Key Highlights:

- US Treasury blocks Garantex, Grinex, executives, and six affiliated companies.

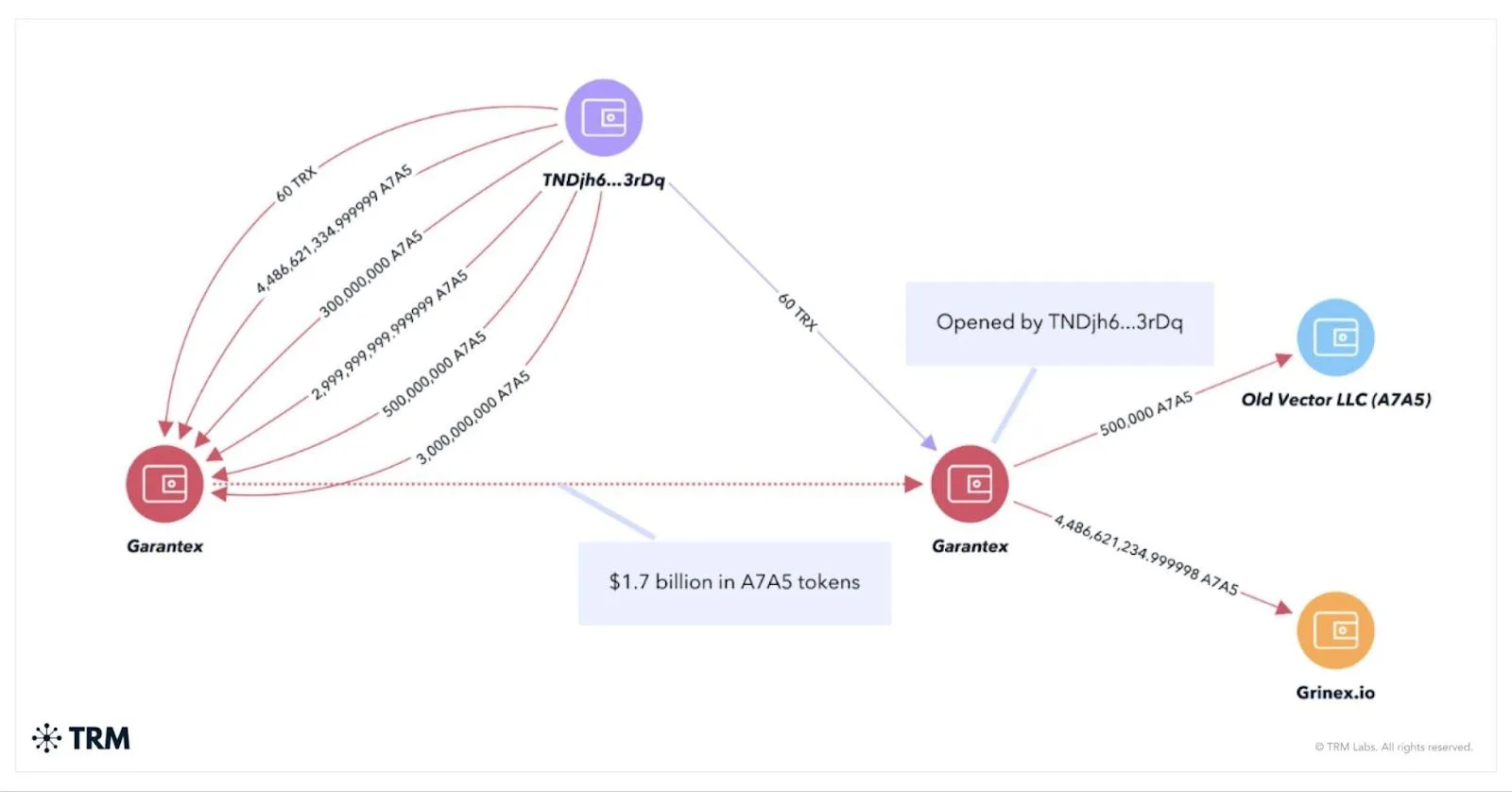

- $1.66B in transactions linked to Grinex; funds shifted after Tether’s wallet freeze.

- $6M reward offered for tips leading to arrest of key crypto network leadership.

The US Treasury Department’s Office of Foreign Assets Control (OFAC) has reintroduced Garantex, its successor Grinex, and a number of other individuals and entities to its sanctions list. The reason for this update is accusations of laundering illegally obtained funds and facilitating the circumvention of restrictions imposed on the Russian Federation.

Timeline of Sanctions and Freezing of Assets

Recall that OFAC added the Garantex crypto exchange to the sanctions list in April 2022. According to authorities, the platform facilitated the laundering of more than $100 million related to illegal activities.

In February 2025, restrictions against the platform were introduced in the EU. It suspended operations in March amid the freezing of wallets by Tether, the issuer of USDT. The accounts were blocked in assets in the stablecoin for 2.5 billion rubles (about $28 million at the time).

Emergence of Grinex and Connections to Garantex

Soon after, another exchange, Grinex, appeared on the Russian market. We previously covered a report by Global Ledger, according to which this platform is effectively the successor to Garantex.

