As the overall crypto market rebounds, with Bitcoin rising 2.2%, Ethereum soaring 10.1%, and XRP up 6.5%, whales aren’t pursuing every surge. Large holders are strategically investing in tokens where they perceive the best risk-reward balance.

This discrepancy clarifies why some assets remain stagnant despite a general recovery, while others experience substantial inflows. Observing which coins crypto whales are purchasing after Powell’s Jackson Hole speech provides insight into where the big money anticipates momentum to grow. Continue reading as we highlight three such tokens.

Cardano (ADA)

Cardano has swiftly entered the ranks of altcoins being acquired by crypto whales, fueled by optimism surrounding potential interest rate reductions in September after Powell’s Jackson Hole remarks. While Ethereum and other leading coins surged dramatically, ADA’s increase has been more gradual, indicating it may have further room to grow.

On-chain data reveals a surge in whale interest. Wallets holding between 10 million and 100 million ADA increased their balances from 12.97 billion to 13.08 billion ADA within just 24 hours, adding 110 million ADA, valued at approximately $102 million at the current price of $0.93.

Simultaneously, mega whales with holdings of over 1 billion ADA had already made moves earlier in August, increasing their reserves from 1.82 billion to 1.88 billion ADA; an increase of around 60 million ADA, worth nearly $55.8 million.

This level of accumulation demonstrates the confidence among large holders that ADA could gain significantly if the Fed confirms easing in September.

