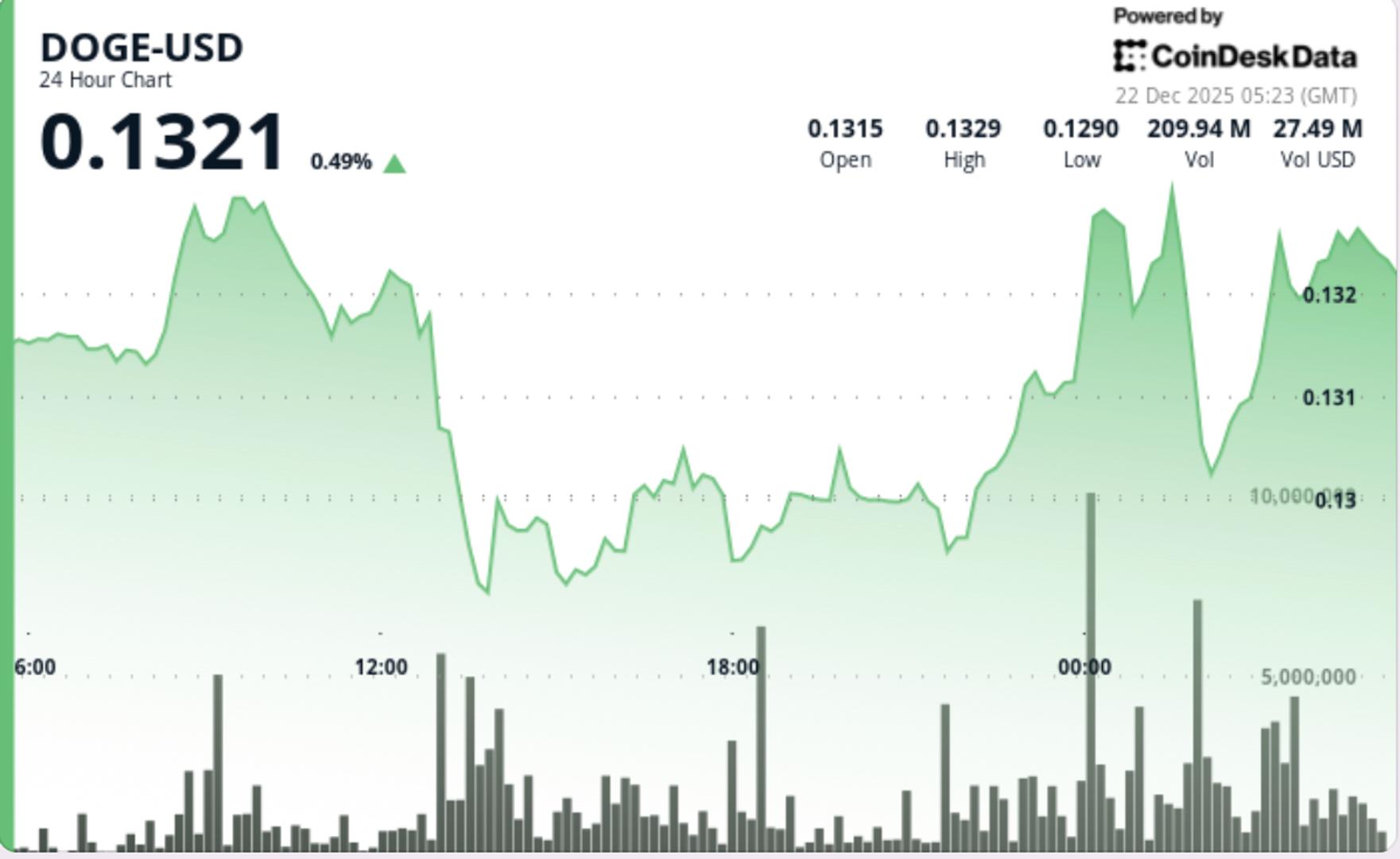

Dogecoin experienced a slight decline over the last 24 hours as selling pressure drove the token below a crucial support level around $0.129, with high volume validating a breakdown from its recent consolidation zone.

Market Overview

- DOGE fell approximately 0.3% over the 24-hour period ending Dec. 22, dropping from $0.1309 to $0.1305 after failing to maintain support that had held for several sessions.

- Despite the modest percentage change, intraday volatility spiked to about 4%, indicating heightened sensitivity at nearby technical levels.

- Trading activity surged during the session. Overall volume rose significantly, with turnover climbing well above recent averages as prices fluctuated around the upper and lower limits of its range. Initial strength pushed DOGE briefly toward $0.134 before sellers emerged, solidifying that level as immediate resistance.

Technical Analysis

- The technical outlook weakened during U.S. and early Asian hours as DOGE slipped below $0.1289, a level that had attracted buyers consistently in recent sessions.

- The breakdown coincided with a notable rise in volume, indicating active engagement rather than a low-liquidity drift.

- The most significant move occurred just after 02:00 UTC, when the price dropped from the $0.132 region to $0.130 amid a concentrated wave of selling.

- This move clearly departed from the previous consolidation structure, transforming former support into resistance.

- On shorter timeframes, DOGE now trades below its immediate moving averages, with momentum indicators trending downward rather than diverging.

- Attempts to recover toward $0.132 have so far faced selling pressure, sustaining downside momentum.

Price Action Summary

- DOGE fluctuated between roughly $0.134 and $0.130 during the session.

- Volume increased well beyond recent averages during the breakdown phase.

- A brief rally early in the session faltered near the $0.134 resistance.

- Late-session selling drove the price below $0.129 before stabilizing around $0.130.

Even with some stabilization around current levels, the price has yet to regain the previous range floor.

What Traders Should Watch

- $0.132–$0.134 now serves as resistance overhead following the breakdown.

- $0.129 is the initial level to monitor on the downside; a sustained drop could signal further weakness.

- A quick reclaim of $0.129–$0.130 on increasing volume would be necessary to counteract the bearish setup.

- Persistently high volume without upward momentum would further support the outlook of a consolidation leading to a drop.

Currently, DOGE remains in a technically precarious state, with sellers dominating rebounds and buyers showing little conviction above former support.