Sure! Here’s a rewritten version of your content, while keeping all the HTML tags intact:

The cryptocurrency market is experiencing a resurgence following a tumultuous week that wiped out billions from the overall market cap, leaving traders feeling apprehensive.

Summary

- The cryptocurrency market has kicked off October on a robust note, elevating its total value to $4.17 trillion.

- Bitcoin has surged by $118,000 on the day, reflecting a 4% increase, while Ethereum climbed 6% to reach $4,400.

- Other altcoins also saw significant increases, with cryptocurrencies like Zcash and Zora achieving impressive double-digit gains.

- Market analysts suggest that the bullish trend is still in play, with potential for further growth in “Uptober.”

This upward trend follows a broad recovery in the crypto market, as various coins bounce back from recent lows.

Leading the charge, Bitcoin (BTC) has surpassed $118,000, gaining around 4% within the last 24 hours. Ether (ETH) is also back in the spotlight, rising over 6% to briefly touch $4,400 after falling to $3,900 during the latest market correction.

Other prominent altcoins, such as Solana (SOL) and Binance Coin (BNB), have increased as well, with SOL climbing 7% to $225, and BNB hovering around $1,040. Some smaller-cap altcoins experienced even stronger double-digit gains, including Zcash (ZCASH) soaring 73% and Zora (ZORA) climbing nearly 33%.

This rebound is driven by both pricing dynamics and a revitalized sentiment. The total market capitalization for cryptocurrencies has increased by 4.6%, reaching $4.17 trillion today, shifting the overall mood from cautiousness to optimism. Ongoing excitement for “Uptober” is growing among traders and investors, with high hopes for sustained momentum to elevate prices to new heights.

On-chain data supports the Uptober crypto market rally

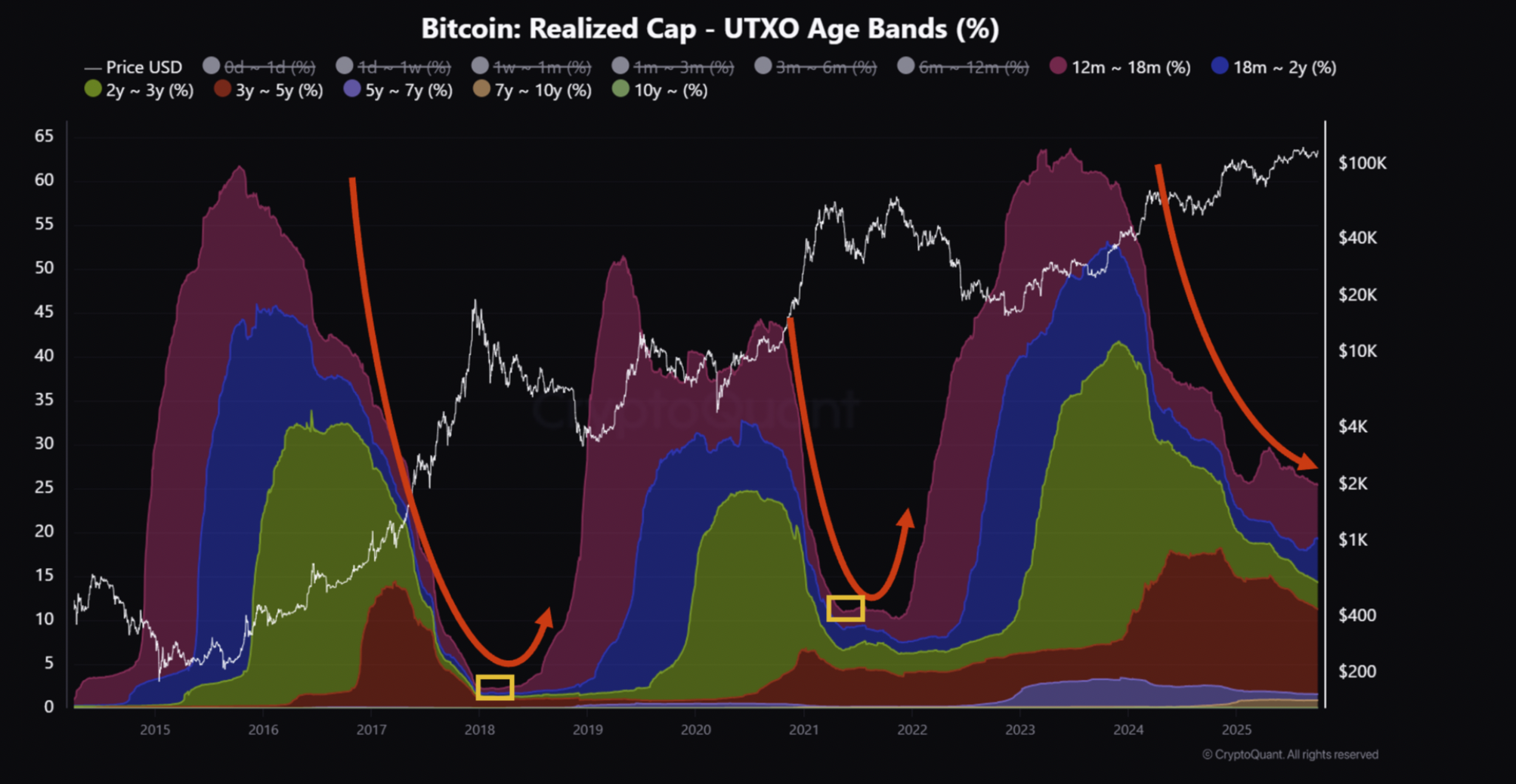

Bolstering this optimistic outlook, a recent analysis from CryptoQuant indicates that the current rally in the crypto market may still have additional momentum. According to the report, the existing bull cycle is deemed “slow but still ongoing,” as long-term Bitcoin holders are gradually reducing their positions without signaling a peak in the market.

Traditionally, the late stage of a bull market is characterized by a sharp decline in the percentage of BTC held for over a year, as early investors capitalize on profit and new investments flow in. This transition has commonly indicated the onset of a shift from bullish to bearish trends.

Currently, the percentage of Bitcoin held long-term is declining at a much slower rate, suggesting that while the cycle is progressing, it hasn’t yet reached its zenith.

According to the report, “The current market is gradually progressing within the bull cycle, yet there are no indications of an imminent conclusion,” suggesting that a more significant upward movement could still be possible.

Combining price movements and on-chain trends indicates a market with considerable growth potential. While volatility is expected to continue, current trends imply that October’s rally is rooted in long-term strength rather than short-term speculation.

If historical patterns hold true, this month may once again be a pivotal period for Bitcoin and altcoins, with the capability to push the market toward unprecedented highs in the coming weeks.