According to a new release from the US Treasury, Grinex is indeed closely linked to the sanctioned exchange. The department also imposed sanctions against three Garantex executives and six related companies in Russia and the Kyrgyz Republic.

According to the agency, after the platform’s wallets were blocked, clients’ funds were redirected to Grinex accounts. At the same time, Grinex’s advertising materials state that it was created in response to sanctions.

Transaction Data and Associated Wallets

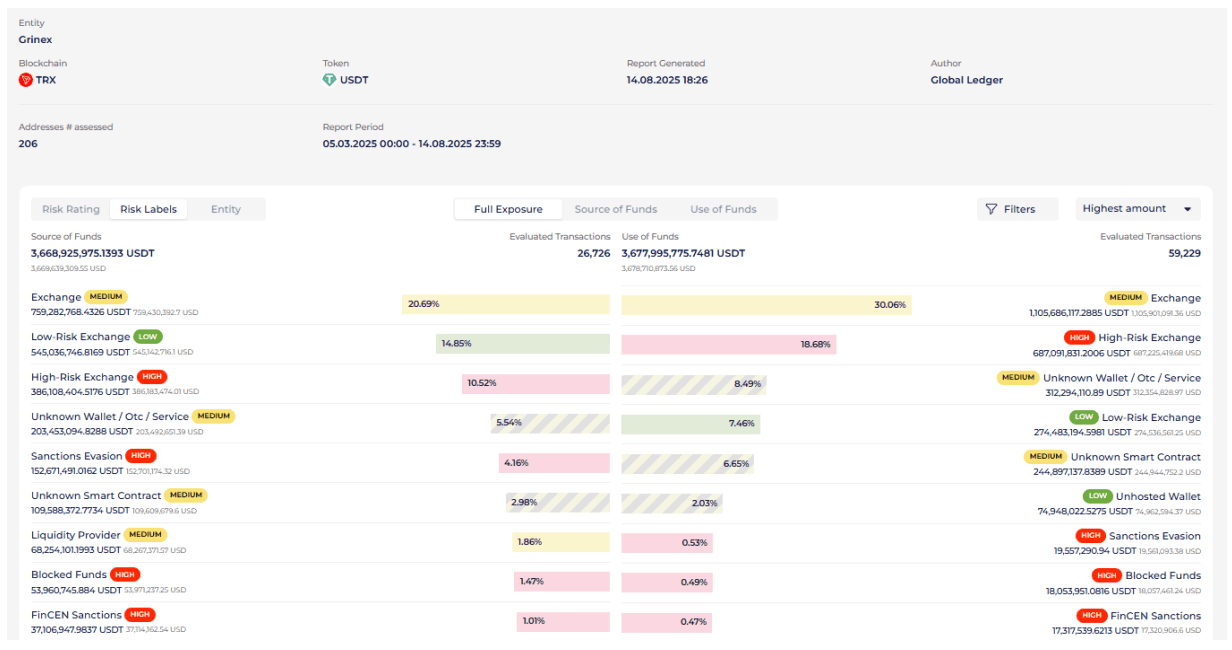

According to a Global Ledger report provided to Incrypted, Grinex processed USDT worth 7.3 billion in transactions between March 5 and August 14. The company identified 312 wallets associated with the exchange, four of which are still active and have not been sanctioned.

The company’s experts also found 180 exchanges that carried out direct or indirect transactions with wallets associated with Grinex, totaling $1.66 billion.

Use of A7A5 Ruble Stablecoin and Its Owners

To conduct transactions and replenish the losses of Garantex clients, the ruble stablecoin A7A5, issued by the Kyrgyz company Old Vector, was used.

The asset was created for A7 Limited Liability Society, which, along with its affiliates, is owned by sanctioned oligarch Ilan Shor and the Russian bank Promsvyazbank (PSB), according to an OFAC release.

According to Global Ledger, the bulk of A7A5 liquidity is so-called wash-trading. Despite this, the project is aimed at the long term, the organization believes. This is indicated by structural and consistent growth:

“The project is showing stable, albeit likely simulated, trading dynamics and continues to infuse USDT liquidity while strengthening its off-chain presence, focusing on brand growth, reputation, and formal presentation as a Kyrgyzstan-based company,” the report said.

Comprehensive Sanctions List

To summarize, OFAC has designated:

Garantex;

Grinex;

Old Vector;

A7, A71 and A7 Agent;

co-founder of Garantex Sergey Mendeleev;

co-owner and commercial director of Garantex Alexander Mira Serda;

co-owner and regional director of Garantex Pavel Karavatsky;

payment platforms InDeFi Bank and Exved, created by Mendeleev to simplify access to Garantex services, and later Grinex.

Effects and Implications of Sanctions

As a result of the measures taken, all property and property rights, as well as companies in which the share of the said persons exceeds 50%, are blocked. Sanctions may also be imposed against any counterparties that carry out activities with them, including financial ones.

Reward for Information

In addition, US authorities are offering a reward of up to $6 million for information leading to the arrest and/or conviction of Garantex’s management. Most of this amount is for information specifically about Alexander Mira Serda.