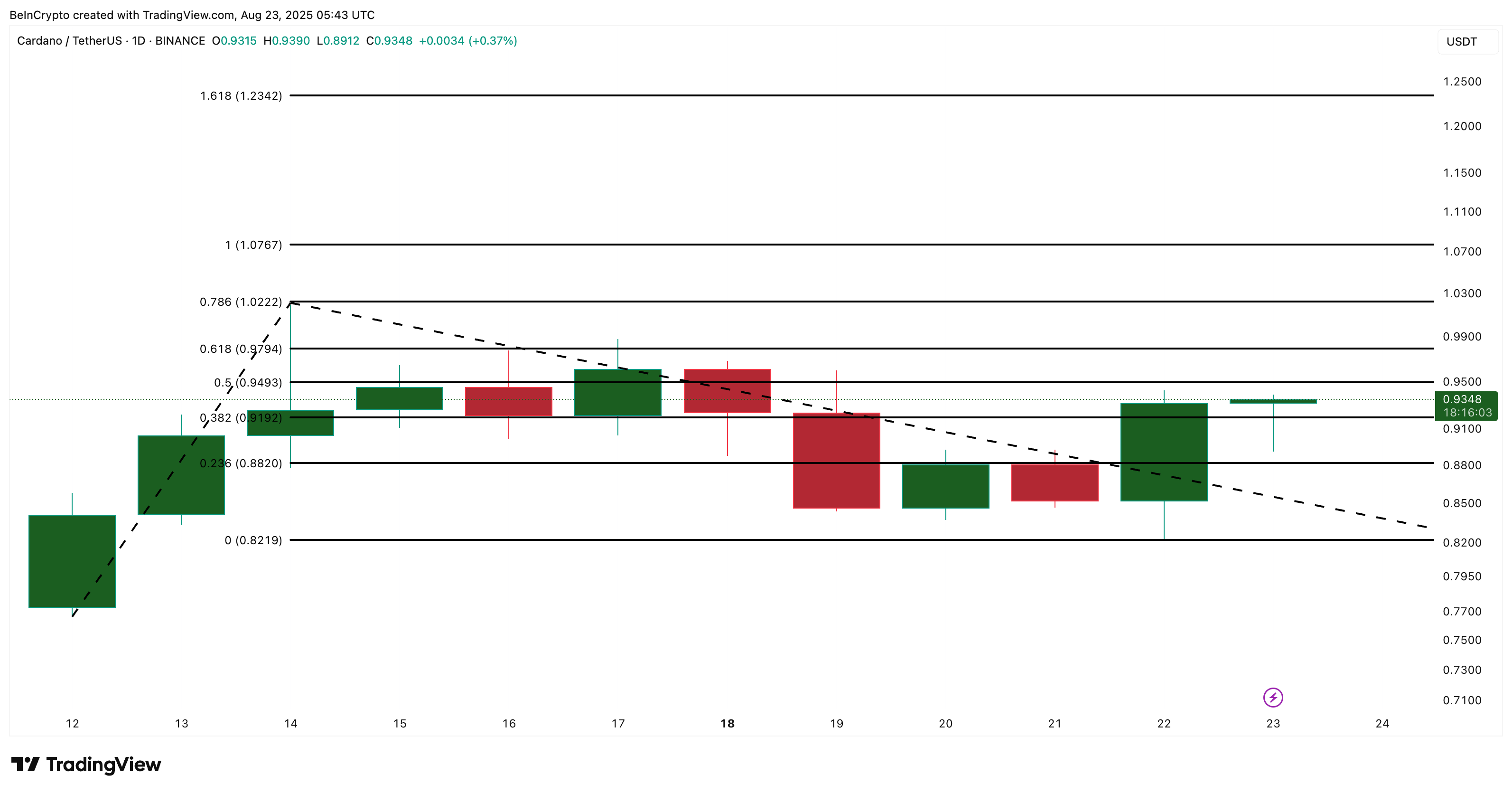

In terms of price, ADA is trading around $0.93, having climbed over 8% in the last 24 hours, although it’s still slightly down –2% for the week. Immediate resistance levels are at $0.94 and $0.97, with a breakout possibly leading to the psychological $1 mark.

Beyond that, reduced resistance could propel ADA toward $1.23. Nonetheless, a drop below $0.82 would invalidate the bullish outlook in the short term, potentially undermining the confidence shown in whale purchases.

Interested in more token insights? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Chainlink (LINK)

Chainlink is also among the tokens that crypto whales are acquiring, buoyed by widespread investor engagement. In the last 24 hours, whales have accumulated approximately 64,674 LINK (around $1.69 million), raising their total to 5.64 million LINK.

Exchange balances have decreased by 0.6%, indicating retail accumulation alongside whale activity, while smart money and top addresses have also increased their investments. Balances fell by about 1.59 million LINK, equivalent to around $41.6 million at the current price of $26.13.

