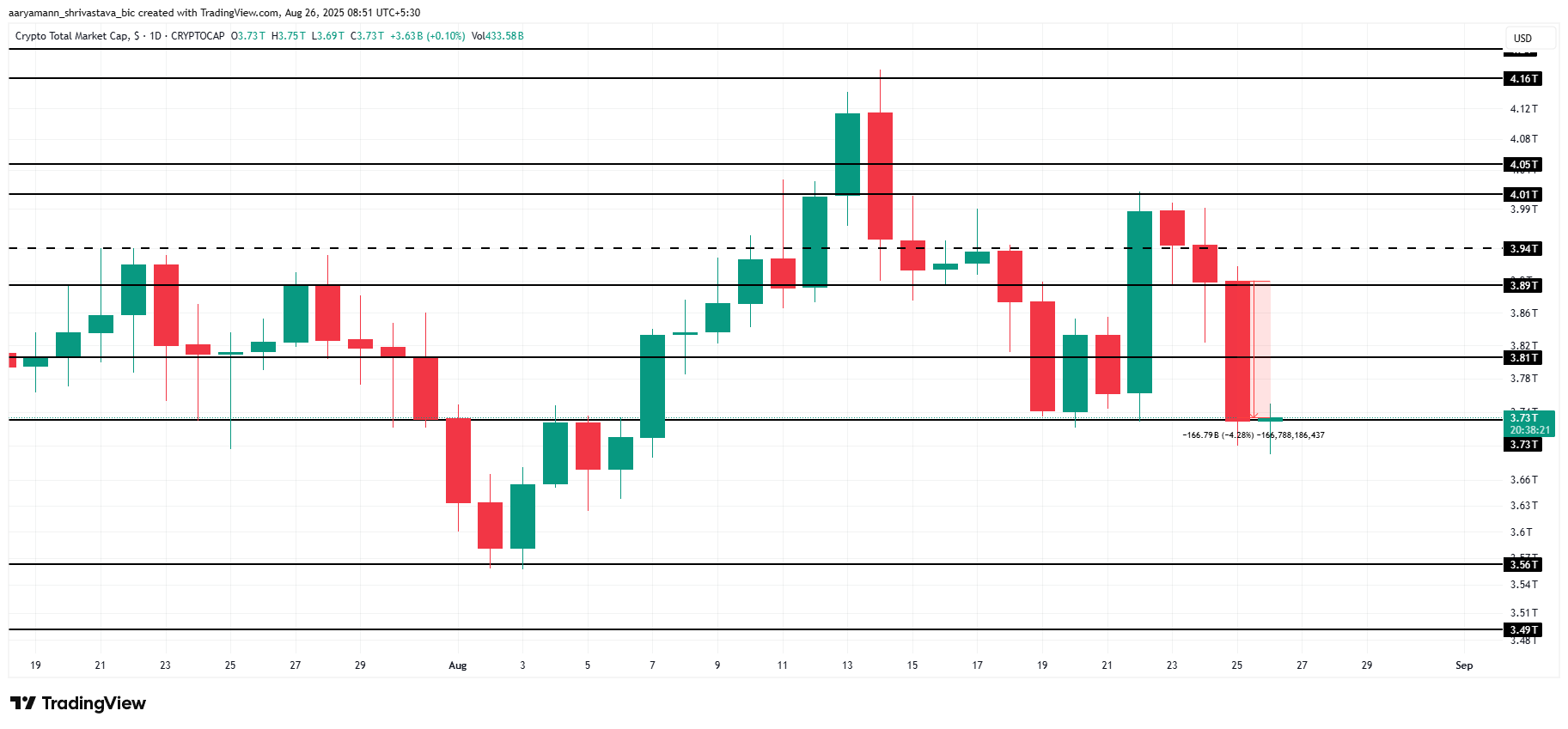

The total crypto market capitalization (TOTAL) experienced significant pressure from bearish investors, resulting in a loss of over $166 billion. Bitcoin (BTC) led the downturn, dropping beneath the $110,000 support level and hitting a month and a half low. Fartcoin (FARTCOIN) was the most affected among altcoins, declining by 17% and reaching a four-month low.

In today’s news:-

- B Strategy is set to launch a U.S.-listed company as a corporate BNB treasury and investment vehicle, with a valuation of $1 billion, supported by YZi Labs. Unlike yield-focused treasuries, it aims to finance core tech development, grants, and community initiatives to bolster the BNB ecosystem.

- Sharps Technology shares surged by 96% on Monday following the announcement of a $400 million plan to create a Solana-based digital asset treasury. The increase was propelled by a $50 million SOL token deal with the Solana Foundation through a PIPE transaction.

The Crypto Market Records Losses

The overall crypto market cap witnessed a $166 billion drop within 24 hours, resulting in $818 million in long liquidations and impacting investor sentiment. TOTAL currently stands at $3.73 trillion, a critical point indicating increased volatility.

Despite the recent slump, TOTAL remains above the essential $3.73 trillion support level, providing bulls an opportunity to regain dominance. The market could potentially rise toward $3.81 trillion if lower prices draw in new capital. A rebound would indicate that investors still perceive strong value in major cryptocurrencies at these levels.

For token TA and market updates: Seeking more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

If bearish momentum continues, TOTAL may decline to $3.56 trillion, exacerbating losses and diminishing confidence in the market. A breach below this level could prolong declines, compelling investors to reassess their risk exposure.

Bitcoin Falls Below Major Support

Bitcoin’s price has dropped 3.2% over the last 24 hours, sliding beneath $110,000 for the first time in a month. The crypto king is currently priced at $109,826, reflecting heightened selling pressure.

BTC is nearing the $108,000 support level, a historically significant point that has previously halted downward movements. This support zone could stabilize current prices if buyers re-enter with confidence.

If conditions improve, Bitcoin could reclaim $110,000 as a key support level, setting the stage for further gains. Such a recovery would enhance investor confidence, paving the way toward $112,500.

Fartcoin Marks a 4-Month Low

FARTCOIN’s price has dropped 17% in the last 24 hours, settling at $0.78, marking a four-month low after losing the $0.80 support level. This decline reflects strong selling pressures, pushing the cryptocurrency below a key level that had provided stability over several trading sessions.

FARTCOIN is approaching the $0.73 support level, which previously acted as a rebound point in April. A move upward from this area could allow the altcoin to reclaim $0.80 as support. Recovery beyond this level may create conditions for a short-term rally, with $0.87 identified as the next resistance point.

If FARTCOIN fails to maintain the $0.73 level, the altcoin could extend its decline to $0.67, establishing a new multi-month low. Such a drop would amplify investor losses and confirm ongoing downward pressure.

The post Why is The Crypto Market Down Today? appeared first on BeInCrypto.