As per NYDIG’s findings, the price fluctuations of Bitcoin are more influenced by the strength of the US dollar and overall liquidity conditions than by direct connections to inflation.

Greg Cipolaro, the global head of research at NYDIG, indicated that there are weak and inconsistent correlations between inflation metrics and Bitcoin. This perspective shifts the focus from the longstanding narrative that positions Bitcoin primarily as an inflation hedge.

Further Reading

Weak Inflation Connection

Cipolaro claimed that inflation expectations serve as a slightly better indicator than headline inflation figures, yet they still do not closely predict Bitcoin’s value.

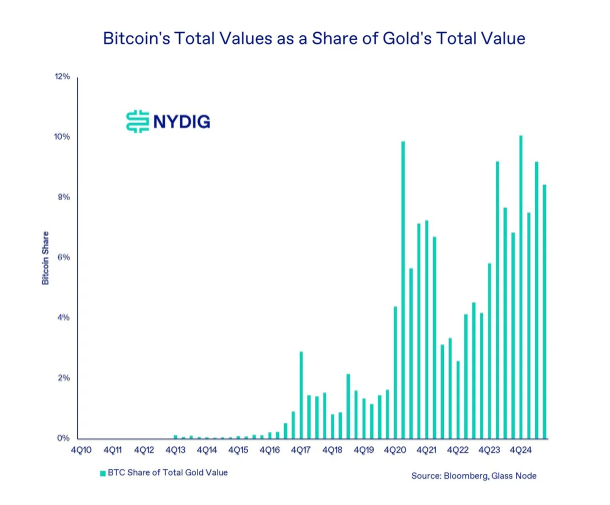

Instead, both Bitcoin and gold tend to appreciate when the US dollar depreciates. While gold’s inverse relationship with the dollar is well-documented, Bitcoin’s contrary movement against the dollar is emerging yet detectable.

Response of Gold and Bitcoin to Dollar Fluctuations

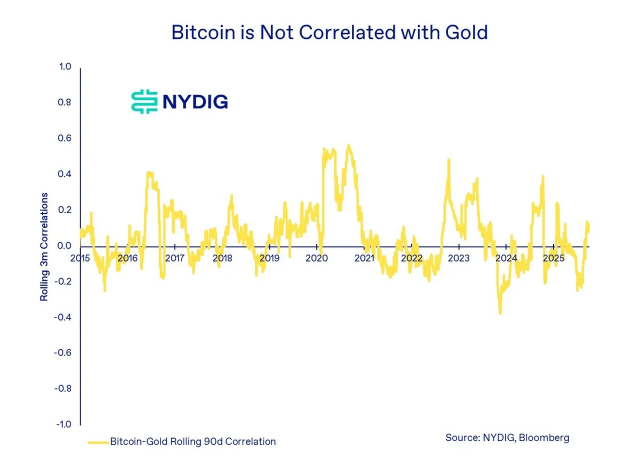

Reports suggest that gold has historically risen as the dollar declines. Bitcoin appears to be following suit, although its correlation with the dollar is less consistent than gold’s.

As Bitcoin integrates further into conventional finance, NYDIG anticipates that its inverse correlation with the dollar will likely intensify.

This aligns with traders who price everything in dollars and seek alternatives when the dollar’s purchasing power diminishes.

Interest Rates and Monetary Supply

Cipolaro emphasized that interest rates and money supply are the two key macro factors impacting both gold and Bitcoin.

Lower interest rates and more relaxed monetary policies have historically supported higher valuations for these assets.

Simplistically: when borrowing costs fall and liquidity increases, Bitcoin often sees advantages. The note characterized gold as more of a hedge against real rates, while Bitcoin is described as a barometer of market liquidity — a subtle but crucial distinction for investors.

Decline in Illiquid Supply; Renewed Selling Pressure

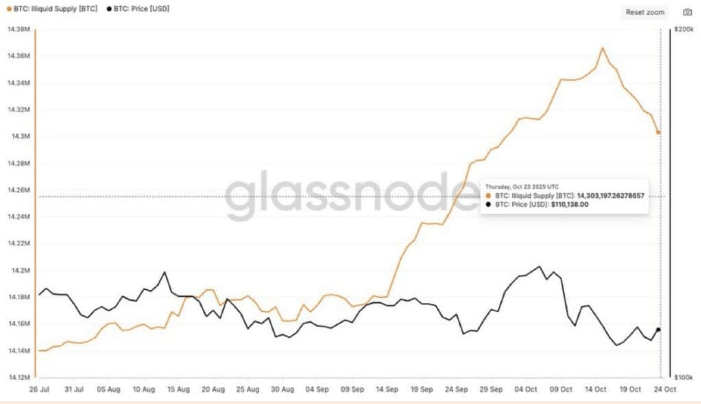

On-chain data indicate signs of renewed selling activity. Reports reveal that illiquid Bitcoin — coins stored in long-inactive wallets — decreased from 14.38 million earlier in October to 14.3 million by the 23rd of October.

Further Reading

This shift signifies that roughly 62,000 BTC, valued at around $6.8 billion at recent market prices, has returned to circulation. Historically, significant inflows have exerted price pressure. In January 2024, a large volume of coins became available, which led to a slowdown in price momentum.

According to Glassnode data, there has been a consistent selloff from wallets holding between 0.1 to 100 BTC, and the supply available to first-time buyers has decreased to approximately 213,000 BTC.

The overall macro perspective and on-chain metrics are not encouraging. Demand from new buyers seems to be declining, momentum traders appear to have stepped back, and a greater number of coins are now available for trading. This combination can hinder price rallies or exacerbate pullbacks until liquidity conditions improve or the dollar depreciates.

Image sourced from Gemini, chart from TradingView