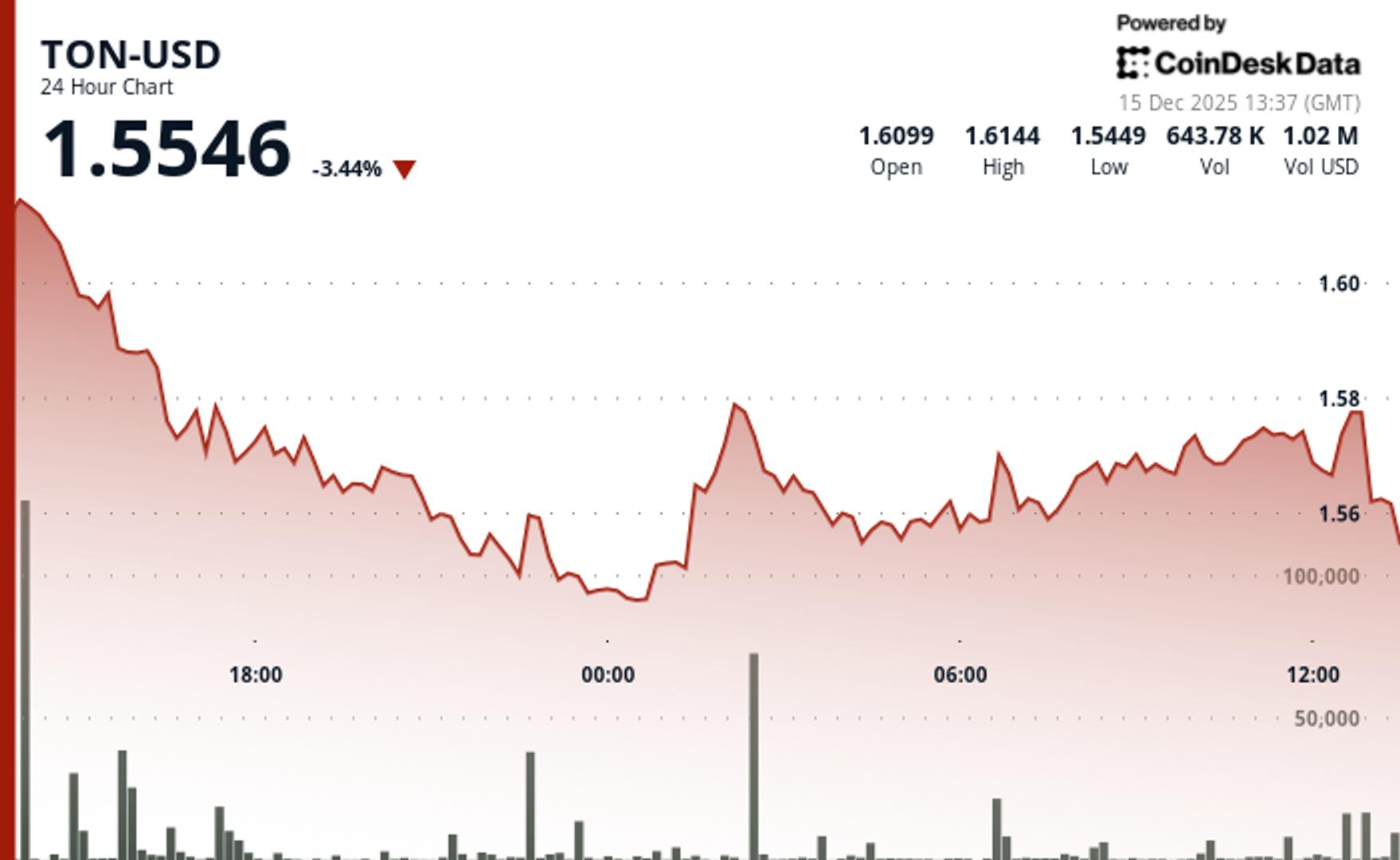

TON’s value declined by 3.4% in the last 24 hours, settling at $1.5567, further widening its performance gap compared to the overall cryptocurrency markets.

The broader market, reflected in the CoinDesk 20 (CD20) index, dropped by 1.8% during this same timeframe. TON’s decline indicates ongoing selling pressure particular to this token.

While the token experienced some brief recoveries, it ultimately continued its trend of lower highs. This steady downward trajectory suggests that sellers remain active even as conditions improve in other areas of the market.

The trading range varied from a peak of $1.6144 to a low of $1.5449, representing almost a 4.3% fluctuation, underscoring the instability associated with the recent decline, according to CoinDesk Research’s technical analysis data model.

Trading volume exceeded 640,000 tokens, with notable spikes during both sell-offs and rebounds that were above the usual daily average. This level of activity shows that traders are making adjustments, albeit not firmly in one direction. It reflects a sense of uncertainty, as market participants are engaged but cautious.

Technical indicators present a mixed picture. The token found some support around $1.5449 and rallied to $1.58 briefly, only to decline again, indicating that buyers entered temporarily before selling pressure resumed. These patterns suggest there may be interest from significant market players, but without consistent follow-through, TON continues to trail behind.

This decline adds to a larger trend of underperformance. Currently, traders are attentive to any signals of stabilization or a more substantial shift away from this asset.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team to ensure accuracy and compliance with our standards. For more details, see CoinDesk’s complete AI Policy.