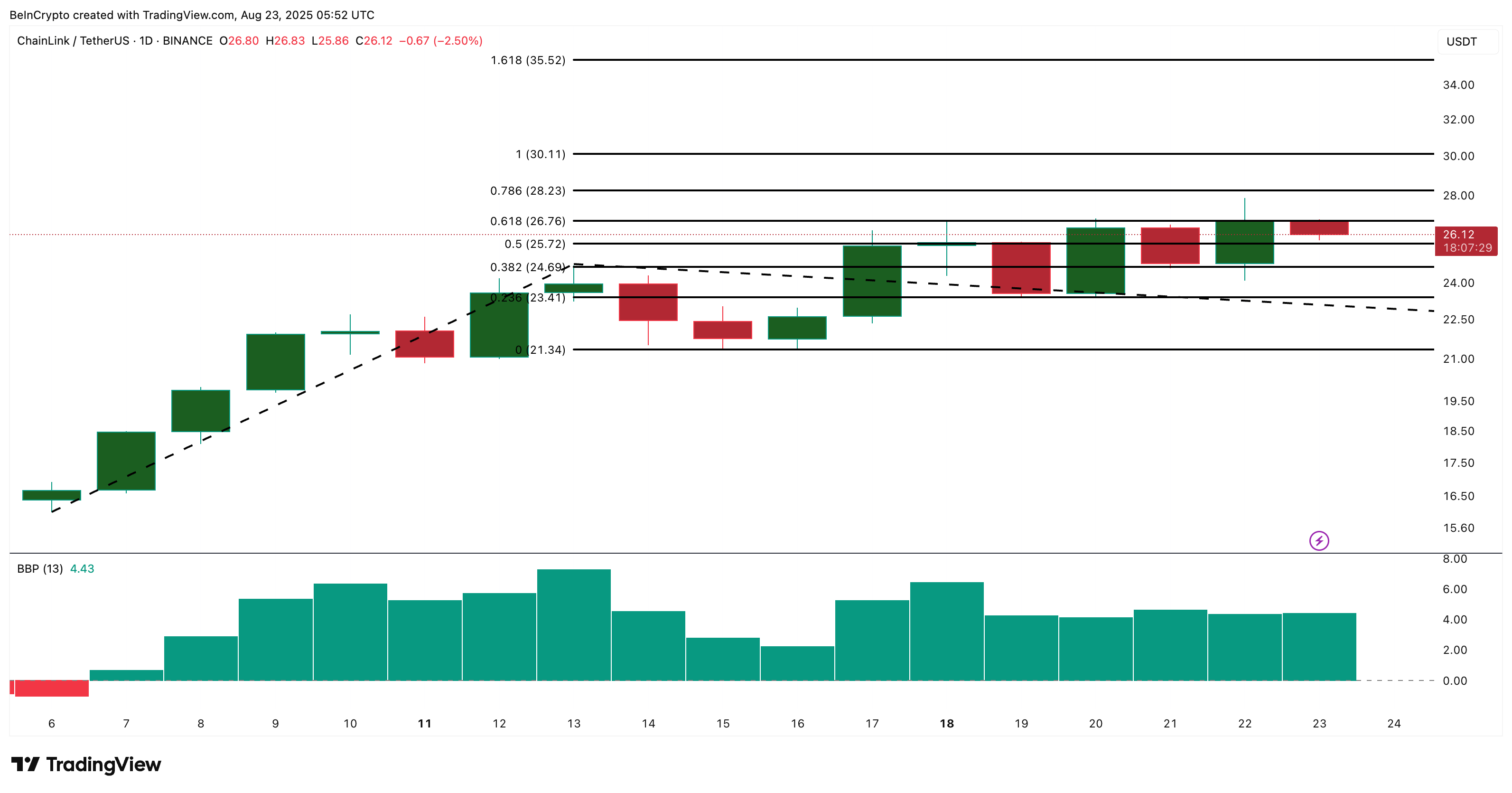

In terms of price, LINK has surged nearly 70% over the past three months and remains in an upward trend. The token is currently testing the 0.618 Fibonacci retracement level at $26.76, widely regarded as a strong resistance point. If that level is surpassed, LINK could rise to $30, with whales likely targeting an extension at $35.52.

Significantly, the bull-bear power indicator has remained in the green for 17 consecutive sessions, confirming a consistent bullish momentum not frequently observed in recent rallies.

With Powell’s indication of easier liquidity, whales may be banking on LINK as a leading oracle play with robust technical support.

The Bull Power Indicator assesses buyer strength by comparing the day’s highest price with a moving average, illustrating the extent to which bulls can push above the average trend.

Morpho (MORPHO)

Morpho, a DeFi protocol facilitating lending and borrowing through efficient vaults, is also garnering attention from whales.

Over the past 24 hours, whale wallets increased their holdings by 1.32%, bringing the total to 3.74 million MORPHO, currently valued at around $9.9 million at a price of $2.64.

At the same time, exchange reserves decreased by 1.35% (currently at 21.32 million MORPHO), indicating parallel retail buying.

