Last week, crypto markets saw a drop in activity, with the global crypto market capitalization declining by 3% as traders pulled back to avoid losses.

In spite of this downturn, some crypto stocks continue to attract investor attention, largely due to institutional adoption and ecosystem developments that might spark renewed momentum. Notable mentions include COIN, MIGI, and ELWS.

Coinbase (COIN)

Sponsored

Coinbase finished Friday’s session at $312.59, reflecting a 1.92% increase. The stock is a focal point this week, with news of institutional adoption boosting investor sentiment.

On September 23, Caliber, a diversified real estate and digital asset management platform, announced its choice of Coinbase Prime as its platform for institutional trading and custody to support its Digital Asset Treasury (DAT) Strategy.

Through Coinbase Prime, Caliber will benefit from enhanced liquidity and institutional-grade custody solutions.

If this news continues to spur buying activity throughout the week, COIN’s price might strengthen towards $329.26.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Sponsored

Conversely, should selling pressure increase, the price may risk falling below $293.61.

Mawson Infrastructure Group Inc. (MIGI)

MIGI closed Friday’s trading at $0.50 per share, marking an 8.54% gain for the day. The stock’s upward momentum has captured the interest of market participants, especially following the company’s recent operational and corporate updates.

In a release dated September 17, the company confirmed that it continues normal operations at its U.S. facilities, with its Midland, Pennsylvania site being a key hub supported by long-term site stability.

Crucially, the company addressed its Nasdaq listing status, indicating that it has engaged advisors and submitted a compliance plan to the exchange. Mawson has received an extension to regain compliance, giving it additional time to maintain its listing.

Sponsored

Given these developments, if buying momentum builds this week, the stock has the potential to move above the $0.53 level.

On the flip side, MIGI might face a retreat and test support near $0.47 if selling pressure increases.

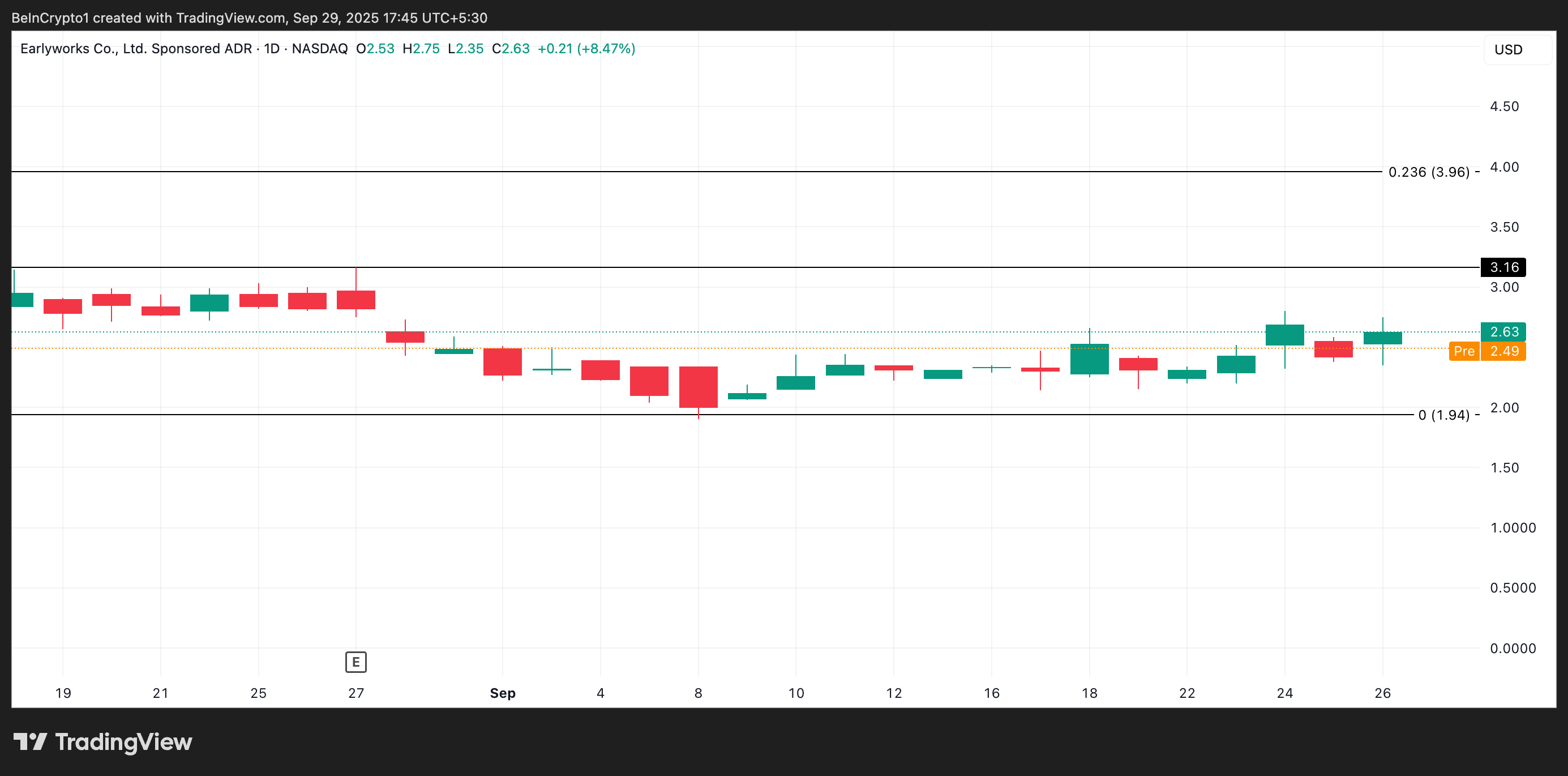

Earlyworks Co., Ltd. (ELWS)

Earlyworks’ shares closed Friday’s trading session at $2.63, achieving an 8.47% gain. This significant movement puts the stock under scrutiny this week as traders consider the company’s latest regulatory update.

Sponsored

On September 23, Earlyworks disclosed that the Nasdaq Hearings Panel has granted it a final extension until October 29 to meet compliance with the exchange’s continued listing standards.

This extension represents the last chance for Earlyworks to fulfill Nasdaq’s requirements. The company is currently pursuing equity financing initiatives to regain compliance; failure to do so by the new deadline will result in delisting of its securities.

In light of the increased attention regarding compliance and financing efforts, price action in ELWS could experience significant volatility.

If buying momentum accumulates this week, the stock’s price may rise towards $3.16.

On the contrary, continued selling could bring shares below $1.94.