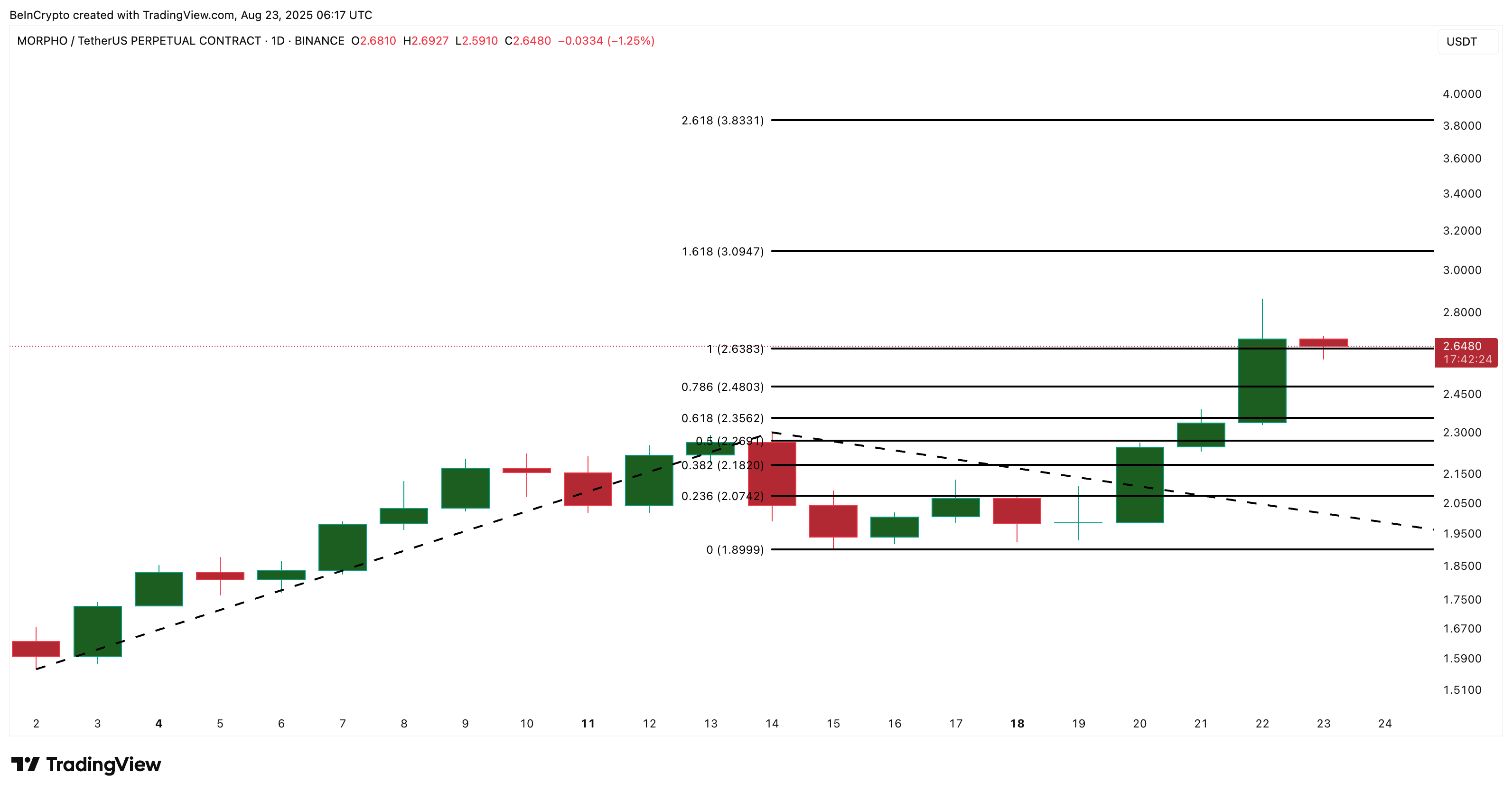

Morpho has outperformed the overall market with 9.4% daily gains and nearly 77% growth over the past three months.

Technically, it recently broke above significant resistance at $2.63 and is aiming for $3.09, with potential upside to $3.80 if momentum is sustained.

In the long run, Fibonacci extensions suggest a target of $4.57, marking a new all-time high. Invalidation lies below $2.18, where the bullish setup would flip bearish.

With Powell indicating potential rate cuts and DeFi set to benefit from renewed liquidity, whales seem to be positioning Morpho as one of the breakout tokens to watch.

The post What Crypto Whales Are Buying After Powell’s Jackson Hole Speech appeared first on BeInCrypto.